For this weekend’s report, we have an update on LNG economics and forward margins.

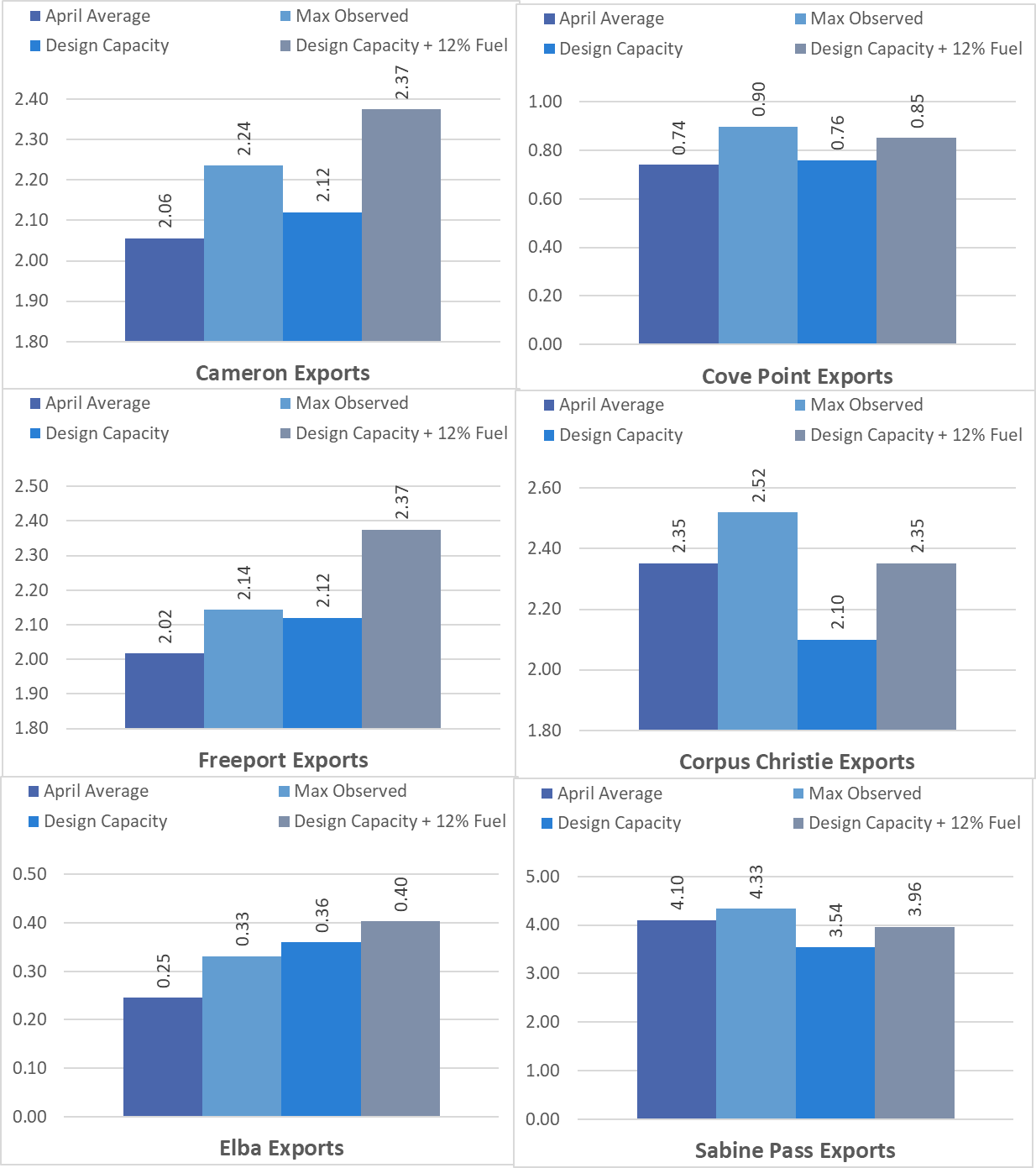

US LNG demand has had a record-setting month in April. Feedgas deliveries to US LNG export facilities have averaged 11.5 Bcf/d. At these levels, most plants are operating above 90% of their observed peak levels. Below is a chart showing average April feedgas volumes vs observed peak levels and design capacity. As can be seen, April flows are strong but there is some upside to the flows of each plant. The coincidental peak of the observed peak level is 12.4 Bcf/d; hence it is possible to see flows at these levels this summer.

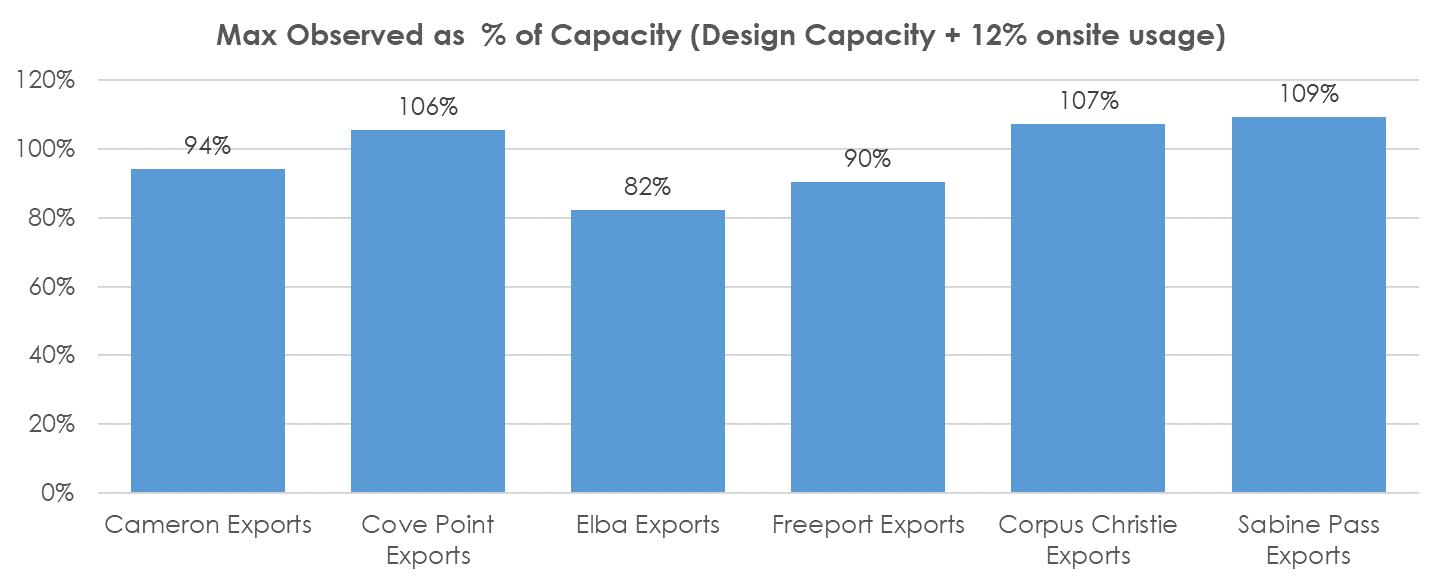

Another thing to note is that most of the plants can ramp up above their design capacity. The chart below shows the max observed for each plant vs. their built feedgas capacity (EIA stated design capacity + 12% onsite usage). The two Cheniere-owned plants can run at 107 to 109% of its design capacity. So in the case of extended maintenance for any one plant, the collective effort of all the other plants could make up the lost volumes.

With May on the horizon, the market is expecting some strong summer LNG exports out of the US unlike last summer when we saw cargo cancellations due to a breakdown in demand and price.

European and Asian natural gas prices are being supported by low storage inventories in Europe and strong demand growth in Asia. Natural Gas forward strip pricing for the remainder of summer (June through Oct) at TTF currently sits at $7.60/MMBtu and JKM is slightly higher at $8.75/MMBtu. Even with the move higher at Henry Hub to $2.98/MMBtu this past week, spreads to both Europe and Asia are more than enough for a positive netback to any US Gulf Coast shipper.

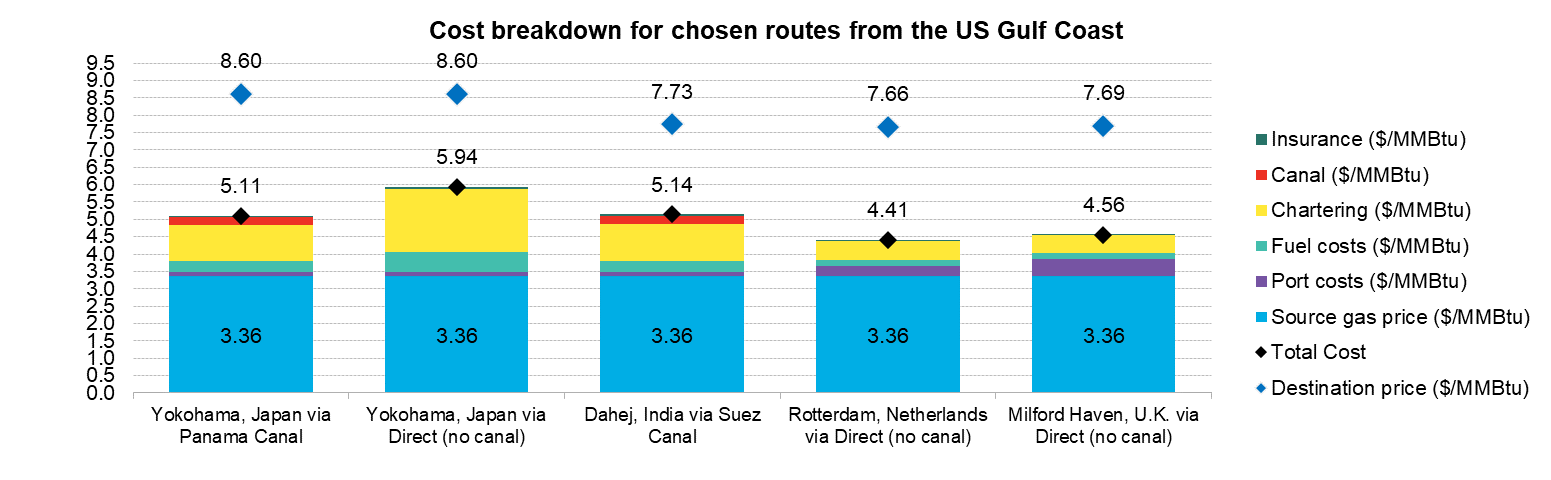

To give some indication of how deep in the money some of the major LNG routes are, we turned to the BNEF LNG calculator and ran some numbers. The first chart below shows the total cost to ship out of the Gulf Coast versus the destination price for June. The cost of the source gas cost is HHub + 15%.

As can be seen, each route is well in the money to flow.

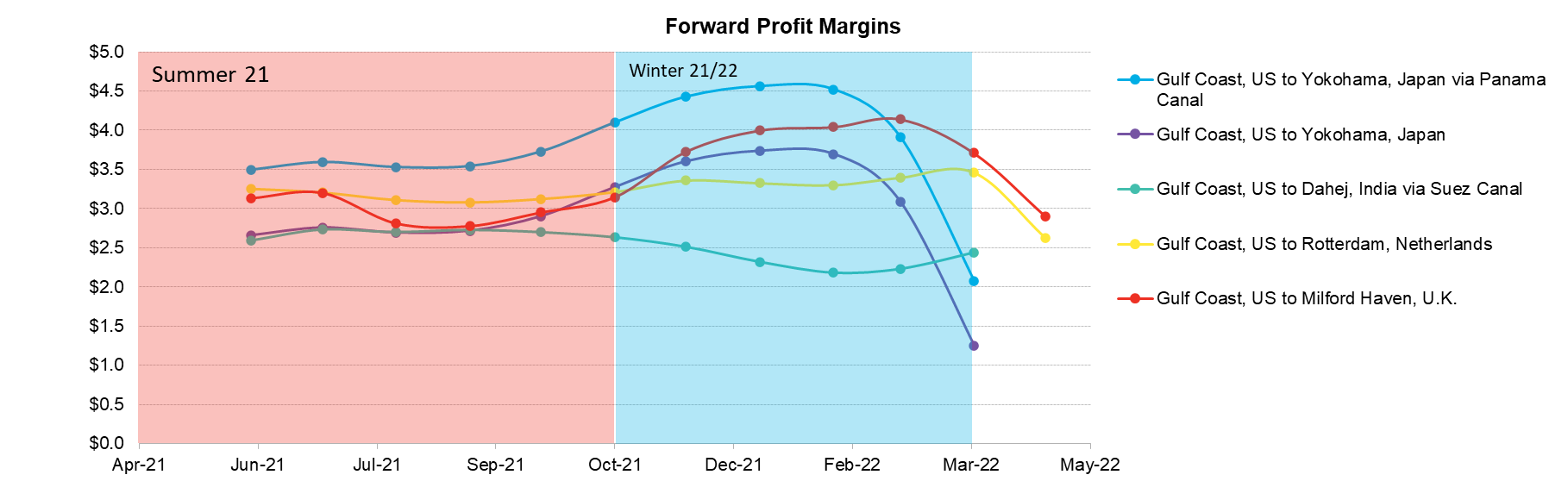

Here are the netback calculations for each route for the next 12 months. It’s clear that US LNG is well in the money to flow to all these destinations for the rest of summer and next winter.

Fundamentals for the week ending April 30: This past week the EIA reported a +15 Bcf storage injection for week ending April 23rd. This report’s injection came in higher than the market consensus of +10 and sent natural gas prices lower on the release of the report. Of interest in the report was the East region which reported an early summer draw of -6 Bcf, when it typically injects +17 Bcf in the same week.

For the week ending April 30th, our early view is +58 Bcf. The 5Yr average is a +81 Bcf injection. Our projected injection would take the L48 storage level to 1956 Bcf (-348 vs LY, -64 vs. 5Yr).

Domestic production was flat week -on-week. There are no significant changes to report this week.

The biggest moving factor this week was consumption, and more specifically the usage dedicated to ResComm. We recorded L48 HDDs dropping by 4.8 degrees from the previous week, while CDDs crept up slightly. The dropping HDDs resulted in ResComm consumption decreasing by -7.6 Bcf/d WoW, and while the small increase in CDDs increased Power consumption increasing by +0.9 Bcf/d WoW. With the current weather forecast, we are anticipating CDDs to arrive earlier than normal.

Deliveries to LNG facilities averaged 11.4 Bcf/d, which was -0.2 Bcf/d lower than the previous week. Mexican exports decreased by 0.1 Bcf/d to 6.7 Bcf/d this past week.

Net the balance is looser by 6.5 Bcf/d week-on-week.

Expiration and rolls: UNG ETF roll starts on May 12th and ends on May 17th.

June futures expire on May 26th, and May options expire on May 25th.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.