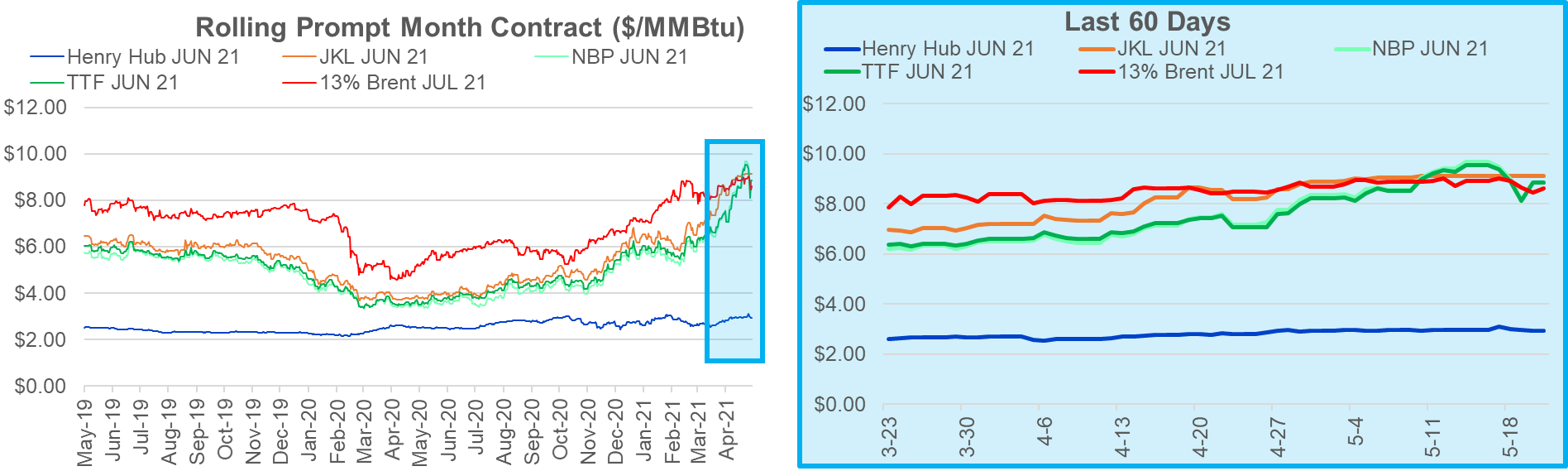

This week we take a look at the rise in global natural gas prices. TTF and NBP prices for the prompt month continued to move higher in an attempt to pull LNG to their ports. Based on the current forward curve, the Asian markets still commands a premium for natural gas for the rest of summer.

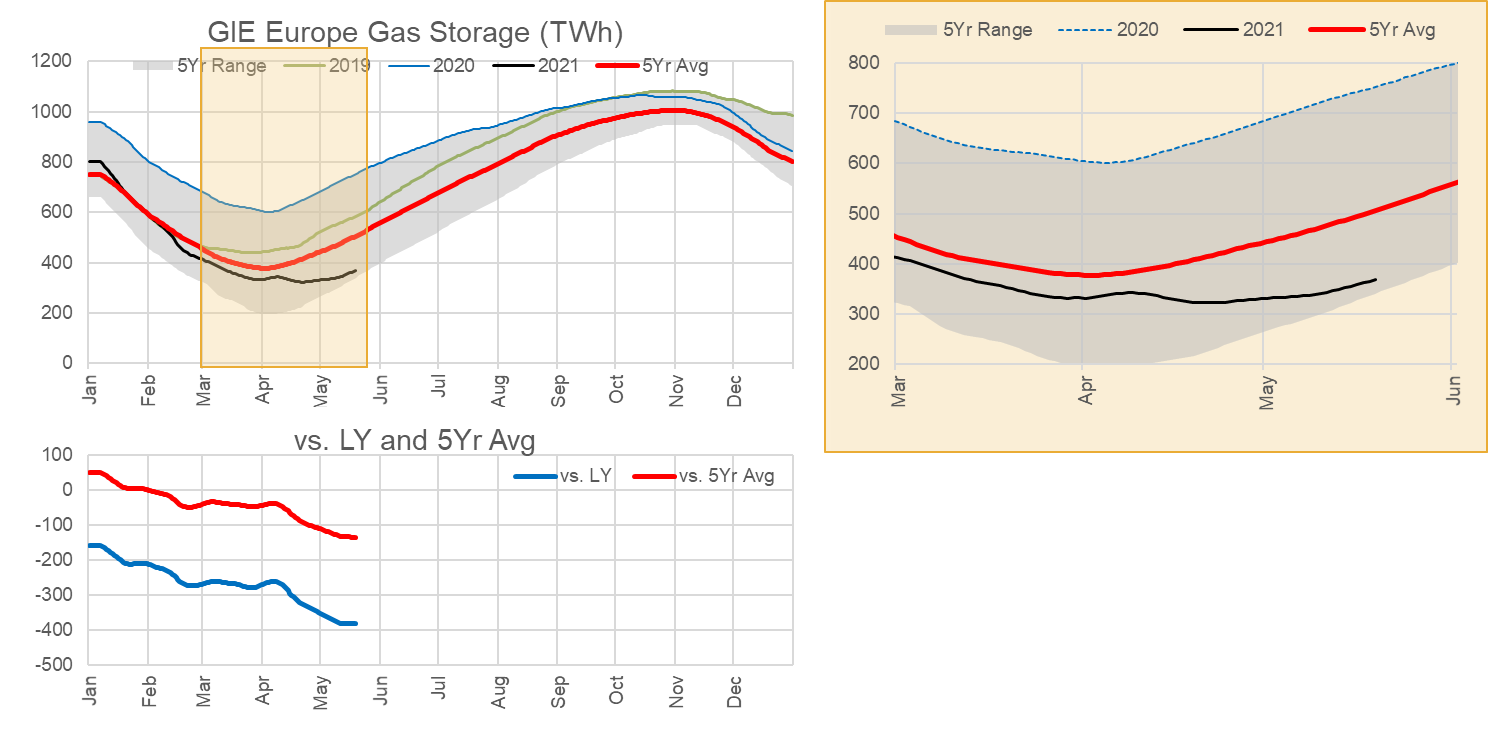

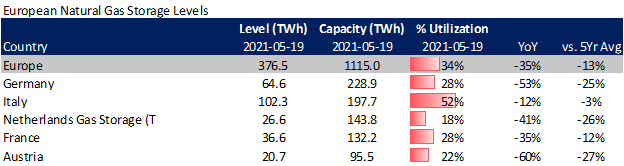

The strength in TTF and NBP shows how hungry the European countries are for natgas to both keep up with summer demand and replenish inventories ahead of the winter. As of this week, European inventories sit at 376.5 TWh or 34% full. This level is -35% YoY, and -13% vs. 5Yr average.

German, France, Netherlands, Italy, and Austria storage sites make up over 70% of the total storage capacity. The table below shows the current status of these sites.

Germany holds the largest level of storage capacity, but it’s currently in the worst shape with a 53% YoY deficit. So what’s keeping the storage levels well below normal levels, and could we see large global spreads for the remainder of the year? We found these 3 main drivers outside of weather leading to the strong European pricing.

1. Strong Asian LNG demand

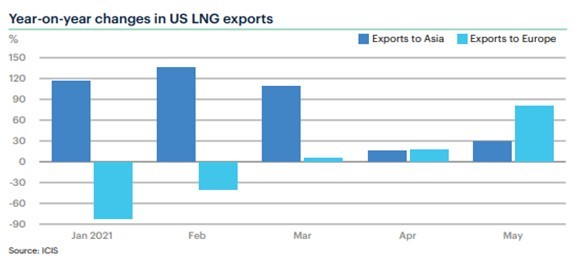

Strong Asian LNG demand diverts all flexible LNG supply away from European ports. This has been the ongoing theme of 2021 as countries such as China are back in growth mode post-COVID.

The JKM forward price continues to trade a significant premium to TTF. This makes spot LNG more economical in Asia. That being said, May saw larger volumes to Europe. This is typical of the shoulder season when Asian heating/cooling demand drops.

2. Limited piped supply from Russia and Norway

Europe’s two big pipeline gas suppliers are not responding to rising regional prices.

Russian flows via the Ukraine route fell sharply into 2020 as the new transit agreement came into force, and regional prices remained weak. In Q4 2020, Russian flows did start to rise but fell back again in 2021. Gazprom’s flow decisions are not simply based on flow economics. In this particular scenario, it is widely thought that Gazprom (Russia) is limiting flows to apply some political pressure on the European countries to ensure Nordstream 2 is not delayed further. This seemed to somewhat work with President Biden seemingly giving up on the campaign to stop Nord Stream 2 in recent weeks. There is now little undermining the construction phase of the project. Earlier this week, the head of the Russian state duma (lower house of parliament) energy committee said construction can be completed in one-to-two months.

Norwegian production has been relatively low in 2021, with Norway engaging in major maintenance early this year. Production in the Netherlands is also ramping down fast with Groningen, Europe’s largest onshore natural gas field, to be halted by 2022 (8 years earlier than initially planned). Groningen produced nearly 54 billion cubic meters (bcm) of gas in 2013 before tremors blamed on drilling damaged buildings and prompted a series of lowered caps on output and protests by residents and campaigners. A strong earthquake in January 2018 and another weaker one in May 2020 prompted the government to move quicker. The field will be kept operational until 2026, but only for high-demand days during the winter.

3. Strong Carbon prices

Finally, we end with the most important driver of higher European gas demand – rising carbon prices. Multiple factors have contributed to pulling carbon higher but the EU’s decision to raise the 2030 emissions reduction target to ‘at least 55% below 1990 levels (from 40%) is the fundamental driver.

The higher carbon prices make C2G switching levels higher as the cost of natural gas generation can more easily beat out coal generation. The resulting higher demand for natural gas is translating into higher prices.

Fundamentals for week ending May 21: This past week the EIA reported a +71 Bcf storage injection for the week ending May 14th. The number came in higher than market consensus point to a balances not as tight as seen this summer so far. The summer started off with daily balances being 6-7 Bcf/d tighter YoY (wx adj). Yesterday’s report pinned the market at 2.6 Bcf/d tight YoY (Apr to Aug data only).

For the week ending May 21st, our early view is +109 Bcf. This week’s higher than expected number adjusted our estimate higher. The 5Yr average is a +91 Bcf injection. Our projected injection would take the L48 storage level to 2209 Bcf (-387 vs LY, -69 vs. 5Yr).

Domestic production was overall flat week-on-week with no major issues to report. The only ongoing issue to keep tracking is the maintenance on the El Paso system which expected to go on until the end of the month.

Total consumption was lower by 5.4 Bcf/d over the storage week with lower recorded L48 HDDs driving the story. The 3rd week of May is typically the timeframe when the transition from HDDs to CDDs takes place. HDDs dropped by 5.8 degrees to almost nil from the previous week, while CDDs moved higher by 1.7 degrees to 4.3. Last week should have been the lowest demand week in the first half of the year. The total net decrease in HDDs resulted in ResComm consumption increasing by +7.7 Bcf/d WoW, while power and industrial increased by 2.6 Bcf/d in total.

Deliveries to LNG facilities averaged 10.5 Bcf/d, which was -0.5 Bcf/d lower than the previous week. All LNG facilities were fairly stable other than Corpus Christie which dropped midway through May17th to returned midway through May 19th. Mexican exports remained strong at 6.7 Bcf/d this past week.

Net the balance is looser by 5.6 Bcf/d week-on-week.

Expiration and rolls: UNG ETF roll starts on June 14th and ends on June 17th.

June futures expire on May 26th, and May options expire on May 25th.