Happy Thanksgiving. This week we will review how industrial demand has continued to evolve this year with COVID slow-downs and shut-downs.

The pipeline nomination gives us decent insight into daily industrial activity. This dataset allows us to roughly see 25% of the total gas delivered to industrial facilities across the country. In some regions we have better visibility than others.

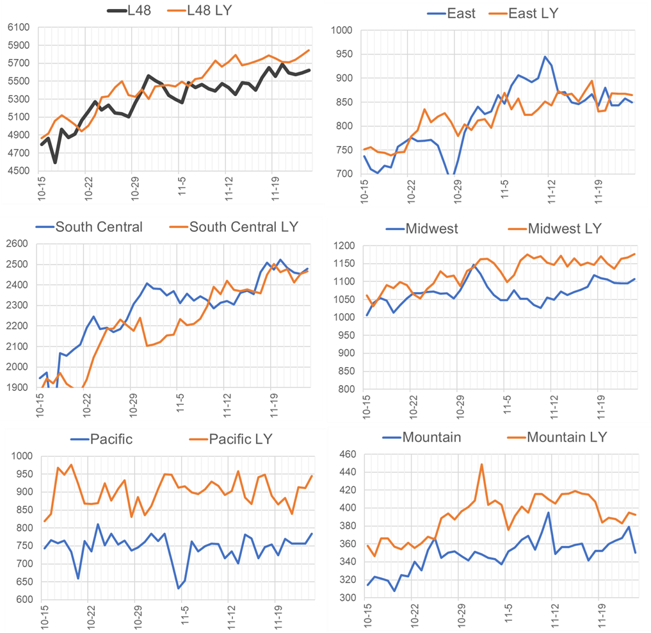

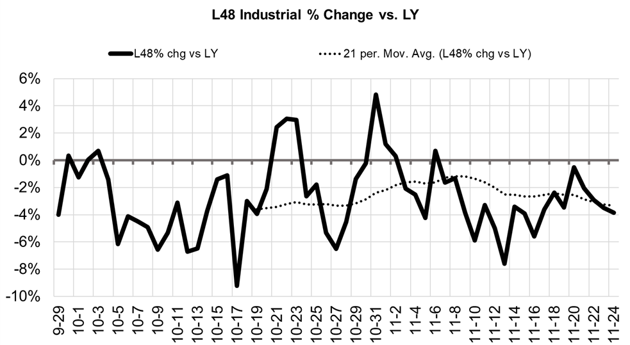

Here is how this year’s data lines up to last year.

This data gives good proxy to where total industrial demand sits relative to last year by region, and what we should expect for the rest of winter.

With out taking temperature into consideration, industrial demand looks to be 5% lower YoY.

Fundamentals for the week ending Nov 27: Our early view for the upcoming storage report is a -9 Bcf withdrawal for the lower 48. This would take storage levels to 3931 Bcf. The industry estimates for this report is -17 according to The Desk. The range was fairly wide this week with it being a non-typical holiday week.

US natural gas dry production increased week on week with domestic production averaging 92.4 Bcf/d for the week. The increase comes from the Gulf region, particularly West Texas. Demand was relatively flat week on week, with total consumption adding up to 82.7, or 0.7 less that the previous week. The slightly warmer temps week on week dropped rescomm consumption by 0.6 Bcf/d.

Canadian imports were fell last week averaging 4.5 Bcf/d. Mexican exports continue to hold steady at an average of 6.3 Bcf/d.

Deliveries to LNG facilities averaged 9.4 Bcf/d, down 0.4 Bcf/d week on week. Sabine operations were lower post the completion of the maintenance on the NGPL interconnect.

Expiration and rolls: UNG ETF roll starts on Dec 15th and ends on Dec 18th.

Jan futures expire on Dec 29th, and Jan options expire on Dec 28th.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.