This week we start to take a look at how the weather has taken the driver seat in moving price daily. Since the close of last week, we have seen one warm forecast after another show up leading to prices cratering, despite three EIA storage numbers that pointed to tighter than expected balances.

Looking at the price journey, we see that prices were relatively flat in September but then climbed throughout October. The December contract hit a high of 3.14 at the end of October and has fallen off a cliff this past week dropping under $3. The close on Friday was $2.888/MMbtu

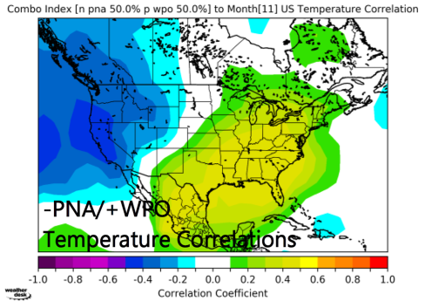

“The large weather scale pattern is the characteristics of the –PNA (a common pattern of La Niña in winter) and the +WPO. Associated features influence the orientation and strength of the northern Pacific jet stream, resulting in a colder airflow into the West and above normal temperatures across the Eastern Half.” [Maxar Weather]

Let’s go through some charts and tables to show just how influential the weather was this past week.

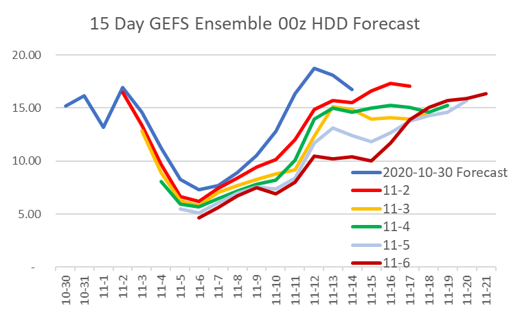

Let’s start with the GEFS Ensemble 15 day forecast. Since last week (looking at trading days only), almost every forecast pointed to warmer temps. Here is a visual picture of the 00z runs.

Note: these are the timing of the model runs each day after last week’s time change.

GEFS Ensemble:

12z starts at 10:30 AM EST

00z starts at 10:30 PM EST

it takes 3 hours to complete

Euro Ensemble:

12z starts at 1:45 PM EST

00z starts at 1:45 AM EST

it takes about an hour to complete

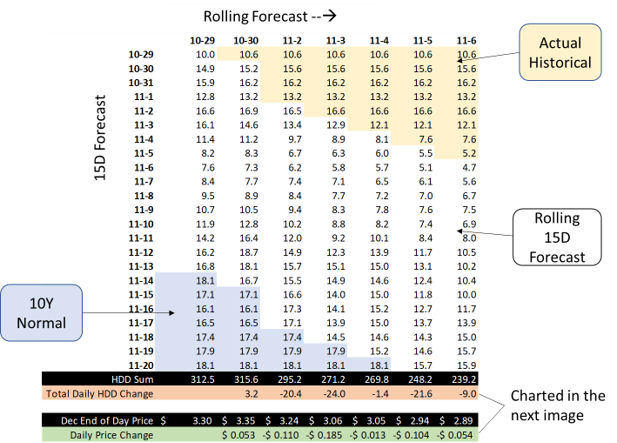

The next table takes the same data and puts it into a format that combines it with actuals (yellow) and 10Y normal (blue). This allows us to see how the first 2/3 of November changed this week.

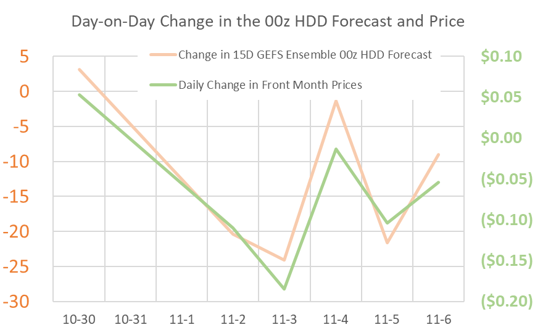

The daily change in HDD is the orange row, while the daily change in price is the green row. When we plot those to on top of each other, the relationship is staggering. This relationship was stronger than we expected but goes to show how the weather has started to take over the conversation.

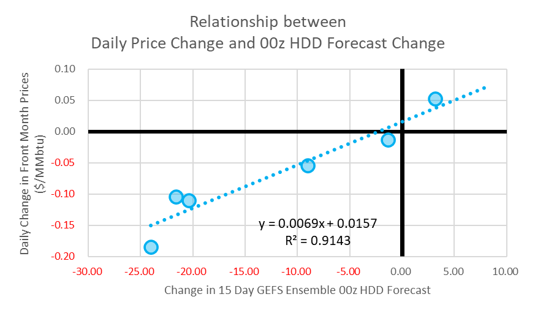

When we take this relationship and create a scatterplot, we can identify a linear relationship that could help determine where the price should move to each day.

What this shows that a 5 HDD move higher results in a 3.5c price move, and a 5 HDD move lower results in a 3.5 price lower.

This analysis is just food for thought. Weather is ever so critical this winter especially with a very tight fundamental market and a strong La Nina condition.

Fundamentals for the week ending Nov 06: Our early view for the upcoming storage report is a -7 Bcf withdrawal for the lower 48. This would take storage levels to 3912 Bcf. The industry estimates for this report range between -20 to +6 according to The Desk.

US natural gas dry production dropped week on week with domestic production averaging 90.5 Bcf/d for the week. The production is 2.3 Bcf/d higher week on week with big increases out of the Northeast and West Texas.

Canadian imports were once again lowered last week averaging 4.9 Bcf/d. Mexican exports averaged 6.0 Bcf/d. As expected, exports to Mexico to start to drop off as temps start to cool.

Deliveries to LNG facilities averaged 10.2Bcf/d, up 1.0 Bcf/d week on week to reach a new weekly record. Current LNG economics for the winter suggest flows at these levels all winter.

Expiration and rolls: UNG ETF roll starts on Nov 11th and ends on Nov 16th.

Dec futures expire on Oct 28th, and Nov options expire on Nov 25th.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.