The EIA in its monthly Drilling Productivity Report (DPR) on Tuesday analyzed production trends into November.

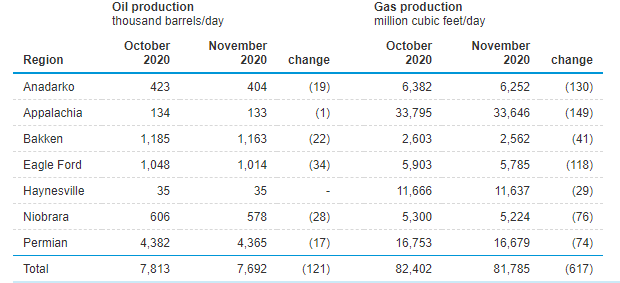

According to the latest report, the November 2020 crude oil production and natural gas production in DPR regions is expected to decrease by 0.121mmbbl/d and 0.62 MMcf/d, respectively, compared with October 2020 estimates. The primary inputs used to model these figures come from the Baker Hughes rig count numbers and FracFocus.org filing rates.

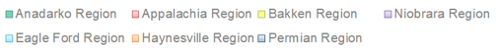

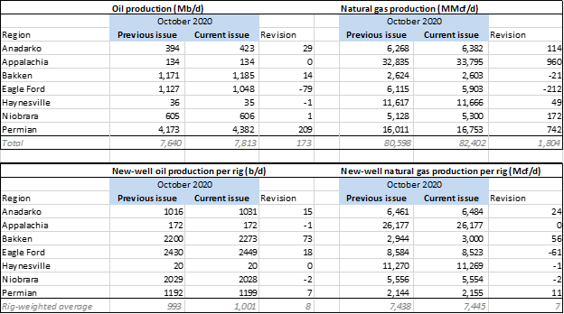

The chart below shows the production trends for all the major shale regions. As can be seen, both oil and gas production has held up relatively well despite rig lower by 555 when compared to last September. Producers seem to be relying on the DUC inventory and only drilling in areas where the production characteristics are superior.

[Note: Message us if you want to see the raw data and charts in an excel format.]

We focus on the Appalachian and Permian regions this week.

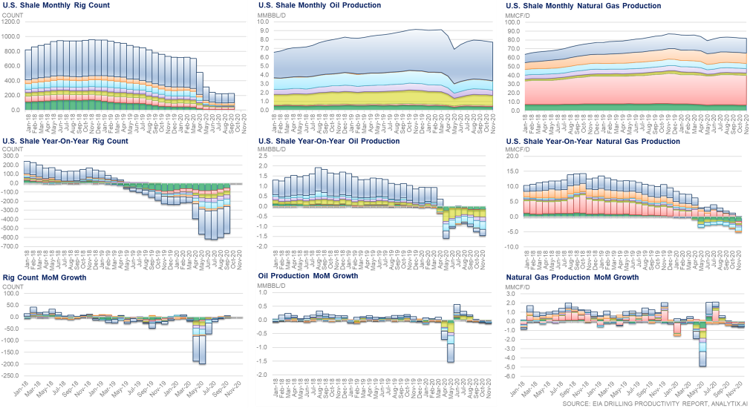

Starting with the App basin. After seen multi-year growth from the Marcellus and Utica, production from that region looks to be leveling out. November with an average of 33.65 Bcf/d is expected to be the first month to see a YoY drop since the start of shale production. With rig counts down to 31, or -33 YoY in Sept – we should be pleased with flat YoY production this November.

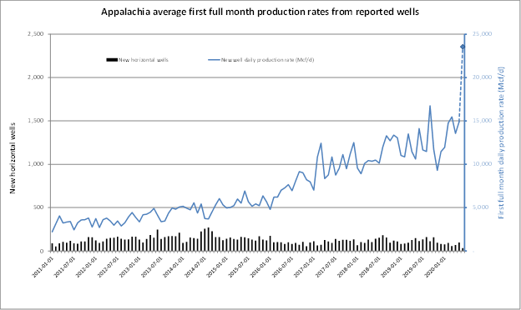

These are some additional charts provided by the EIA. Below we can see how the first full month daily production rates have exponentially grown over time as operators have refined their fracking method by increasing the length of laterals, optimizing their fracking pressures, and focusing on highly productive segments.

According to the chart, a horizontal well’s IP rate has jumped from about ~12 MMcf/d in 2018 to a projected ~24 MMcf/d in June of this year. This is what is keeping production strong.

It is hard to say if this high production rate is sustainable because only 32 wells came on in June. The few wells are a small sample set of the best wells, and therefore we expect to continue seeing much volatility in the remainder of the 2020 data.

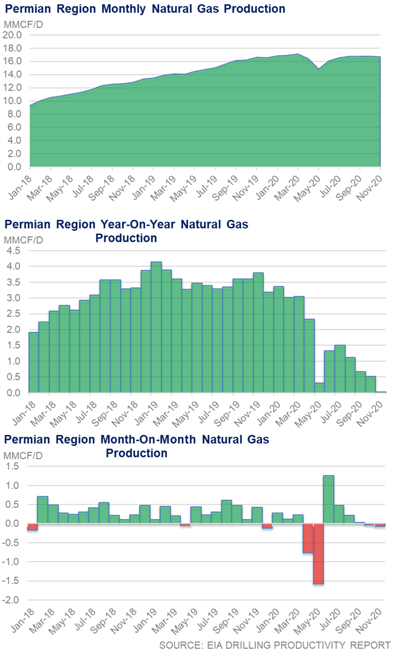

Next, let’s look at the Permian. Natural gas production in November is expected to be 16.7 MMcf/d from this region, which is essentially flat to last year.

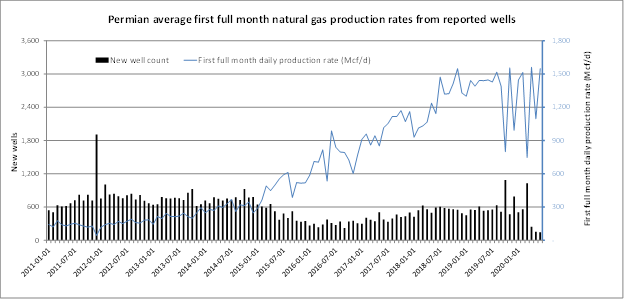

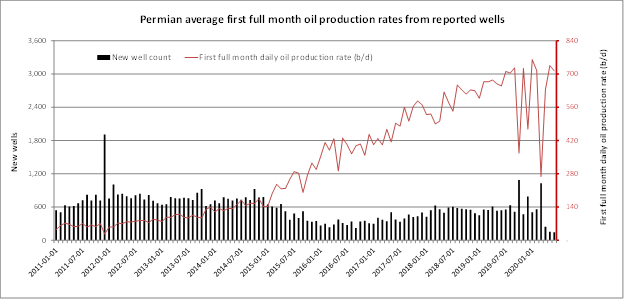

Permian rig counts were 295 lower than last September, yet production is only slightly lower than last year. Below is the Permian showing both oil and natural gas IP rates. It’s not as exciting, but we see the number of new wells has been dropping while initial production rates have been increasing since 2017.

As with the Appalachian wells, there is lots of volatility in the oil and gas production rates with fewer monthly wells being drilled in 2020.

On a final note, we wanted to show the month-on-month DPR revision summary for the October 2020 update. Natural gas production for October was revised higher by 1.804 Bcf/d, primarily from Appalachian and Permian wells.

Fundamentals for week ending Oct 16: Our early view for the upcoming storage report is a +55 Bcf injection for the lower 48. This would take storage levels to 3932 Bcf. The industry estimates for this report range between 44-70 according to The Desk.

US natural gas dry production was higher week on week with domestic production averaging 85.8 Bcf/d for the week. The production is 1.4 Bcf/d lower week on week with decreases primarily coming from lost Gulf of Mexico production due to Hurricane Delta. As of Friday’s repot from the BSEE, production is almost fully back. The Report showed only 0.16 Bcf/d still shut-in. Total natural gas demand was lower from the RC consumption dropping by 2.0 Bcf/d week on week.

Canadian imports were once again lower last week averaging 4.0 Bcf/d. Mexican exports averaged of 6.3 Bcf/d.

Deliveries to LNG facilities averaged 6.9 Bcf/d, down 0.6 Bcf/d week on week with Sabine and Cameron being impacted by Delta.

Expiration and rolls: UNG ETF roll starts on Oct 14th and ends on Oct 19th.

Nov futures expire on Oct 28th, and Nov options expire on Oct 27th.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.