From: research

Sent: Monday, April 13, 2020 5:45:56 AM (UTC-06:00) Central Time (US & Canada)

To: research

Subject: Daily Market Report – April 13, 2020

Saudi Arabia and Russia ended their oil price war on Sunday by finalising a deal to make the biggest oil production cuts in history. The 9.7 million barrels per day cut will begin on May 1, and will extend through the end of June. The cuts will then taper to 7.7 million barrels per day from July through the end of 2020, and 5.8 million barrels per day from Jan. 2021 through April 2022. The group will meet again on June 10 to determine if further action is needed.

G20 nations such as the US, Canada and Brazil supported the deal but were not required to make official commitments to cut. Statements from OPEC+ countries noted that these other producing nations would add up to 4 mmbbl/d of cuts from natural declines.

Global oil demand is estimated to have fallen by around 30 million bpd as more than 3 billion people are locked down in their homes due to the outbreak.

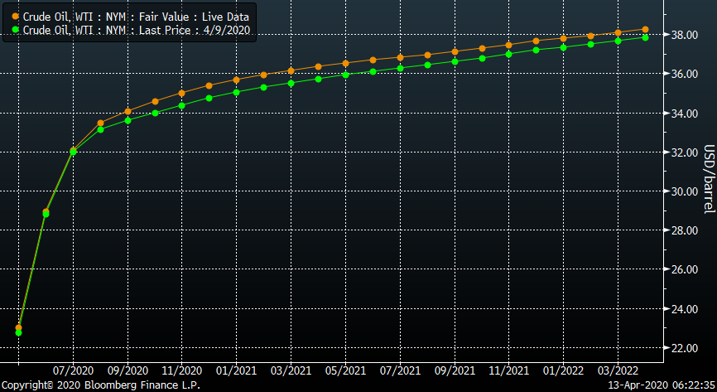

Traders do not seem to believe the cuts are enough to bring the oil markets back in balance. The WTI curve is only marginally higher past this summer bringing into question how much US shale oil production and associated natural gas will decline this year.

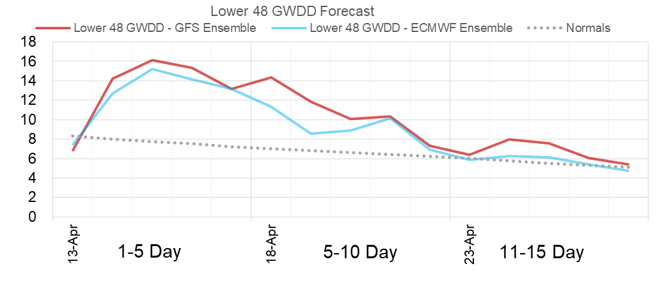

Weather forecast continue to look cooler than normal through the next 10 day, after which temps return to more normal levels.

Fundamentals:

Daily US natural gas production is estimated to be 90.4 Bcf/d this morning. Today’s estimated production is -0.5 Bcf/d lower than yesterday, and -0.70 lower higher than the 7D average.

Natural gas consumption is modelled to be 69.8 Bcf today, -2.0 Bcf lower than yesterday and -6.6 Bcf lower than the 7D average. US power burns are expected to be 24.9 Bcf today, and US ResComm usage is expected to be 22.3 Bcf.

Net LNG deliveries are expected to be 8.7 Bcf/d today.

Mexican exports are 4.8 Bcf/d. Canadian imports dropped to 2.8 Bcf/d.

Bloomberg IM: Het Shah

enelyst DM: @het.co

Tel: 917-975-2960

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.