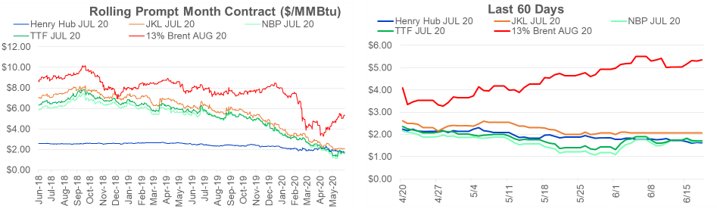

Global natural gas markets are under severe pressure with oversupply colliding with the destructive economic/demand impact of the Covid-19. This double whammy has driven down gas pricing benchmarks to record lows in Europe, the US and Asia.

These low global price and tight spreads have killed LNG shipping economics and with that we are getting LNG cargo cancellations. June has already been a brutal month for US LNG exports, but July could be worse with potentially 50 cargo being cancelled.

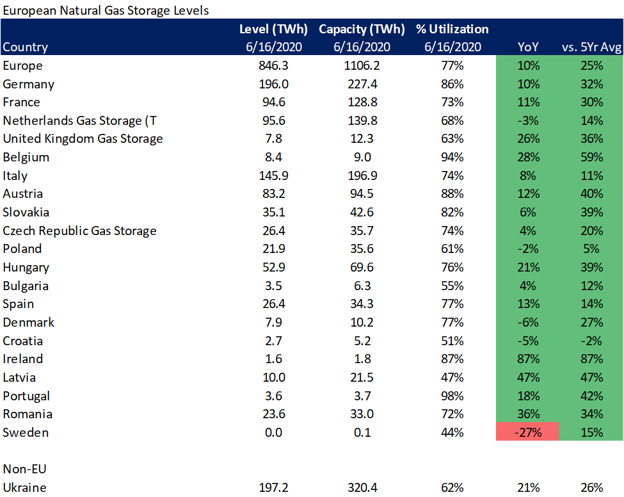

This week we dive a bit deeper in to European storage inventories and give some numbers around what could solve their balance. As of this week, European storage inventories are at 848 TWh or 77% full.

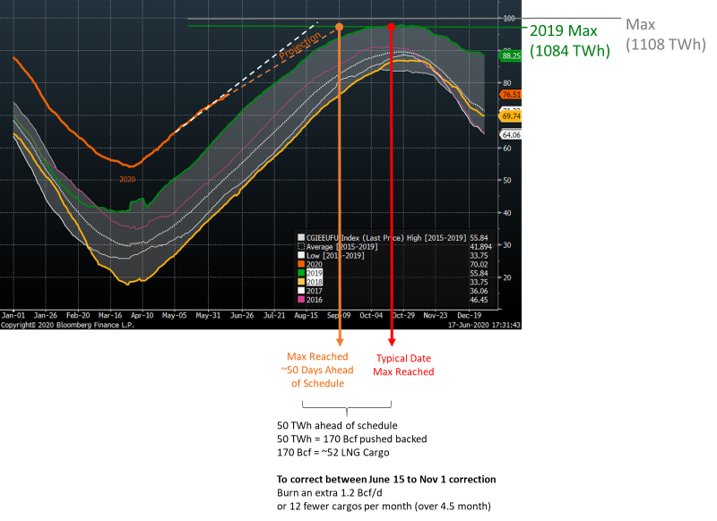

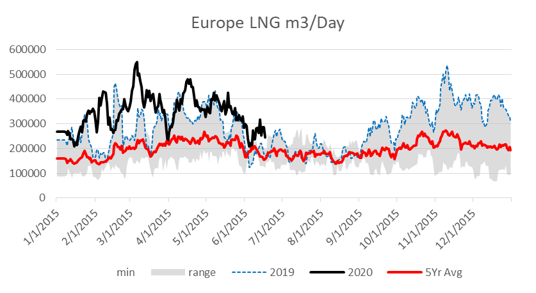

As can be seen, the crash course prior to June (white line – based on the trajectory of fill) was late August, but the drop in price has started to correct some of the problem. The combination of LNG cargo cancellations, and increased power burns should fix the problem – although we have not seen a reduction in LNG receipts just yet. We are anticipating lower LNG receipts for the remainder of the month since big US cargo cancellations started June 1st and it take 2 weeks to travel to European destinations.

As for power burns, the rate of fuel switching in European countries in 2019 and 2020 has rapidly increased due to a combination of strength in carbon emission allowance prices and extreme weakness in gas markets. A good market to watch is Germany because of its vast gas and coal fleets. Over the first half June, gas-fired generation exceeded coal (lignite) output for the first time.

Based on our simple storage projection (orange line), the European market is still 50 days ahead of schedule. This tell us that we should anticipate weak LNG economics throughout the summer as LNG imports in Europe will need to remain low to ensure storage injection keep at a low pace. This ultimately means that gas gets pushed back into the US markets adding to our 4 Tcf problem.

We end with a table showing storage levels in each European country vs LY and the 5Yr average. We’ll continue to track this story as we progress through the summer.

Fundamentals for week ending June 19: Our early view for the upcoming storage report is a +113 Bcf injection for the lower 48. This would take storage levels to 3005 Bcf

US natural gas dry production is slightly higher week-on-week with domestic production averaging 84.5 Bcf/d for the week. Average weekly production is 0.3 Bcf/d lower than 4 weeks ago.

Natural gas demand moved lower last week as weather patterns turned cooler. Residential and commercial sector consumption increased by 0.2 Bcf/d, but power consumption dropped by 4.0 Bcf/d.

Canadian imports were lower last week averaging 3.7 Bcf/d.

Mexican exports stayed flat to average 5.5 Bcf/d.

Deliveries to LNG facilities decreased week-on-week to 3.8 Bcf/d.

Expiration and rolls: UNG ETF roll starts on July 12th and ends on July 17th.

July futures expire on June 26th, and July options expire on June 25th

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.