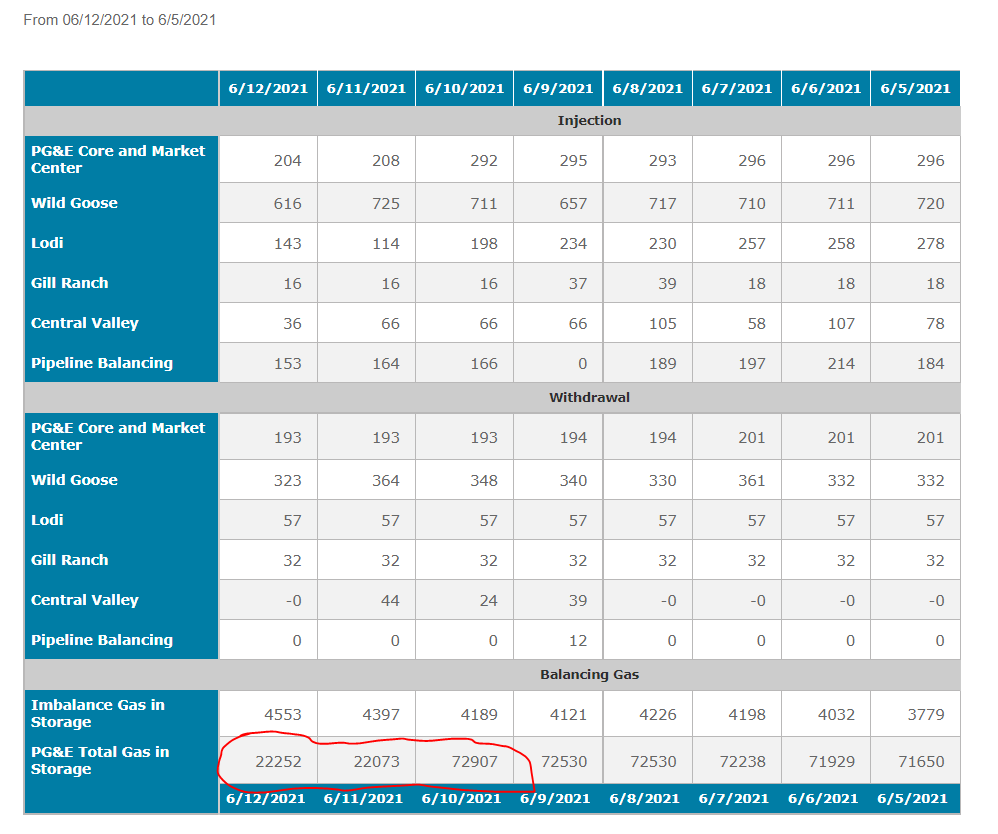

On Friday afternoon, I sent out a notice regarding PG&E reclassifying 51 Bcf of Working Gas into Cushion (Base) Gas. This change has already taken place on PG&E balances, as you will see below.

Here is the full notice: https://www.pge.com/pipeline/news/newsdetails/index.page?title=20210610_2445_news

[someone posted this on www.enelyst.com]

Modified PG&E Total Gas in Storage

Thursday, June 10, 2021

The 2019 Gas Transmission and Storage (GT&S) Rate Case Final Decision (D.) 19-09-025, issued on September 23, 2019, adopted the Natural Gas Storage Strategy (NGSS) that substantially changed PG&E’s gas storage asset holdings, its operational functions and CGT’s role in the market. As part of the NGSS, the Commission adopted PG&E’s proposal to reclassify 51,098 MMcf of PG&E owned gas from working gas to cushion gas (or base gas). Under the NGSS, PG&E’s working gas capacity is approximately 52,460 MMcf. PG&E is changing the reporting of the storage inventory level to be consistent with this change in working gas capacity. Beginning with the actual data for June 11, 2021, PG&E Total Gas in Storage inventory numbers will reflect the reduction in current inventory of the reclassified 51,098 MMcf to cushion gas. The current inventory of PG&E Total Gas in Storage and Storage Activity Archives will be adjusted going forward and can be found on the Pipe Ranger Operations page

PG&E doesn’t typically cycle this gas (the did not the past 2 years), but it’s a meaningful amount of gas that will not be available in a worst case scenario – especially this year with already low projected end of summer storage levels and the current low-hydro levels. As can be see in the chart below PG&E storage dropped from 72.9 Bcf to 22.1 Bcf starting the June 11th.

This from PG&E website(link),

This from the EIA show the total working gas capacity before the reclassification. The 102.2 Bcf should now only be 51.1 Bcf.

|

Reservoir Code |

Company Name |

Field Name |

Reservoir Name |

Field Type |

County Name |

Base Gas |

Working Gas Capacity(Bcf) |

|

2 |

PACIFIC GAS AND ELECTRIC COMPANY |

MCDONALD ISLAND |

MCDONALD |

Depleted Field |

San Joaquin |

54.6 |

82.0 |

|

3 |

PACIFIC GAS AND ELECTRIC COMPANY |

PLEASANT CREEK |

PETERS |

Depleted Field |

Yolo |

5.1 |

2.3 |

|

1 |

PACIFIC GAS AND ELECTRIC COMPANY |

LOS MEDANOS |

DOMENGINE |

Depleted Field |

Contra Costa |

11.2 |

17.9 |

|

70.8 |

102.2 |

Our thinking is that this will show up as a reclass on the EIA storage number next week. I did contact someone at the EIA to get further answers, but they were not able to disclose too much. They pointed me to the revision guidelines, which states “Revisions are disseminated in the Weekly Natural Gas Storage Report (WNGSR) according to the established schedule and shall occur when the net reported changes to working gas levels are at least 4 billion cubic feet (Bcf) at either a regional level or for the Lower 48 states.” So we believe the market will see a bit of stinger in this week’s EIA report.

Our estimate is +16 Bcf (67 Bcf – 51 Bcf) for week ending June 11. Note: since the change was made for Friday June 11th, it is quite possible the adjustment shows up the following week (i.e. the EIA storage report on June 24th for week ending June 18th.

Fundamentals for the week ending June 11: This past week the EIA reported a +98 Bcf storage injection for the week ending June 4th. This past week’s injection withing market consensus, and both our S/D and flow model nailed it. This report once again supports loosening conditions similar to last week. This past week’s report was only 0.4 Bcf/d tight YoY (Apr to Aug data only). That being said, if LNG was operating at full capacity then we would have been much tighter.

As we have noted in the past, 2020 was an abnormal year. So we compare this report against the 3Yr average (2018-20). This past week’s number was only 0.6 Bcf tighter than the 3Yr average.

For the week ending June 04th, our early view would have been +67 Bcf without any revisions. The 5Yr average is a +87 Bcf injection. With the reclass the estimate is changed to +16 Bcf.

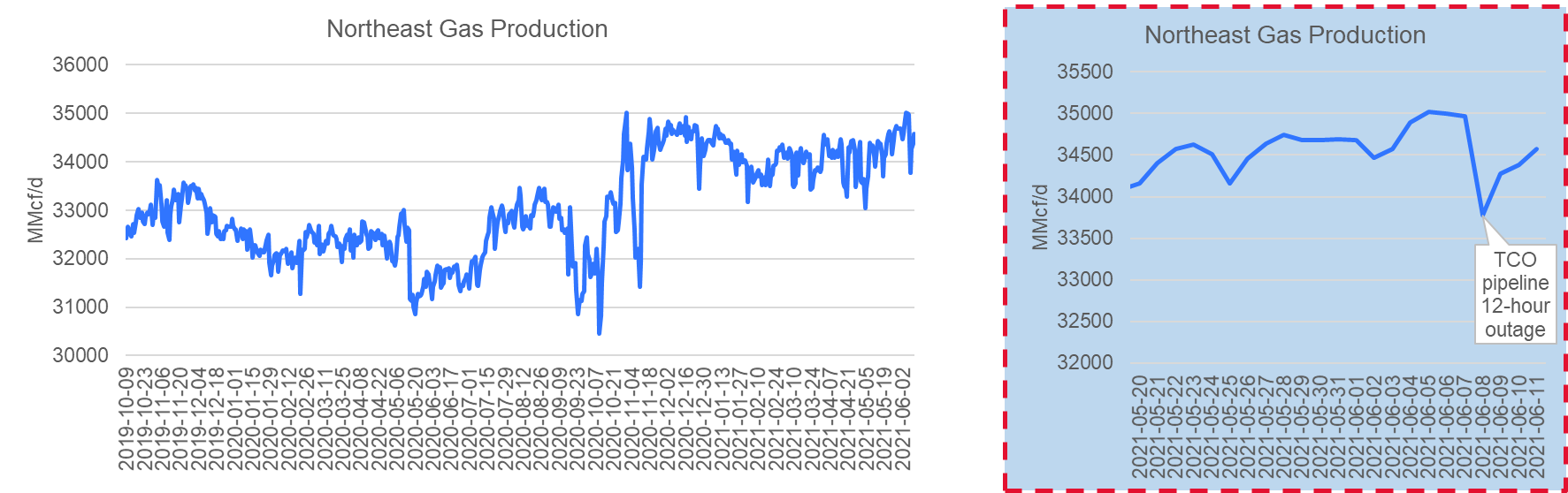

Domestic production was +0.4 Bcf/d higher week-on-week with the all the gains coming out of the South Central. Northeast production was unchanged (between 34-35 Bcf/d) this past week, despite the reduced N-to-S TETCO flows.

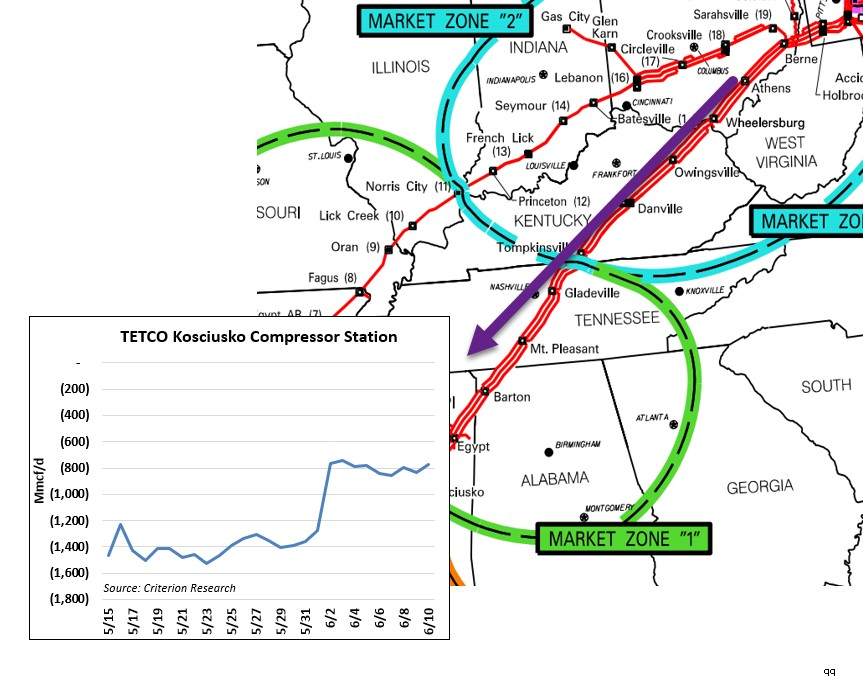

More specifically, TETCO’s production receipts have not shown a decline despite the late May PHMSA order leading to a sizeable drop in N-to-S flows (see map/chart below). PHMSA suspended the renewal of TETCO’s temporary request to remain at its full capacity and thus TETCO was required to reinstate a 20% pressure restriction on Lines 10 and 15 between Kosciusko and Uniontown effective June 1, 2021. This equates to about 700 Mmcf/d of reduced throughput.

TETCO has a history of explosions and this could be one of the reasons the PHMSA is being more strict with the pipeline – The first was in January 2019 in Ohio, the second in August 2019 in Kentucky, which was fatal, and the third in May 2020 in Kentucky.

A notice on late Thursday gave more details on the decision by PHMSA and potential length of the outage.

Notice Link: https://infopost.enbridge.com/infopost/NoticeListDetail.asp?strKey1=109233&type=CRI&embed=&pipe=TE

As previously posted, Pipeline and Hazardous Material Safety Administration (PHMSA) issued an Amended Corrective Action Order (ACAO) on June 1, 2020 impacting TE’s Lines 10, 15, and 25 between Kosciusko to Uniontown (30″ System). In late December 2020, TE had completed the work identified in its Remedial Work Plan (RWP) and PHMSA temporarily approved TE’s ability to recommence operations at its full maximum operating pressure (MOP). Subsequently, in the most recent approval process, PHMSA suspended its renewal of TETLP’s temporary request to remain at its full MOP and thus TE was required to reinstate a 20% pressure restriction on Lines 10 and 15 between Kosciusko and Uniontown effective June 1, 2021.

Leading up to the suspension of the renewal, as part of TE’s comprehensive integrity program across its system, TE has been inspecting its system for numerous types of threats which pipelines may be subject to using specific in-line inspection tools designed to look for each type of threat. In compliance with the ACAO, TE reported an anomaly feature that was identified during a recent EMAT tool run. Following the identification of the anomaly, PHMSA suspended its renewal of TE temporary request to remain at its full MOP between Kosciusko and Uniontown while PHMSA works to further understand and evaluate the findings of the EMAT tool run and how that finding could impact other Line 10 and Line 15 segments along the 30″ system.

TE continues to meet regularly with PHMSA and is in the process of conducting an engineering analysis to address PHMSA’s concerns to support a return to service and will continue to do so over the next several weeks. At this time, TE anticipates that the earliest the 30-inch pipeline between Kosciusko and Uniontown will be returned to full service would be late 3rd Quarter of 2021. TE understands the importance of returning its system back to full service as soon as possible, and endeavors to provide a more exact timeframe and potential scope of work by the end of the month.

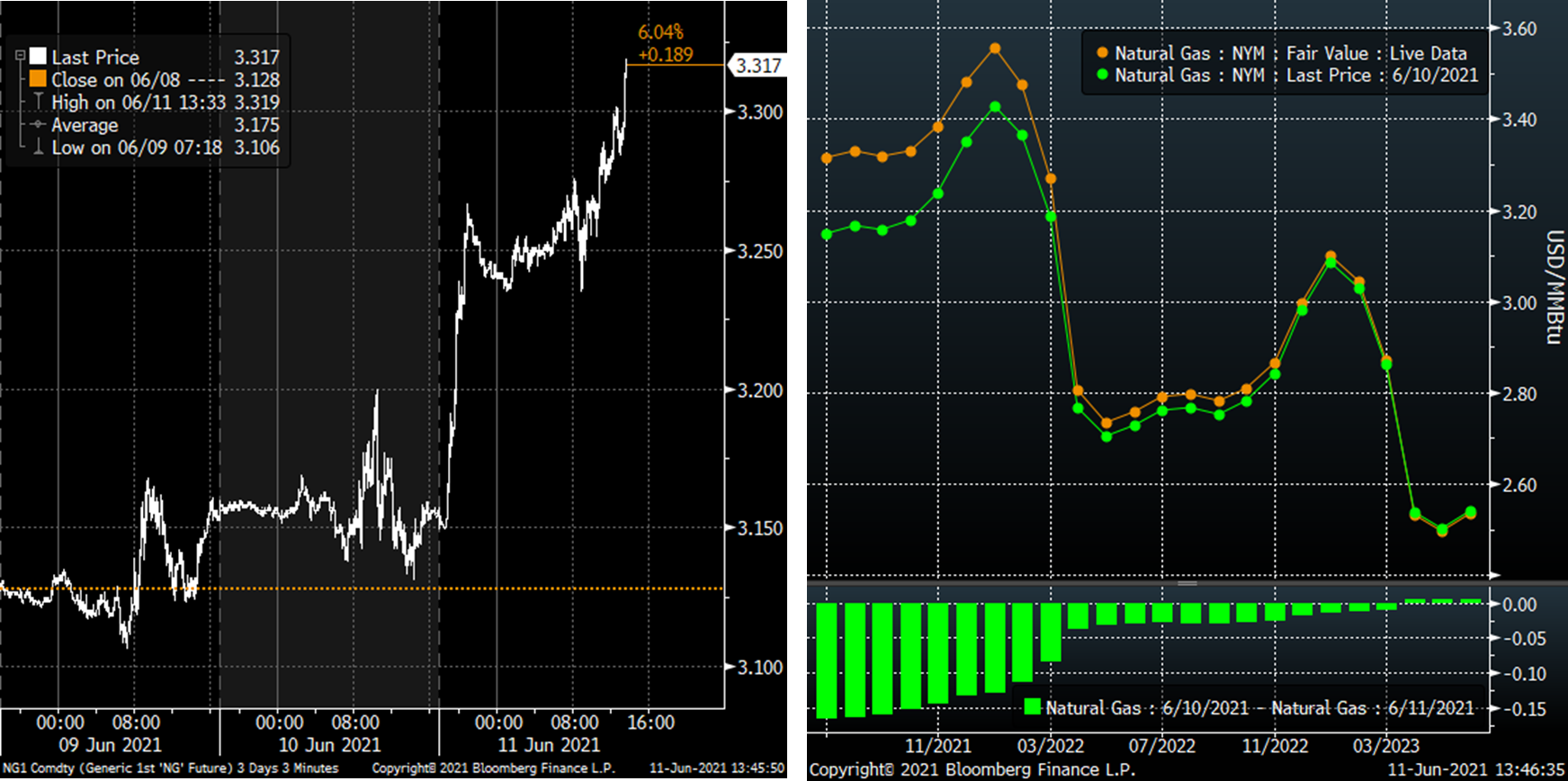

With the release of the notice, the market soared after hours with the release of the notice. Prices continued the rally on Friday reaching levels seen during winter storm Uri.

Producers have kept volumes steady so far partly due to high Zone 3 demand and ample storage space available upstream. We could see a decline in production receipts if cooling demand drops substantially, but even that is unlikely with flow diversions on other pipelines leaving the Marcellus/Utica basins.

If for some known reason production did need to be shut in, than the greatest impact would be ~77 Bcf.

110 days (left in summer) x 0.7 Bcf = 77 Bcf

We will continue to monitor the story.

moving on to the other fundamental pieces…

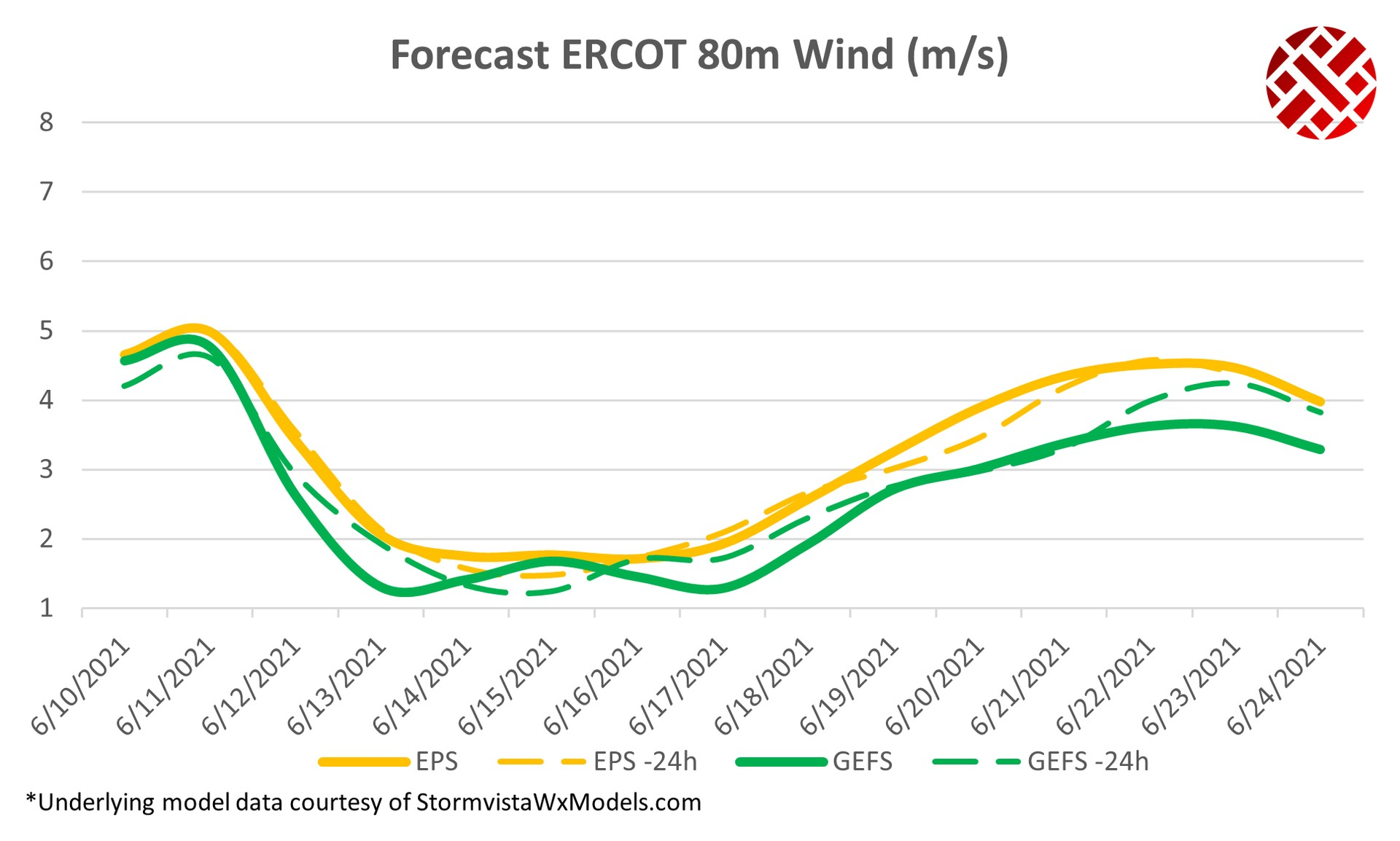

This week consumption climbed with hot weather blanketing the Midwest and East. CDDs moved higher by +7.4F to 12.7F. With that temperature change, ResComm consumption decreased by -3.3 Bcf/d WoW, while power increased by 7.0 Bcf/d in total. This past week showed strong wind in the ERCOT region leading to reduced burns. Next week, wind levels in the ERCOT region are expected to drop which will likely lead to higher burns. This could put some bullish pressure on price.

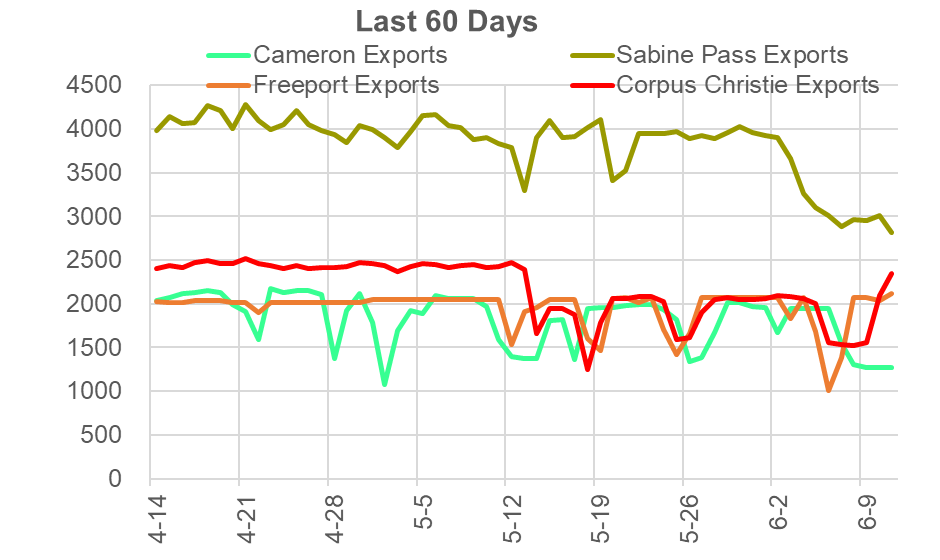

Deliveries to LNG facilities averaged 9.3 Bcf/d, which is 1.7 Bcf/d lower than the previous week. Freeport LNG facility experienced a short emissions event on June 6th, which “resulted in unplanned and unavoidable venting to the Liquefaction Flare due to a sequential series of events that resulted in the trips of Trains 1, 2, and 3. Cheniere seems to have wrapped up their annual maintenance at the Corpus Christi LNG facility after a 27-28 day period, with the terminal ramping back to nearly 2.4 Bcf/d this morning. With completion of that maintenance, it appears that Sabine Pass is performing their annual maintenance now. Sabine Pass flows have been lower since June 2, and they continue to hold lower with just 2.8 Bcf/d. It’s possible the same crew moved from Corpus Christi to Sabine. If we assume the same length of maintenance, then Sabine could be operating at these lower levels until July 5th.

Net balances are tighter by +4.9 Bcf/d week-on-week.

Expiration and rolls: UNG ETF roll starts on June 14th and ends on June 17th.

July futures expire on June 18th, and July options expire on June 25th.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.