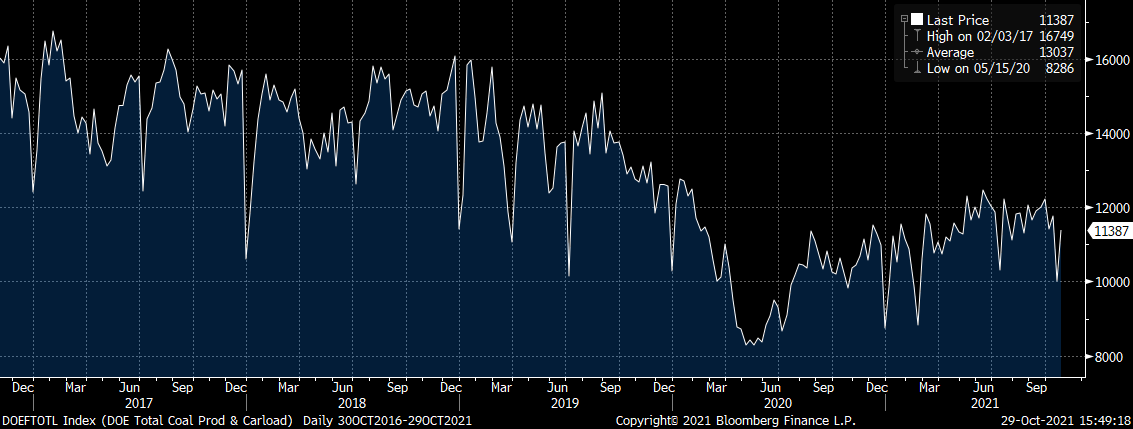

Natural generation levels are more of an issue for balances during the summer months when power loads pick up for A/C and less of a concern during the winter. That being said, we do see power consumption rise in the winter slightly with shorter days and some electric space heating requirements. Below is a seasonality chart of total US power loads throughout the year. In the shoulder months, the average daily load can drop to 350GWh, while in the summer we can rise above 575 GWh.

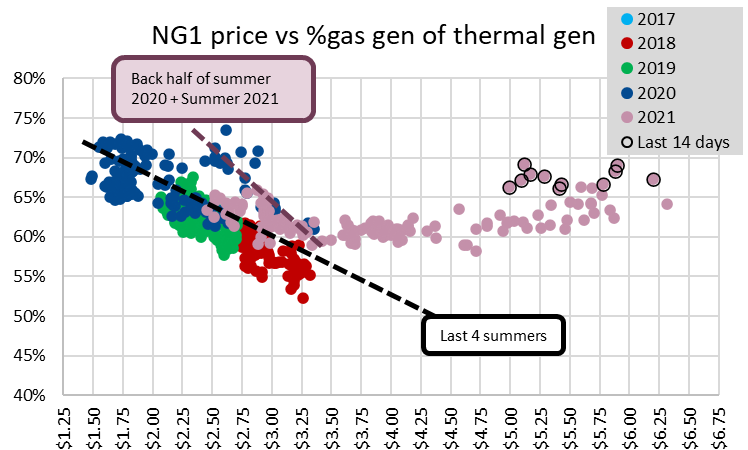

In the winter, at higher natural gas prices we see coal generation lower in the daily power stack; and hence it takes on more of a dominant role. This year could be a lot different after seeing coal generation lag during the summer months:

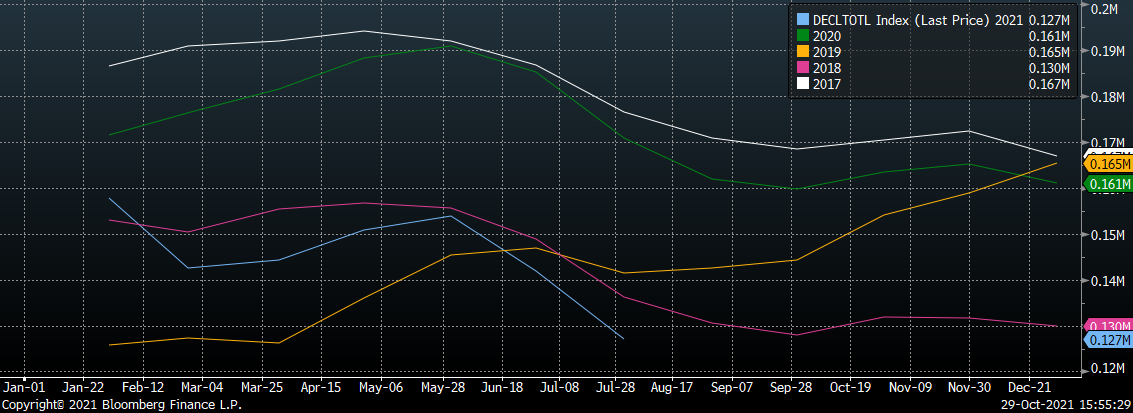

1) Coal inventory levels are the lowest level in decades with coal production much lower (some mines temporarily shut-in last year due to COVID) and strong exports due to global demand.

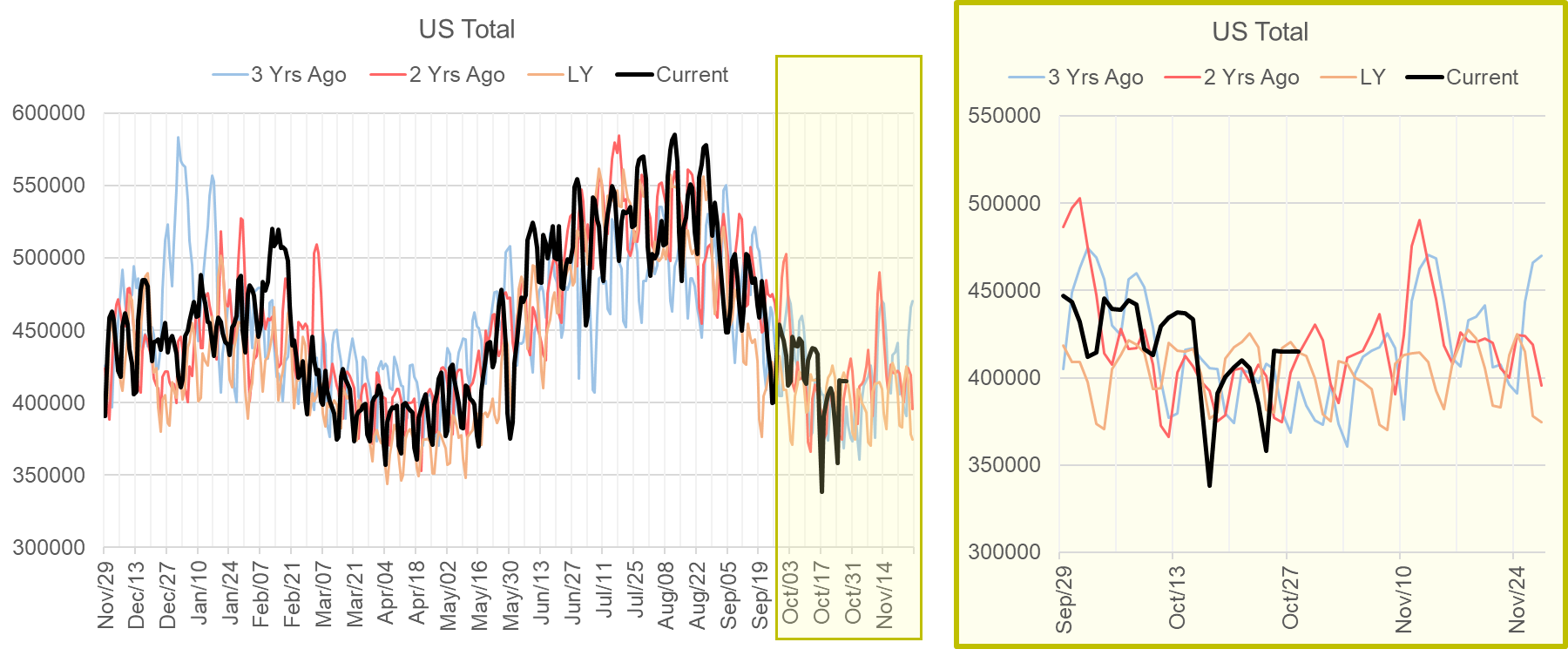

US Weekly Coal Production

US Coal Stockpiles Seasonality Chart

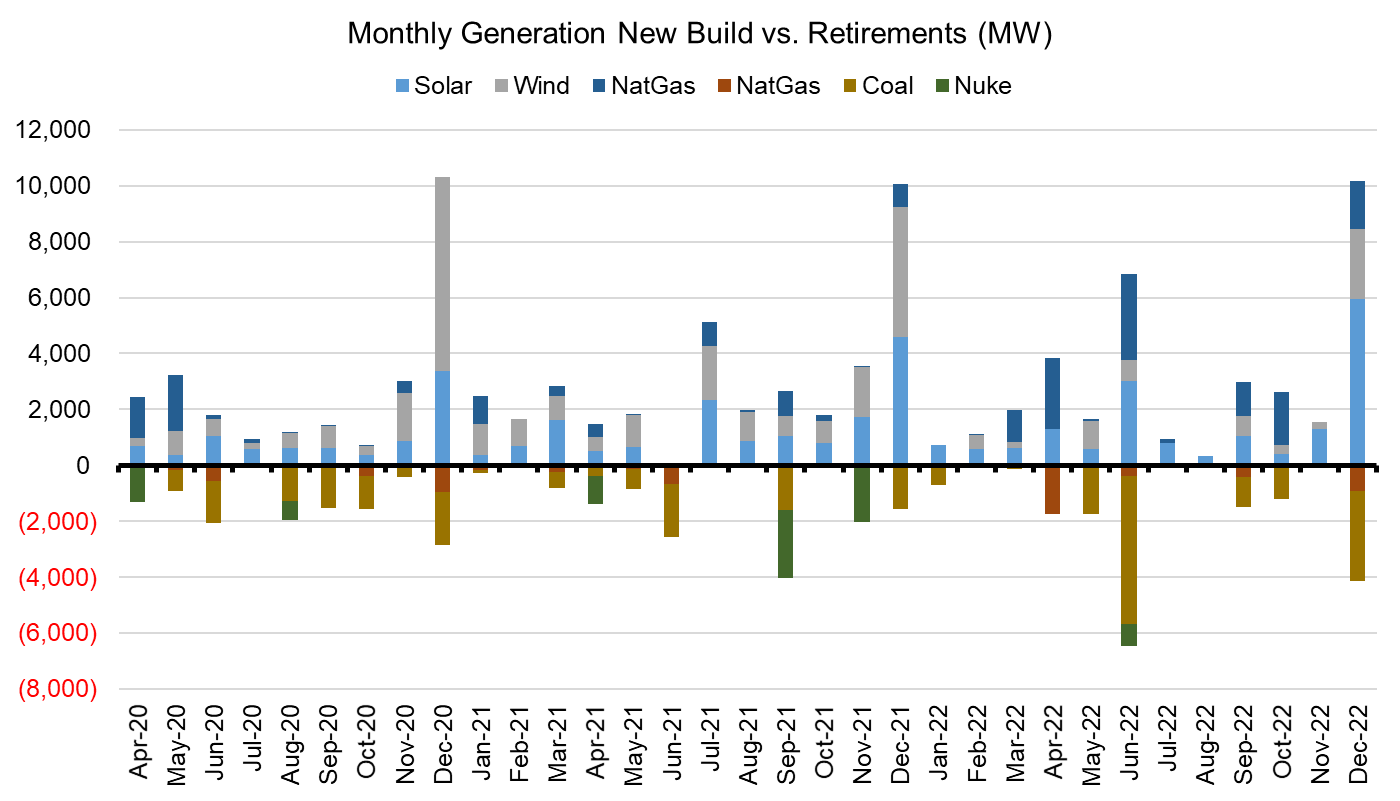

2) Retired coal plants are being replaced by natural gas and renewables generation. Since April 2020, there has been over 15GW of coal capacity retired already.

We should note that the capacity factor of wind is ~35-40% and solar is ~20-25%; hence natural gas generation is heavily relied on as coal retires.

3) with the increase in wind generation (as seen above), natural gas generation can instantaneously react to real-time variations in wind output.

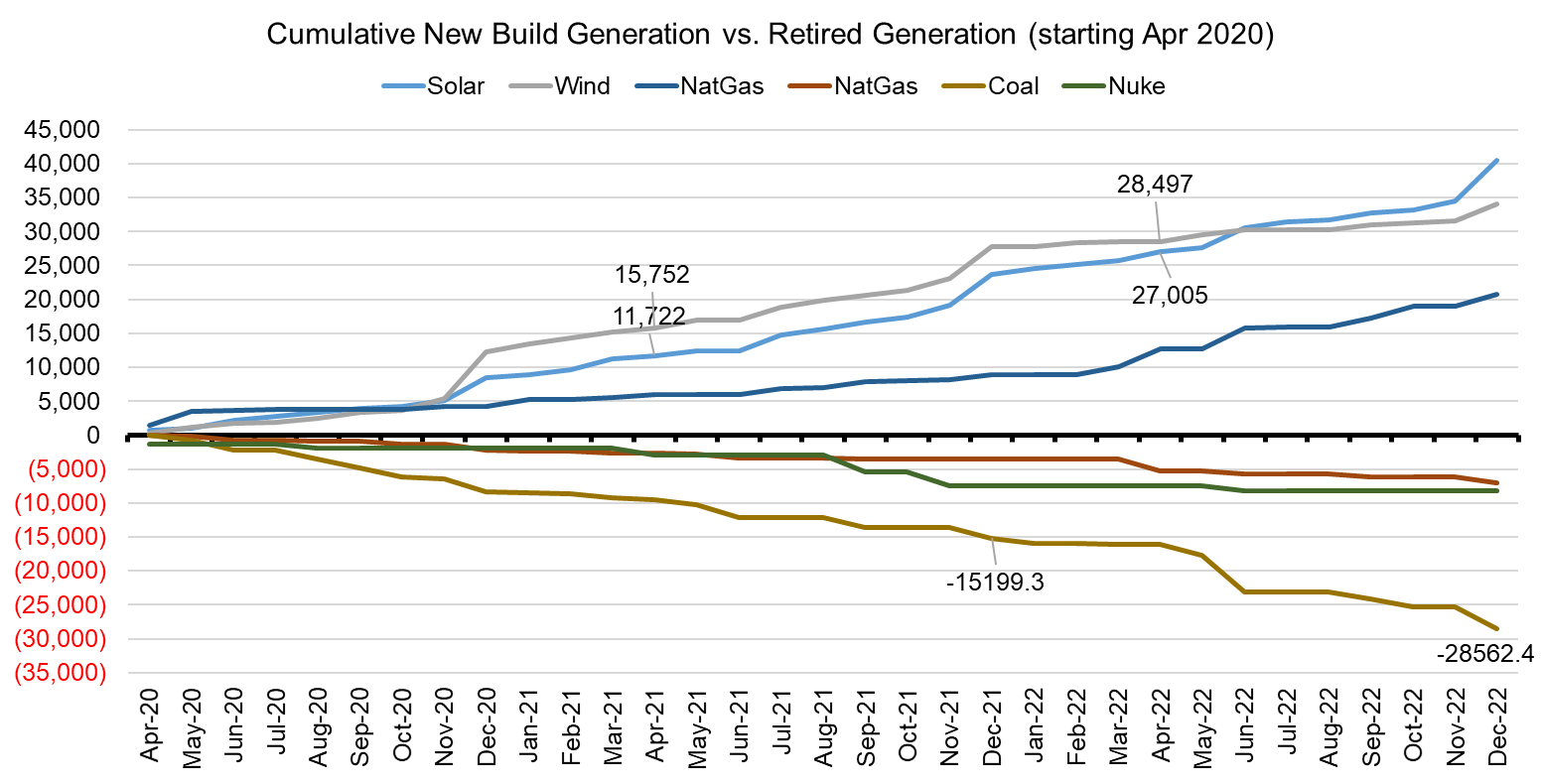

Fundamentals for the week ending Oct 29:

The EIA reported a +87 Bcf injection for week ending Oct 22, which was in line with the consensus. This is now the 6th week in a row where the injection exceeded both LY and the 5Yr average injection levels. For the week, power burns would have dropped even further if it were not for a drop in both wind and nuclear generation relative to the week prior. We estimated the drop in wind and nuclear added on average 1.7 Bcf/d of gas consumption.

One of the offsetting factors for the reporting week was an increase in net Canadian imports. Canadian imports have been relatively strong compared to last year due to a few factors:

1) ample storage space available across the US, unlike max capacity issues seen in 2020.

2) increased WestCan production with the completion of some NGTL maintenance this year

3) strong Eastern Canada storage levels keeping Mich to Ontario flows low

For the week ending Oct 29, our early view is +61 Bcf. Our projected injection would take the L48 storage level to 3609 Bcf (-315 vs LY, -103 vs. 5Yr). This would be a very healthy injection compared to past years. The 5Yr average for this week is +38 Bcf, and last year a withdrawal of -27 Bcf was reported.

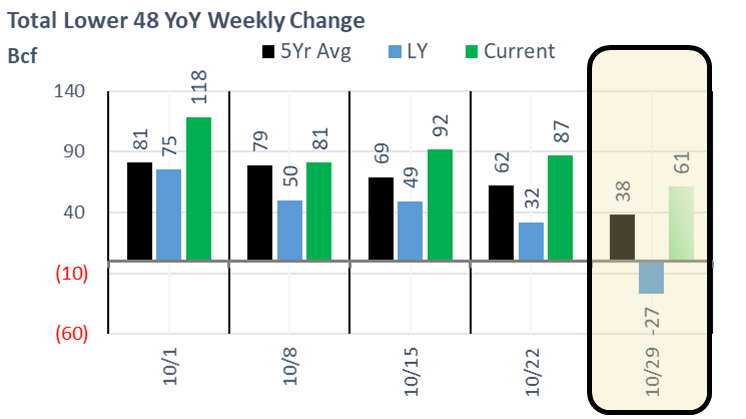

Domestic dry gas production made a significant move higher this week. We observed production from the South Central and Northeast taking production 0.9 Bcf/d higher to an average of 93.3 Bcf/d. A portion of the South Central gains come from GoM production resuming to 1.8-1.9 Bcf/d for the first time since the Hurricanes disrupted offshore rigs and onshore processing capacity. These production levels are now on par with late-August before the storms hitting the Gulf.

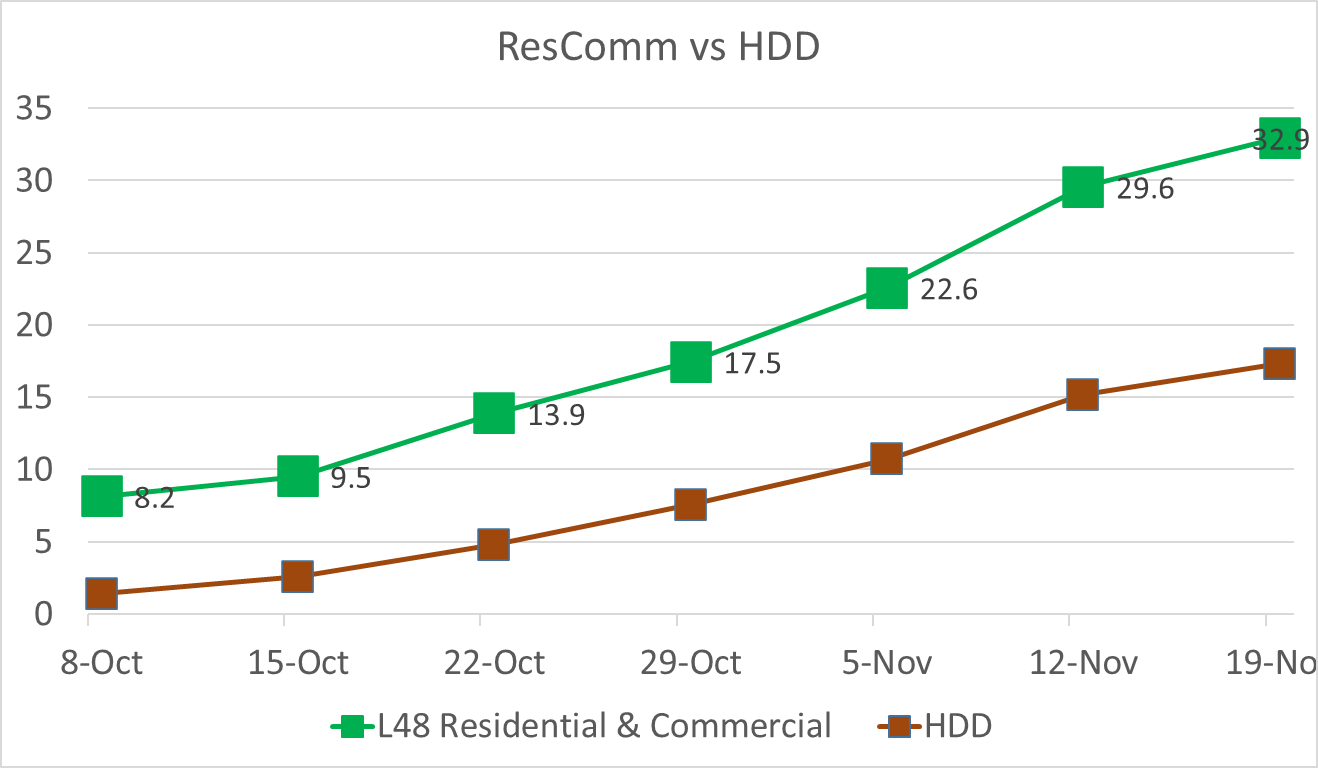

Total consumption is starting to move higher as weather transitions from CDDs to HDDs in most Northern regions. At the national level, CDDs are essentially irrelevant while HDDs continue to gain. ResComm consumption is estimated to be 3.6 Bcf/d higher this past week with HDDs rising by 2.7F WoW. Below is our forecast of ResComm levels for the next few weeks as the cooler temps set in. There is a big jump in gas demand during week ending Nov 12th, which could lead to the first storage draw of the season.

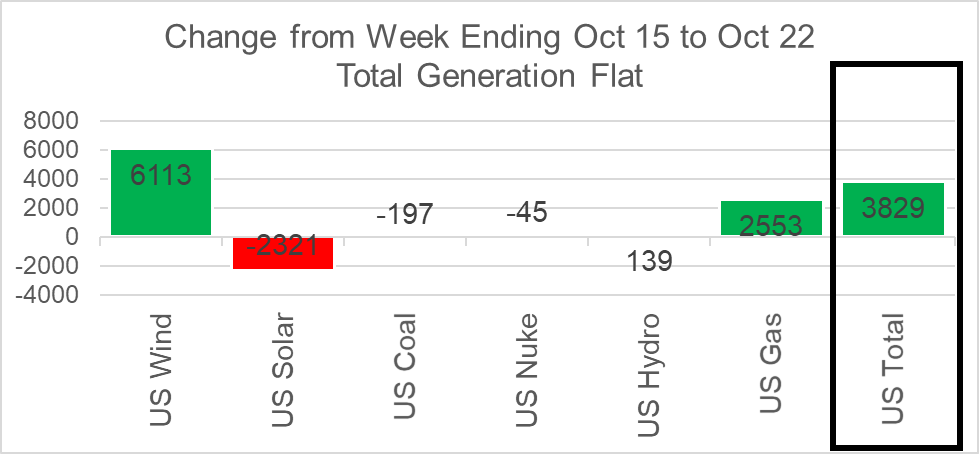

Also for this past week, we saw wind generation once again pick up reaching the strong levels we saw during week ending Oct 15. The strong wind offset the drop in solar but also took away some gas gen. Here is how the generation stack changed week-on-week.

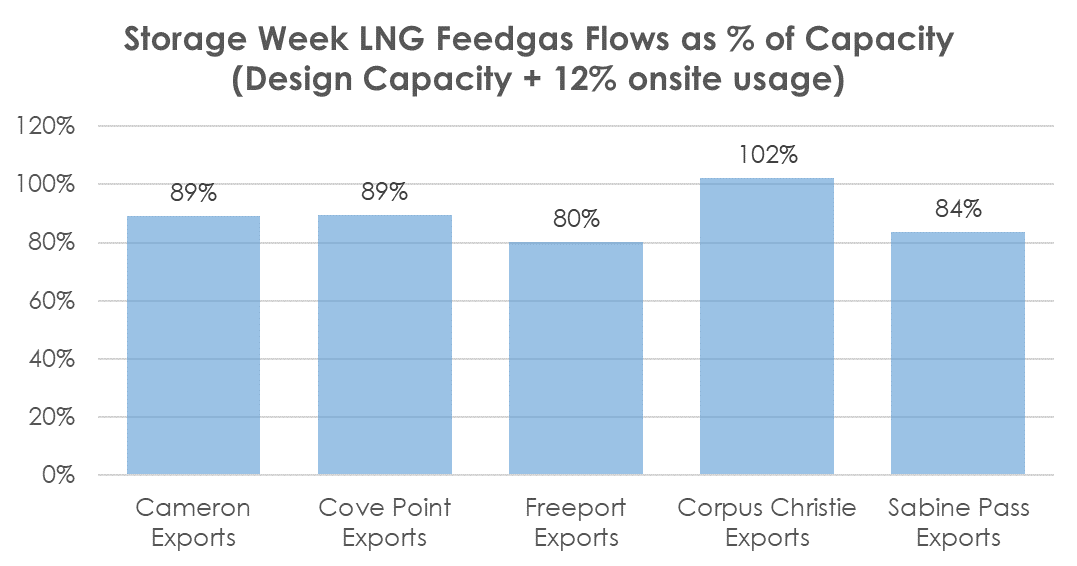

Deliveries to LNG facilities averaged 10.8 Bcf/d, which was flat to the previous week. At these operational levels, all major facilities are running at strong levels except for Sabine and Freeport. Freeport has been experiencing some feedgas issues due to wax buildup in the feeder pipes, while Sabine had a train out for maintenance. As of Friday Sabine feedgas jumped to over 4 Bcf/d or 94% of design capacity for the first time in 24 days.

Some other notes on LNG:

- Cheniere has asked the FERC for approval to return LNG Storage Tank S-101 to service no later than November 5th. The tank has been offline since 2018, along with Storage Tank S-103. Sabine storage is made up of 5 storage tanks with a total capacity of 17 Bcf. The return of the one unit will better allow Cheniere to manage feedgas flows for departing tankers.

- Venture Global has asked for FERC approval to commission Block 1 of their LNG modules along with the South LNG Tank. They asked to do so no later than October 29, 2021. We are already seeing small deliveries to the plant in the range of 5-10 MMcf/d.

The net balance was 3.7 Bcf tighter week-on-week.

Expiration and rolls: UNG ETF roll starts on Nov 11th and ends on Nov 16th.

Dec futures expire on Nov 28th, and Dec options expire on Nov 27th.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.