This week, we will review some slides from the Genscape natgas team. These are from a public webinar from Oct 22nd that dived into their winter outlook.

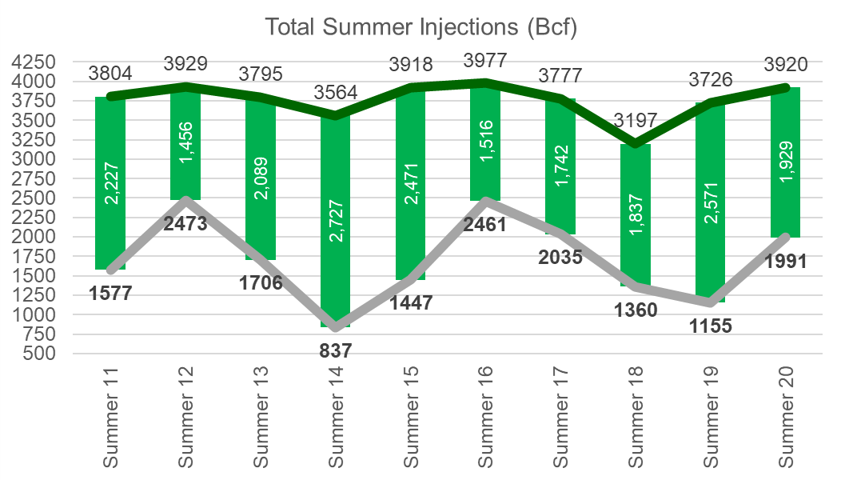

Their end of summer storage forecast was 3.95 Bcf on Oct 31, and it appears that is higher than where things ultimately end up with a with draw expected for week ending Oct 30. We are projecting storage levels to be approximately 3920 on Oct 31, which points to 1929 Bcf being injected over the summer months. This is 642 Bcf less gas injected than Summer 19, but only 98 Bcf lower than the 5 Yr average summer injection.

Source: Analytix

Genscape’s base case for end of winter is 1.45 Tcf, based on the winter strip as of 10/16 being at 3.21 and 30Y normal weather. On Friday, the winter strip closed at 3.24 (with Nov expiring at 2.99) and the expectations are for a warmer than normal winter; hence taking those two into account the end of winter could be slightly higher now with less C2G and warmer temps.

Below are some details on the their individual S/D components that got them to their end of winter storage estimate.

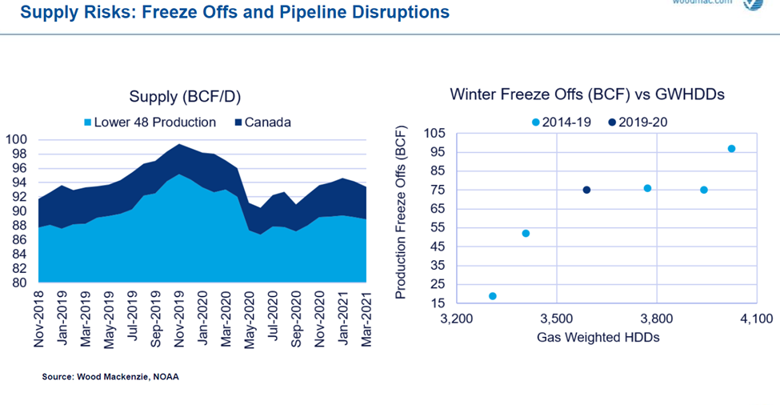

Production will be lower by 4.5 Bcf/d YoY, which includes a total of 65 Bcf lost through the winter due to freeze-offs.

Production past the winter will need higher prices in order to rebound.

“Capital disciplined producers are hesitant to re-deploy increased cash flow for the remainder of 2020”.

SW Marcellus and Haynesville production look to the marginal molecules that needs to be activated to increase production substantially. The break-even for those wells is 2.50-$3.00/mmBtu.

This past summer’s LNG pushback contributed to 700 Bcf to our current storage level. Cargo cancellations started in April, and last through October.

Their LNG feedgas forecast is roughly 10 Bcf/d over the winter. Current spreads suggest that we should be flowing at those levels as we showed in a weekend report a couple of weeks back.

Power burns are expected to be ~3.5 Bcf/d lower year-on-year. This the result of higher prices this year pushing coal back in the power stack, and increased renewable penetration.

Fundamentals for week ending Oct 30: Our early view for the upcoming storage report is a -31 Bcf withdrawal for the lower 48. This would take storage levels to 3924 Bcf. The industry estimates for this report range between -38 to -12 according to The Desk.

US natural gas dry production dropped week on week with domestic production averaging 87.3 Bcf/d for the week. The production is 1.8 Bcf/d lower week on week primarily due to Gulf of Mexico production disruptions due to Hurricane Zeta, and cooler temps in the West Texas leading to operation issues at local gas plants.

Canadian imports were once again lower last week averaging 4.8 Bcf/d. Mexican exports averaged of 6.3 Bcf/d. We expect exports to Mexico to start to drop off as temps start to cool.

Deliveries to LNG facilities averaged 9.2Bcf/d, up 1.2 Bcf/d week on week with Sabine and Cameron returning to normal operational levels. Infact, total US LNG hit a new record level of 9.76 Bcf/d. This looks to be a preview of what is to come this winter.

Expiration and rolls: UNG ETF roll starts on Nov 11th and ends on Nov 16th.

Dec futures expire on Oct 28th, and Nov options expire on Nov 25th.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.