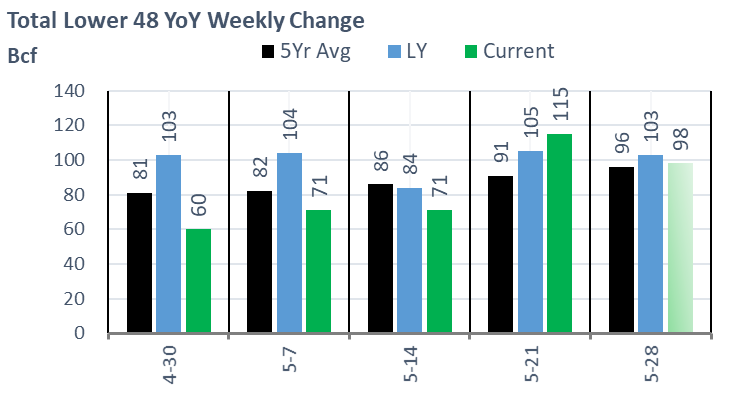

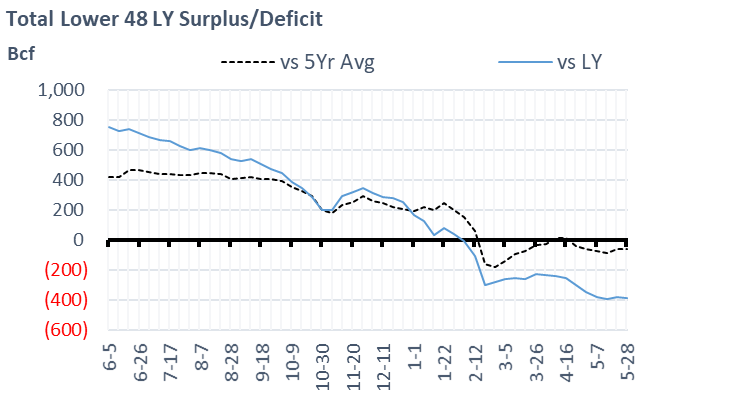

Fundamentals for the week ending May 28: This past week the EIA reported a +115 Bcf storage injection for the week ending May 21st. This past week’s injection was well above the market consensus, and even our estimate of +111. This report once again supports loosening conditions. The summer started with daily balances being 6-7 Bcf/d tighter YoY (wx adj). Those dynamics have quickly shifted to this past week’s report being only 1.6 Bcf/d tight YoY (Apr to Aug data only).

2020 was an abnormal year, so we compare this report against the 3Yr average (2018-20). This past week’s number was only 0.6 Bcf tighter than the 3Yr average.

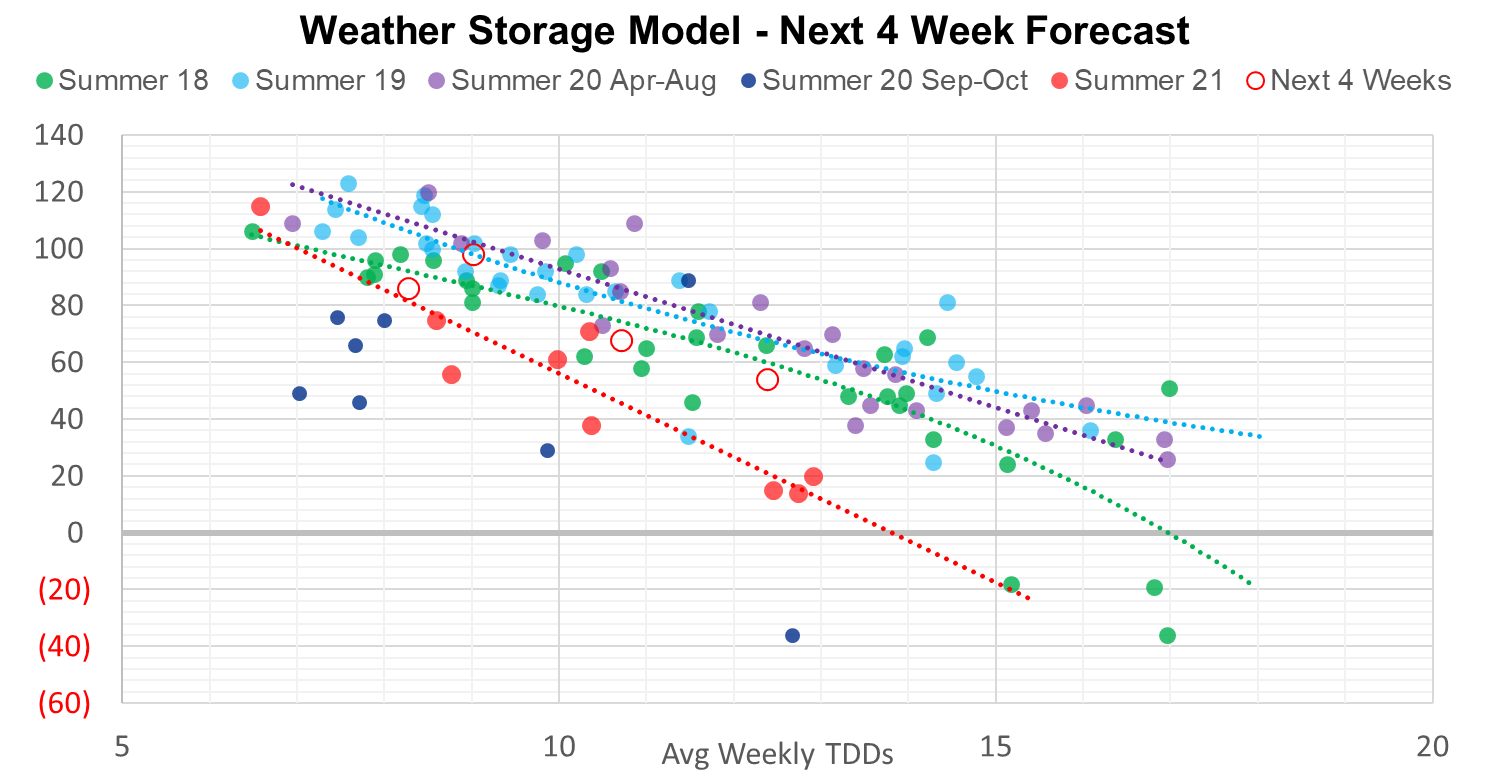

For the week ending May 28th, our early view is +98 Bcf. The 5Yr average is a +96 Bcf injection.

Our projected injection would take the L48 storage level to 2313 Bcf (-386 vs LY, -61 vs. 5Yr).

Domestic production slightly higher last week with a few basins adding a little bit of volume. There are two maintenance events going on that should have wrapped up last week – Transco’s Leidy Line and El Paso compressor work.

The biggest moving factor this week was consumption. The 3rd week of May (last week) is typically the timeframe when the transition from HDDs to CDDs takes place; hence we should see total consumption start to climb with power gen usage increasing into the summer cooling season. HDDs dropped by 0.9 degrees to nil from the previous week, while CDDs moved higher by 3.3 degrees to 7.5. With that temperature change, ResComm consumption decreased by -1.3 Bcf/d WoW, while power and industrial increased by 4.1 Bcf/d in total.

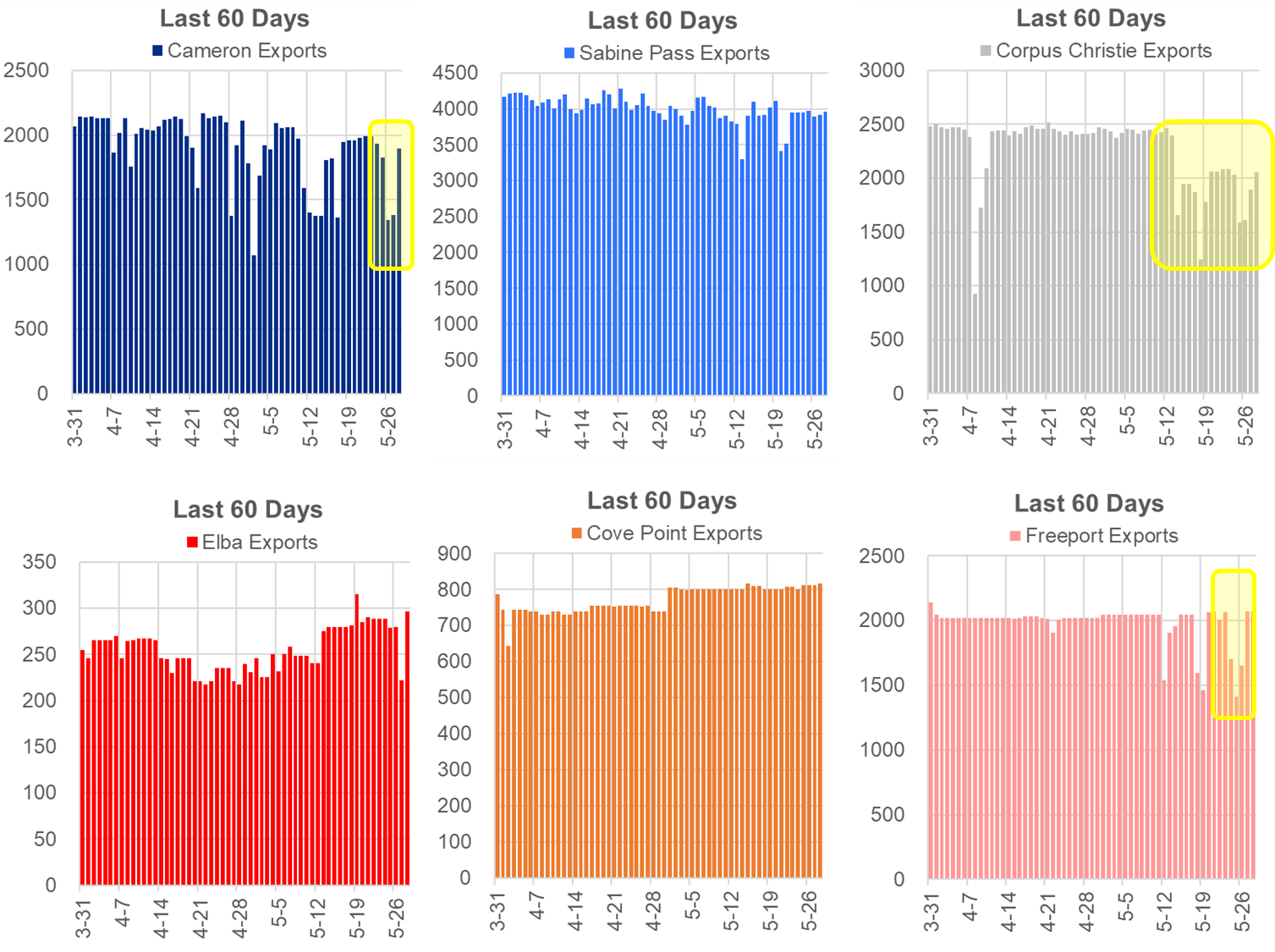

Deliveries to LNG facilities averaged 10.4 Bcf/d, which was flat week-on-week. There appears to be maintenance-related activity at several facilities. Cheniere’s Corpus Christie booked another 1.25 Bcf in Pine Prairie IT storage on May 21, which is typical of Cheniere during maintenance events. Corpus Christi usually takes >2.4 Bcf/d, but flows have been lower since May 14th. Also to note is Cameron volumes dropped by 0.6 Bcf/d starting May 26th, and Freeport volumes dropped starting May 24th.

Net the balance is tighter by 1.8 Bcf/d week-on-week.

Expiration and rolls: UNG ETF roll starts on June 14th and ends on June 17th.

July futures expire on June 18th, and July options expire on June 25th.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.