This week we spend some time looking at the brewing situation in Europe. Understanding the situation in Europe is critical to North American energy markets this winter and coming summer. It’s unlikely to result in cancellations, but then again no one expected the deep level of cancellations we had this past summer.

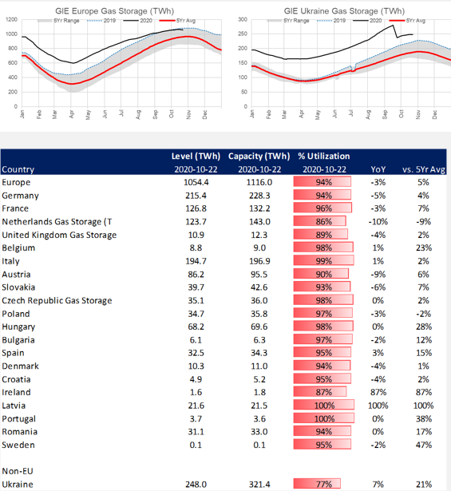

This could be a larger story for next summer if Europe storage levels exit at a high levels.

1) COVID – Covid-19 cases in the UK, France, Germany, Italy, and Spain all registered highs in recent days. France is in a state of a health emergency, with curfews in Paris and other major cities and restrictions on private gatherings. The UK government has introduced a system of tiered restrictions, and millions of people in England and Wales are already under the maximum third tier. Ireland has effectively re-entered total lockdown, and private gatherings are restricted in Italy, Spain, and other countries.

The length of these restrictions will surely impact natural gas consumption from both the power sector and industrial sector, leading to potentially fewer LNG imports.

2) Nordstream 2 – A little over 150 km of Nord Stream 2 remains to be laid in Danish and German waters after an initial threat of US sanctions last December forced principal pipe-layer Allseas to halt work. On Oct. 20 widened the scope of sanctions against the pipeline and warned companies involved in the final installation that they face sanctions if they do not wind down activities.

Capacity would double the Russia-Germany subsea gas export corridor to 10.64 Bcf/d or 110 Bcm/year if completed.

Denmark cleared on Oct 1st the final hurdle to Nord Stream 2 potentially starting operations in Danish waters, with rumors of a Q1 startup.

3) BP and its partners finished a major new pipeline from Azerbaijan into southern Europe. The Trans Adriatic Pipeline, or TAP, project is “substantially complete. The link will bring an additional 0.8 Bcf/d to Italy, and 0.1 Bcf/d to Greece and Bulgaria. The plan is for max flows by mid-2021.

Source: BNN Bloomberg

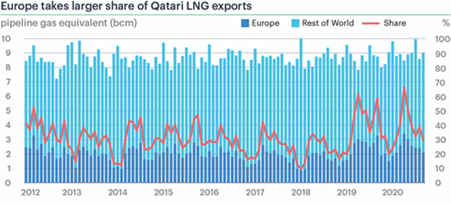

4) Qatar recently booked 10 Bcm/day of long-term capacity at the UK Isle of Grain terminal. This follows a similar move last year when Qatar booked up long-term capacity at the Zeebrugge terminal in Belgium, which will run until 2044. The company has secured all unloading slots at the site until that year.

IUK, which operates the bidirectional interconnector pipeline linking Britain and Belgium, has reduced tariffs to increase bookings. The normal flow direction on the pipeline is to Britain during the winter and Belgium in the summer, but the interconnector now has competition from the BBL, which previously only flowed towards Britain from the Netherlands but is now bidirectional.

Qatar looking to monetize volumes at the NBP, or to ship that gas into Europe

Qatari LNG exports to Europe are driven by Asian prices. Europe becomes a sink market for excess cargoes, particularly during the shoulder months.

5) Europe LNG and Ukraine LNG – After two warm winters and the coronavirus pandemic, demand for gas is sagging across Europe, leaving inventories well above the average for the season. Another warm winter plus the above factors could result in a high end of winter storage level.

Fundamentals for week ending Oct 23: Our early view for the upcoming storage report is a +28 Bcf injection for the lower 48. This would take storage levels to 3954 Bcf. The industry estimates for this report range between 17-49 according to The Desk.

US natural gas dry production jumped week on week with domestic production averaging 89.1 Bcf/d for the week. The production is 3.2 Bcf/d higher week on week with increases primarily coming from Gulf of Mexico due to Hurricane Delta the week prior, and the Northeast ramping up production.

Canadian imports were once again lower last week averaging 3.6 Bcf/d. Mexican exports averaged of 6.3 Bcf/d. We expect exports to Mexico to start to drop off as temps start to cool.

Deliveries to LNG facilities averaged 8.0 Bcf/d, up 1.1 Bcf/d week on week with Sabine and Cameron returning to somewhat normal operations. Sabine is still dealing with the aftermath of a fire at Train 1, and Cameron channel access is still not allowing cargos to leave with full draft.

Expiration and rolls: UNG ETF roll starts on Nov 11th and ends on Nov 16th.

Nov futures expire on Oct 28th, and Nov options expire on Oct 27th.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.