This weekend’s commentary comes from Brian Lovern at Bespoke Weather.

Our expectation remains for another hot summer this year, and we have definitely gotten off to a hotter start early on, with June being projected to rank in the top three hottest Junes on record, in terms of national demand (GWDDs). This is in spite of the demise of the La Niña state, as sea surface temperatures have shifted to normal in the key ENSO regions, as seen on the map below:

Most Recent Sea-Surface Temperature Anomalies

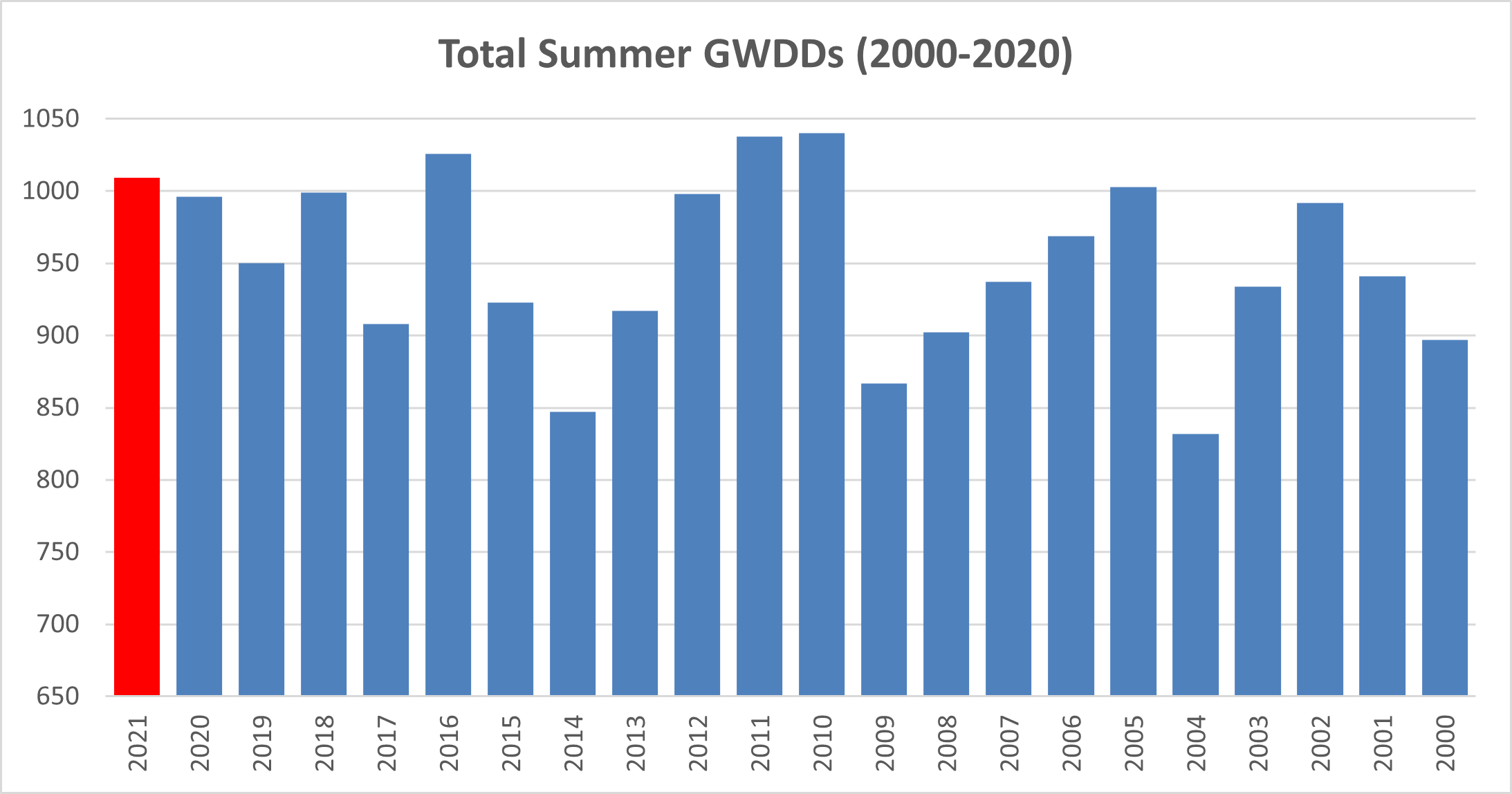

While, over the longer term, summers have been hotter when a La Niña state is present, or when the atmosphere is heading into a La Niña state, that correlation has not been quite as strong over the last decade, as we have tended to run hot no matter what the ENSO state is doing. We believe this is tied into enhanced forcing from the Indian Ocean, which has become more dominant as those waters warm more relative to other parts of the world, and appears to be a factor again this summer. Given the hotter June, we have bumped our summer (June-August) GWDD forecast to 1010, behind only 2010, 2011, and 2016 in our historical record, and those could be challenged if July and August follow June’s lead.

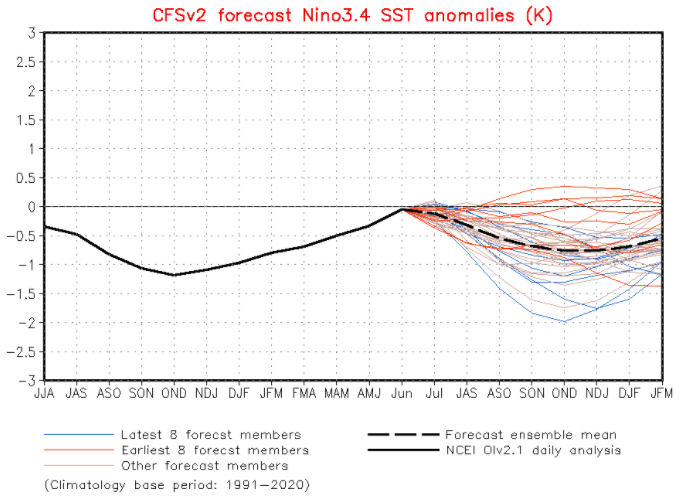

Now, the CFS does show the potential for La Niña conditions to return later this year, but would be more of a factor toward autumn and next winter if this forecast comes to fruition. This would pose warmer risks as we move through autumn, so is something to keep in the back of your mind once we wade through the summer heat.

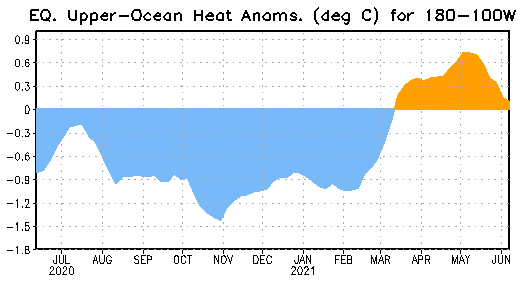

Upper oceanic heat content in the equatorial Pacific appears to have peaked in early May, and is near neutral currently. Further declines would support the CFS’ idea of La Niña’s return later this year.

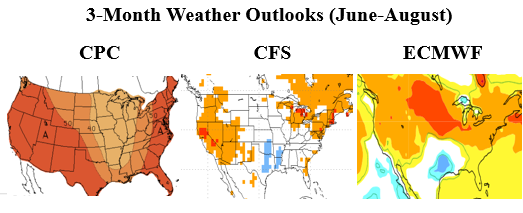

In terms of the primary long-range models, and CPC’s guidance, there is agreement on the hotter overall view, though the CFS and the ECMWF are cooler toward Texas. While June did start cooler there due to all of the rain, both models may be too cool, as things have dried out, and recent temperatures have over-performed vs what has been forecast, so we would remove any “blues” there. In short, support remains strong in favoring a hot summer once again, especially considering the hot start here in June.

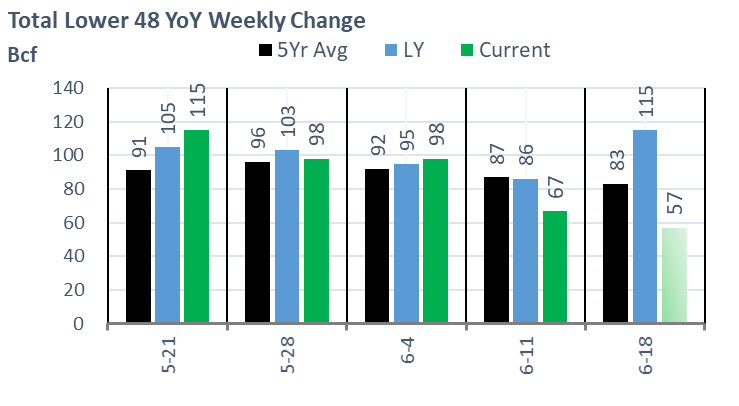

Fundamentals for week ending June 18: This past week the EIA reported an implied flow of +67 Bcf storage injection for the week ending June 11th. This does not include the noteworthy reclassification of 51 Bcf from working gas to base gas in the PG&E territory. With the reclassification, the next storage level is now 2427 Bcf. This was the largest reclassification on record and it does dramatically impact the end of season estimates. The west region is already tight this summer with low hydro levels and stronger than normal levels of heat. The lower available storage will now put the California market more reliant on incoming pipeline flows during the summer peak days.

For the week ending June 18th, our early view is +57 Bcf. The 5Yr average is a +83 Bcf injection, and last year was +115 Bcf.

Domestic production was lower week-on-week with no major new issues to report. A drop of 1.0 Bcf/d from Texas and the midcontinent regions took overall production down to 91.9 Bcf/d. This level is still inline with production levels we have observed since the start of summer – hence the lower rig counts have not impacted production yet.

Total consumption was higher by 1.3 Bcf/d to 72.1 Bcf/d. The national temperature was not as warm this past week. Overall CDDs fell by 2.1F. Most of the week-on-week consumption gains came from a rise in industrial demand.

Deliveries to LNG facilities averaged 9.6 Bcf/d, which was +0.2 Bcf/d lower than the previous week. Sabine and Cameron LNG feedgas flows remain low this week. Mexican exports continue to rise this week as summer heat is leading to rising flows down south. Flows to Mexico averaged 7.5 Bcf/d this past week.

Net the balance is tighter by 2.0 Bcf/d week-on-week.

Expiration and rolls: UNG ETF roll starts on July 14th and ends on July 19th.

July futures expire on June 28th, and July options expire on June 25th.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.