This past week the EIA reported a +76 Bcf storage injection for week ending Sept 17th. The report once again came in a few Bcf higher than expectations, but the market shook it off and price started to move higher for the balance of the day and into Friday. As with last week’s report, this report indicated loosening conditions from the last few weeks of August. We estimate this report was 0.4 Bcf/d tight versus the average 3Yr wx-adjusted injection.

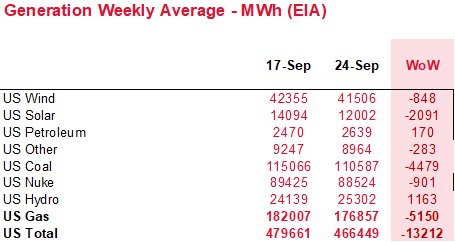

Wind and Solar generation picked up significantly during this reporting period. Wind generation averaged 42.3 GWh during the reporting period, which we calculate to be 18% stronger than normal. Solar generation averaged 14.1 GWh during the reporting period, which we calculate to be 7% stronger than normal. The net impact of the strong renewables dropped gas burns by 1.34 Bcf/d leading to ~9 Bcf of more natgas directed to storage over the week.

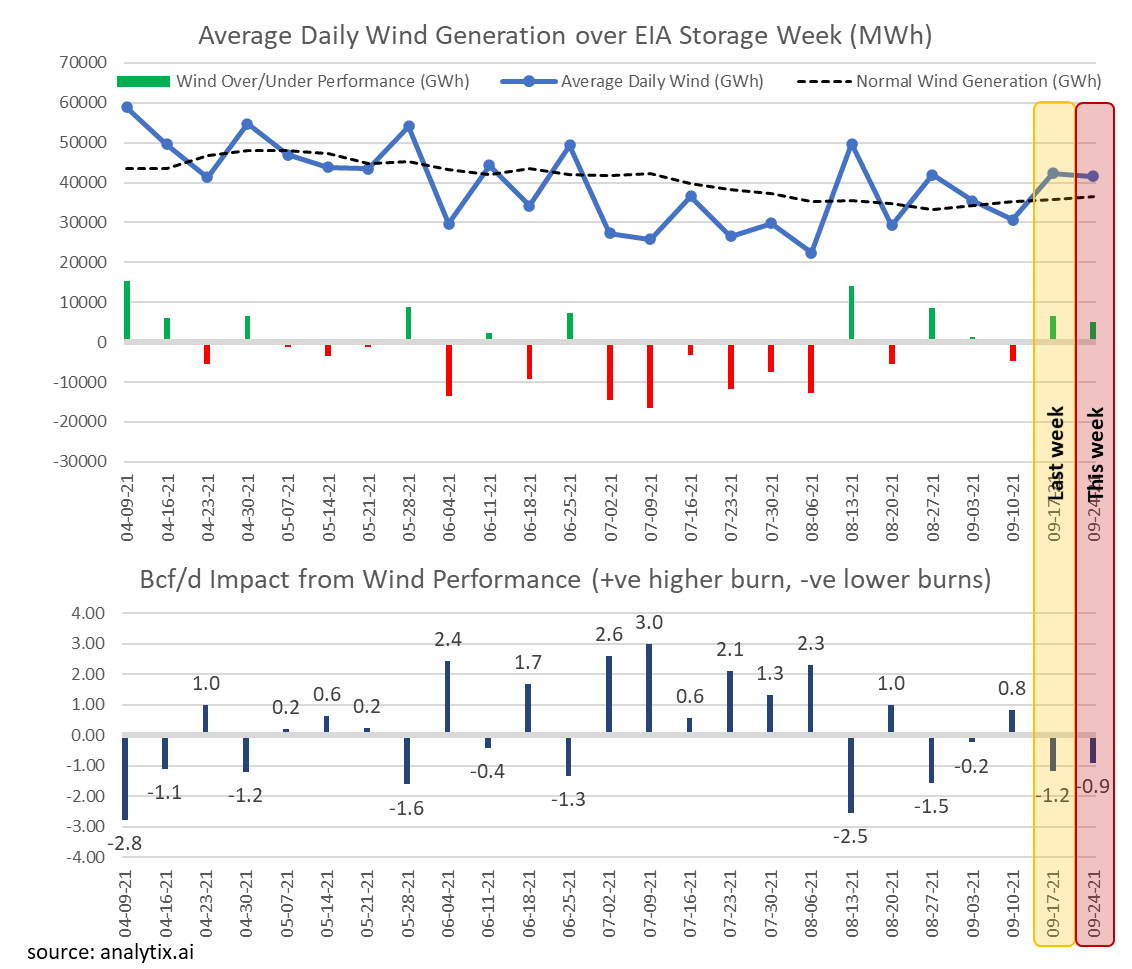

The wind has specifically led to some very volatile storage numbers this summer. Below is our assessment of wind’s performance over this summer. We show the weekly average wind generation versus our calculated normal for that given week. As can be seen, we had very strong wind in late Q1 and early Q2, followed by very low wind in Q3. The low wind during Q3 (the peak summer months) led to tight balances and concerns of low end-of-summer storage inventories. In the accompanying chart right below, we show the net impact the over/under wind gen had on gas burns for that given week.

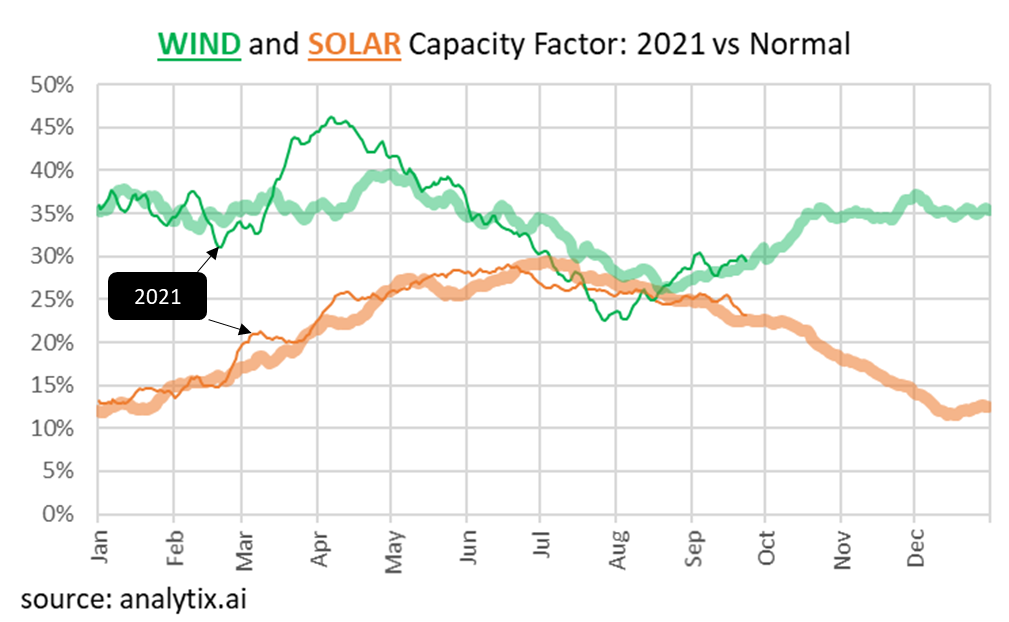

Wind and solar are two new variables that we now need to closely monitor week to week. The projected capacity additions and any variance to the expected capacity factor can greatly influence the forward balances. In the chart below you can see the typical seasonal capacity factor for wind and solar. They do somewhat complement each other.

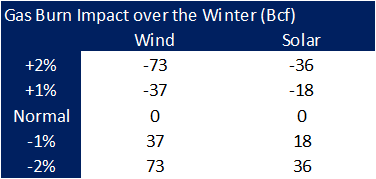

For this coming winter, we ran some scenarios to understand how a 1% variance in wind/solar gen would impact gas burns and more importantly end of winter storage levels. We found that if wind gen performed 1% better than its normal capacity factor, then we would have 37 Bcf less consumed by natural gas generation.

Fundamentals for the week ending Sept 24: For the week ending Sept 24th, our early view is +90 Bcf. The 5Yr average is also a +72 Bcf injection. Our projected injection would take the L48 storage level to 3172 Bcf (-573 vs LY, -211 vs. 5Yr).

Domestic dry gas production was higher by 1.0 Bcf/d to an average of 92.7 Bcf/d during the week. Production continued to return in the GoM as Entergy has almost fully restored power to gas processing facilities in the Southern Parishes of Louisiana. BSEE.gov published their final Hurricane Ida report on September 23rd in which they stated that 0.54 Bcf/d or 24.3% of GoM natural gas production was still shut-in. Entergy has noted that all power will be restored before September 29th.

Here is a good link to keep track of the restoration process: https://www.entergy.com/hurricaneida/etr/

Total consumption was lower this week, primarily driven by lower temps reducing the total power demand. Total national temps were lower by 2.4F week-on-week. Total national power generation was lower by 2.8% from the previous week. As we showed in the chart above, wind generation was lower than the previous week but still well above normal. We estimate the higher-than-normal wind generation removed 0.9 Bcf/d or 6.3 Bcf of gas burns to help loosen the balances.

Deliveries to LNG facilities averaged 9.9 Bcf/d, which was -0.2 Bcf/d lower than the previous week. During the week we had Freeport returns after power being knocked out for 3 days due to Hurricane Nicholas. To offset those gains we had Cove Point start its annual 26 day maintenance and Cameron performing a some short-term maintenance that closed off train 1. Cameron is back as of Friday.

The net balance is looser by 2.4 Bcf/d week-on-week.

Expiration and rolls: UNG ETF roll starts on Oct 14th and ends on Oct 19th.

Oct futures expire on Sept 28th, and Oct options expire on Sept 27th.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.