This week we focus in on weather. The changes in the short-term weather forecast has taken natural gas prices through a wild journey in November so far. Since Oct 30th, the market has traded in a 76c range, with Friday’s close of $2.65 being 70c below the Oct 30th close of $3.35.

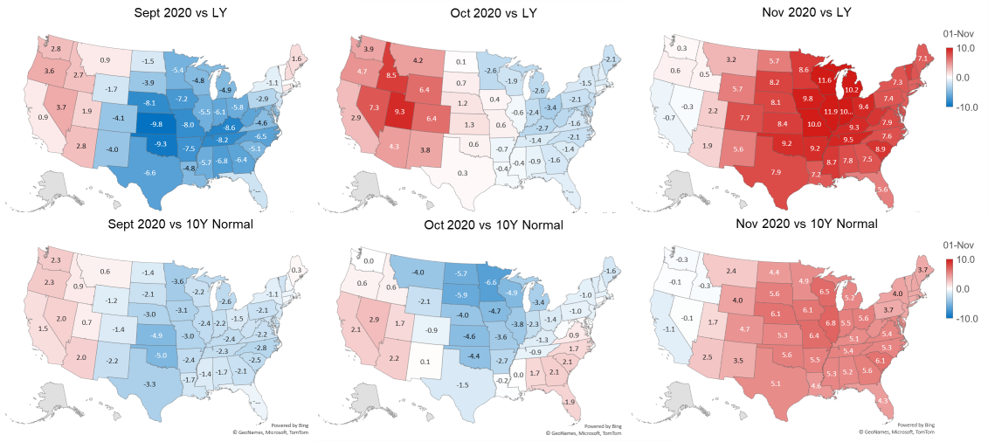

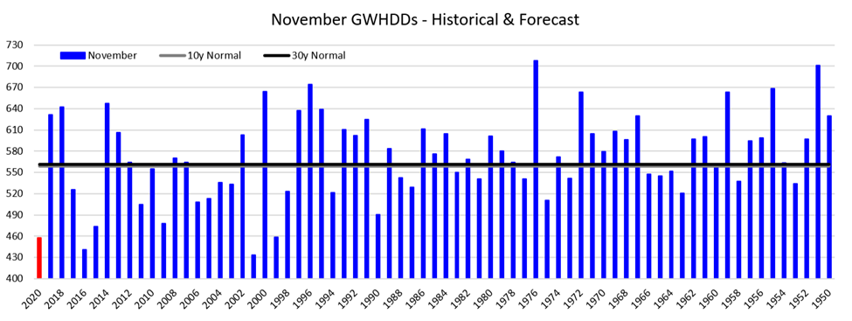

November has been one warm revision and another. November is now forecast to total 458 GWHDDs. This comes after September and October came in cooler than expectations.

It would rank as the 3rd warmest on record, among national data dating back to 1950.

Top-10 record warmth for November per GWHDD measures are in the following regions: Mountain (#4), South Central (#1), Midwest (#3) and East (#5).

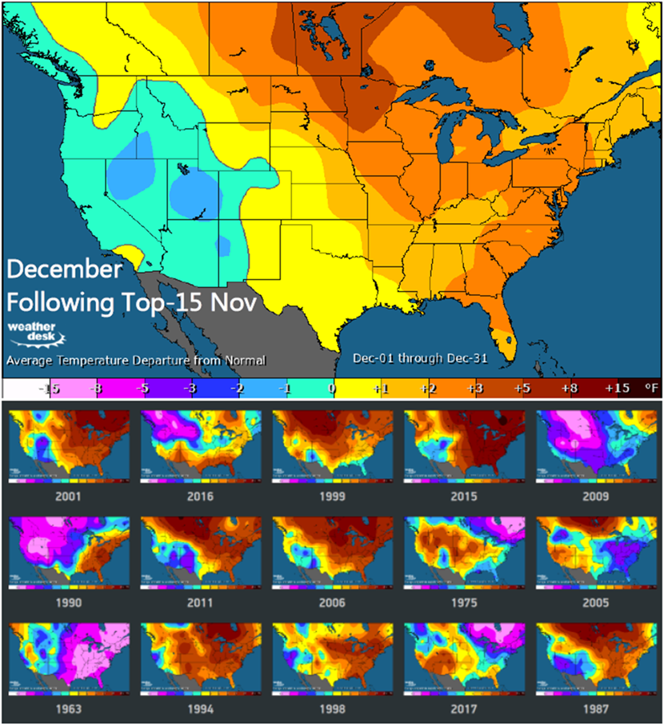

A neat tool we looked at this week comes from Maxar Weather (Earthsat MDA) called Dynacast. The tool allows you to do a historical analysis like the following.

The larger map below is a composite of the 15 smaller maps representing Decembers following a top-15 warm November.

There appears to be a warm signal, particularly in the Eastern Half. Among the 15 years shown, 11 Decembers show the East being warmer than normal including three in the top-5 for warmest back to 1950.

All 15 analogs average 835 GWHDDs, which falls between the warmer 10-year normal (807) and colder 30-year normal (874).

Among the colder than normal Decembers are 2017 (884 GWHDDs), which was in the previous La Niña season, 2005 (920 GWHDDs), 2009’s start of an Arctic blocking influenced winter (934 GWHDDs) and the #2 ranked cold December from 1963 (1087 GWHDDs).

The statistical connection is not significant between November and December GWHDDs, with an anomaly correlation of just +0.18.

That said, the connection between GWHDDs in November and that for all of winter (i.e. December to February) is more significant, with an anomaly correlation of +0.30. Among the top-15 warm Novembers are 12 that went on to feature a warmer than normal winter per GWHDD measures. The 2020-2021 winter is expected to add to the list of warmer seasons.

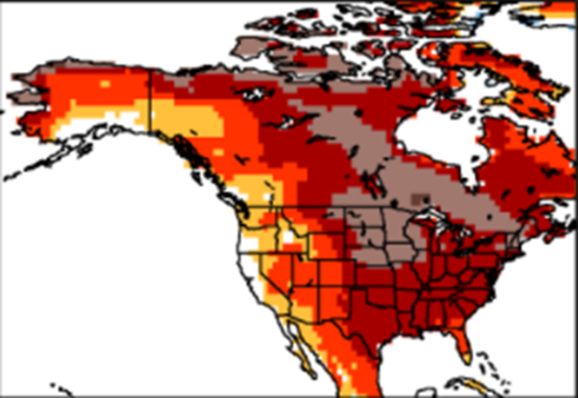

The CFS continues to be on fire as well, showing no changes in what it has been show

Fundamentals for the week ending Nov 20: Our early view for the upcoming storage report is a -22 Bcf withdrawal for the lower 48. This would take storage levels to 3936 Bcf. The industry estimates for this report range between -47 to -10 according to The Desk

US natural gas dry production dropped week on week with domestic production averaging 91.7 Bcf/d for the week. Northeast production swung higher early in the week with stronger cash prices at the end of last week. With Nymex and regional cash prices falling throughout the week, we observed production starting to fall out the Marcellus and Utica. This flex production seems to be very reactive to pricing.

The other big mover was the change in demand. With cooler temps, consumption picked up by 11.7 Bcf/d. Rescom made up the vast majority of that increase, accounting for 10.4 Bcf/d of the total.

Canadian imports were higher last week averaging 5.1 Bcf/d. Mexican exports continue to hold steady at an average of 6.2 Bcf/d.

Deliveries to LNG facilities averaged 10.2 Bcf/d, down 0.2 Bcf/d week on week. Freeport looked to have some operational issues early in the week, and Sabine had maintenance on one of its incoming feeder pipelines starting GD19.

Expiration and rolls: UNG ETF roll starts on Dec 15th and ends on Dec 18th.

Dec futures expire on Nov 26th, and Nov options expire on Nov 25th.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.