The price relief was partly due to headlines that Putin would begin increasing supply to Europe in the coming weeks/months. The message from Putin was unclear on exactly how since Russia’s Gazprom is still looking to fill storage at home. The market quickly suspected that the offer to increase supplies to Europe was likely intended to put pressure on Germany to certify the Nord Stream 2 gas pipeline for use, as Russia is waiting on Germany’s energy regulator to authorize. This political pressure could be a method of fast-tracking something that could take several months otherwise.

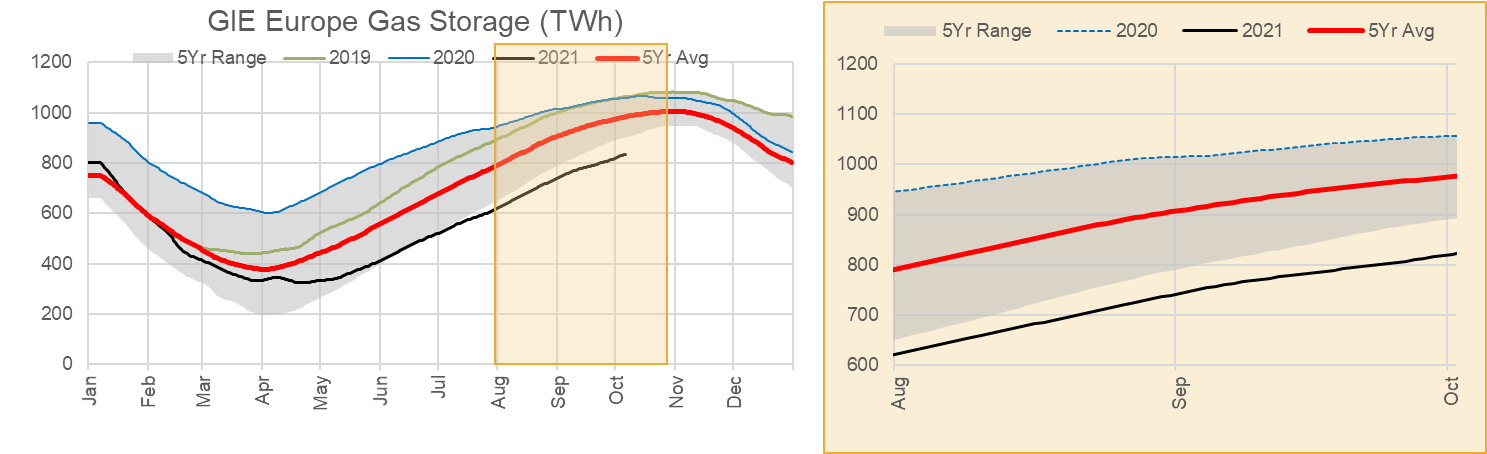

European gas storage levels are currently sitting 19% below last year, and 14% below the 5Yr average. Looking at some of the larger storage hub countries such as Germany and the Netherlands we see the situation to be even worse. German and Netherland’s storage is currently 25% and 33% behind last year, respectively.

The exploding prices have caused panic as these fragile economies are still recovering from the impacts of COVID. European industries are being hit with surging energy costs and in some cases shutting down production, while power/gas retailers are failing with inadequate hedges to cover their short position. In response, France, Spain, Romania, the Czech Republic, and Greece have issued a joint statement to address the rally in gas and wholesale electricity prices this summer.

They are suggesting a five-pillar approach to the problem, which includes:

Pillar 1 – Full European Approach

A common approach to the problem at the European level will be needed, such as a “European policy toolkit” that would coordinate national responses to react immediately when prices surge

Pillar 2 – Addressing Gas Prices

With regards to natural gas, they are calling for an investigation into the functioning of the European gas market to “understand why current gas contracts have been insufficient.” They also want to build in common guidelines for gas storage to “mitigate and smooth price increases.” Lastly, they want to better coordinate gas purchases to increase bargaining power.

Pillar 3 – Reform Wholesale Electricity Market

The electricity market needs to be “improved to better establish a link between the price paid by consumers” and the “average production cost” for power within individual nations. They cited that this is a massive item since the decarbonization movement will increase electricity use within Europe.

Pillar 4 – Energy Independence

They call for Europe to focus on “achieving energy independence” by investing in a diversity of energy supply and cut reliance on gas-exporting nations “as fast as possible.” Wind and solar are their key focus with regards to this push.

Pillar 5 – Stabilize Carbon Pricing

They want to provide a more “predictable carbon price” and avoid excessive volatility with carbon pricing in order to allow stakeholders to plan ahead and shift investments into low carbon activities.

So the question remains, how can Europe back on path?

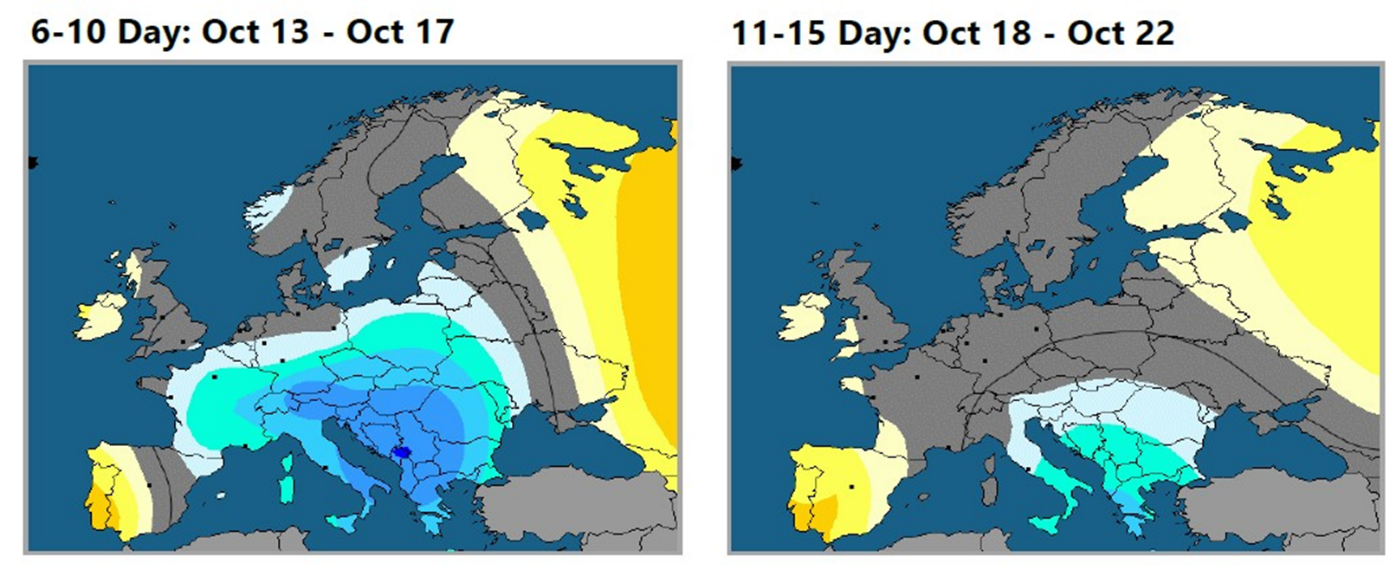

Weather is not going to be helping. Here is the short-term forecast from Maxar:

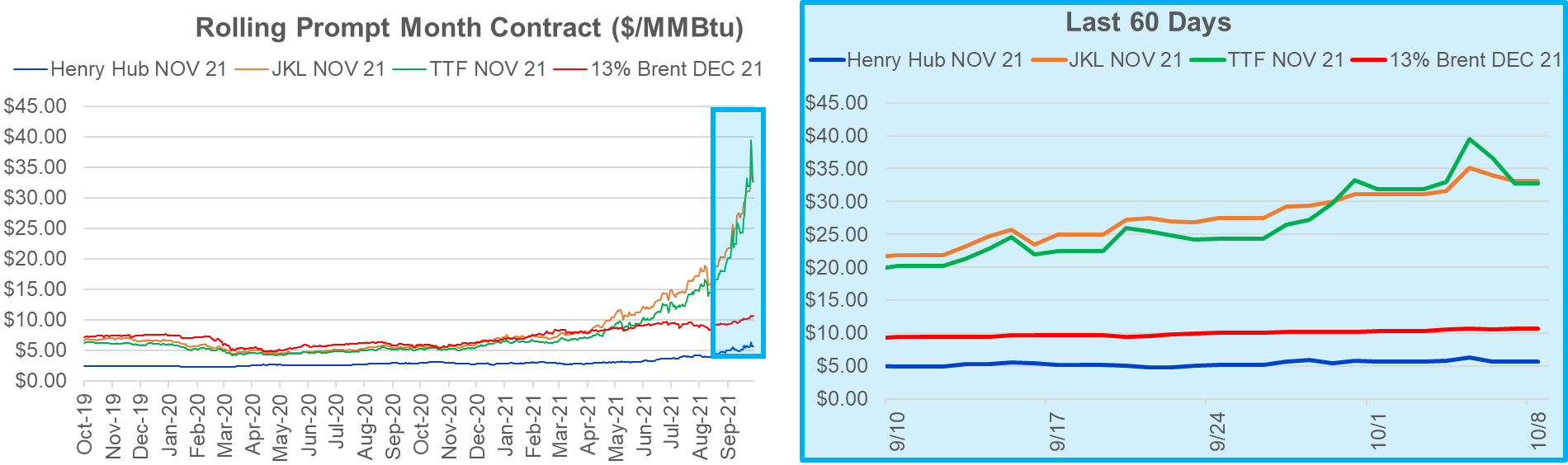

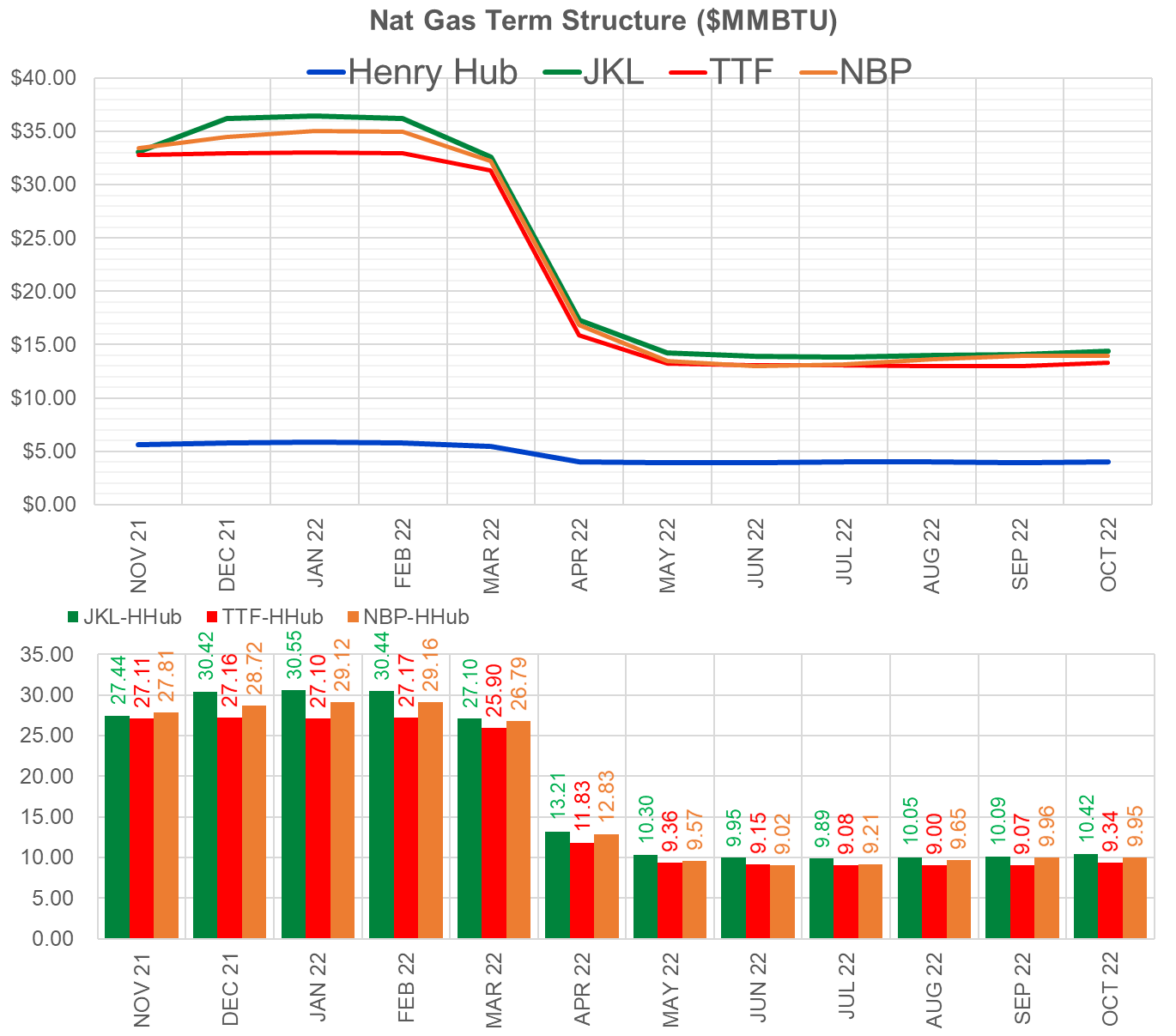

LNG are not able to help with Asian and South American buyers paying a premium to divert cargoes away. For the rest of winter, JKM is pricing above TTF. Every time TTF rises it can only hold a premium over JKM for a very short time.

Norway is trying to bring on more production (already raised its annual permitted production levels), but Russia is the only potential source of meaningful incremental pipeline supply volumes across this winter. This story is still playing out, and with it, the US price benchmark will continue to stay volatile.

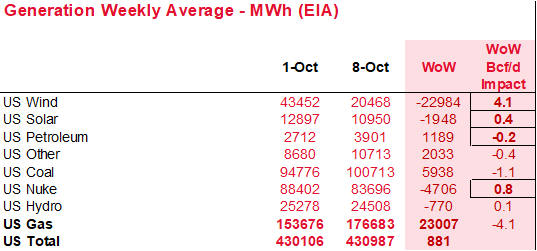

Fundamentals for the week ending Oct 08: This past week the EIA reported a +118 Bcf storage injection for week ending Oct 1st. The report was higher than market expectations, and it appears the strong wind led to the higher injections. Wind averaged over 43 GWh for both week ending Sept 24th and Oct 1st, leading to lower burns.

For the week ending October 8th, the wind did drop off from those high levels. We estimate the 50% drop in wind resulted in an addition 4 Bcf/d of burns; hence left storage injection considerably lower. Our early view is +92 Bcf for last week. Our projected injection would take the L48 storage level to 3380 Bcf (-490 vs LY, –163 vs. 5Yr). As we mentioned last week, if we did not have the PG&E storage reclassification in early June (working->base), we would be 51 Bcf closer to the 5Yr average storage level. That would put storage levels very close to the 5Yr average.

Domestic dry gas production was lower by 0.4 Bcf/d to an average of 92.8 Bcf/d during the week. This week we smalls drops across various regions, which was mainly offset by an increase in Northeast production. The jump in Canadian imports last week did not last this week. Import levels fell back to 5.3 Bcf/d

Total consumption was higher this week, driven by both more pwCDDs and lower wind levels in the early part of the week. Total national power demand was flat week-on-week, but the mix of generation assets was quite different. As we eluded to above, the lower wind was mainly picked up by natural gas generation.

Deliveries to LNG facilities averaged 9.9 Bcf/d, which was –0.4 Bcf/d lower than the previous. The drop was associated with both Freeport and Corpus Christie being offline for a few days. There was no formal announcement from either facility regarding maintenance.

The net balance is looser by 3.7 Bcf/d week-on-week.

Expiration and rolls: UNG ETF roll starts on Oct 14th and ends on Oct 19th.

Nov futures expire on Oct 27th, and Mov options expire on Oct 26th.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.