This was quite the week for price volatility. The market’s mood shifted to the bullish side ahead of option expiry on Friday, and the Oct contact settlement tomorrow. Trading volume has already moved to the winter strip last week, and with the dropping production levels, there is more interest in next summer.

In this week’s report, we turn to a quick note on the changes to the GFS Ensemble model last week and winter weather forecasts.

Let’s start with the GFS Ensemble. This is the first change for the model in about 5 years and brings it up to speed with the GFS Operational model (FV3). The upgrade includes an expanded number of ensemble members, from 21 (old) to 31 (new), and better resolution to 0.25° (~25km) throughout its projections.

The GFS EN will take longer to run, about 2.5 hours versus the 1 hour of the previous version. The model begins at the same time as the GFS OP (about an hour earlier than in the previous version) and now finishes about an hour later.

Overall, skill for near-surface temperatures should be slightly improved. Here is a link with more of a detailed explanation: https://www.noaa.gov/media-release/noaa-upgrades-global-ensemble-forecast-system

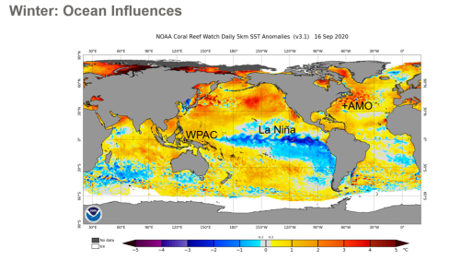

The following winter outlook slides come from Maxar winter outlook. The main oceanic influences that are driving this winter’s forecast are three areas in particular of note — the obvious cool La Niña in the equatorial Pacific, the warm waters of the West Pacific (WPAC), and the warm waters of the Atlantic (+AMO).

La Niña aiming for weak to moderate intensity going into October with latest NOAA CFS model getting more aggressive with strong intensity potential deeper into Q4. The warm waters in the West tend to correlate with temperatures in winter – best in the Southwest and the Northeast. Finally, the +AMO is historically a warm influence in winter. Three signals lining up.

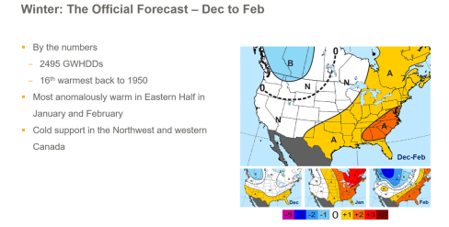

Below is Maxar’s winter forecast. They are calling for above-normal temperatures across the South and East, and below normal for the Northwest. This is a fairly typical La Nina type winter.

The forecast calls for Dec through Feb having 2495 GWHDDs. This is higher than the 2301 GWHDDS for the same winter months last year.

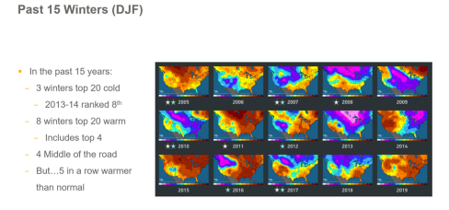

Looking at the past 15 winters, you see a variety of winter outcomes. The white stars represent past La Nina winters, and the green stars represent the most frequently used analog years by Maxar’s forecasters.

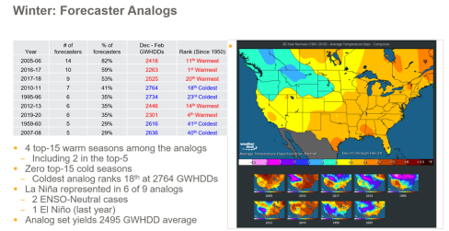

Below is a more detailed look at the analogs used by Maxar’s forecasters. 2005-06 was the top analog year which was used by 14 or 82% of Maxar’s forecasters. The larger map shows a weighted composite of all the analog years – which as expected looks like their winter forecast.

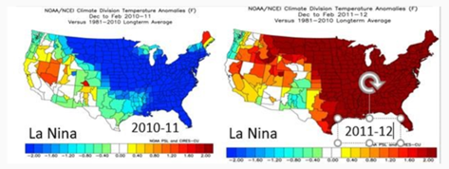

We finish this note with a bit of caution around La Nina winters. Not all La Nina events are the same. So regardless of how strong the signal, other factors can play a role leading to a totally different outcome. Below is two back to back winters that ended up vastly different.

Fundamentals for week ending Sept 25: Our early view for the upcoming storage report is a +83 Bcf injection for the lower 48. This would take storage levels to 3763 Bcf. The industry estimates for this report range between 62-102 according to The Desk.

US natural gas dry production was higher week on week with domestic production averaging 86.2 Bcf/d for the week. The decrease comes from both Texas and the Northeast reducing gas production. Total natural gas demand was lower than the previous week. Power burns were lower by 2.7 Bcf/d week-on-week as we start to transition to HDD load in many northern regions.

Canadian imports were once again lower last week averaging 3.6 Bcf/d. Mexican exports averaged of 6.4 Bcf/d.

Deliveries to LNG facilities averaged 5.8 Bcf/d, down 1.4 Bcf/d week on week with Sabine and Freeport dropping liquefaction levels due to TS Beta.

Expiration and rolls: UNG ETF roll starts on Oct 14th and ends on Oct 19th.

Nov futures expire on Oct 28th, and Nov options expire on Oct 27th.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.