From: Terry Reilly

Sent: Wednesday, July 04, 2018 3:19:52 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Grain Comments 07/04/18

Files attached and reported below: OI, registrations, deliveries, selected weather maps, settlements, news, funds

Busy 24-hours. Algeria buys wheat, China futures end mostly lower for oilseed complex, corn near unchanged

- China cash margins fell 13 cents to 63 cents, on our analyses.

- Brazil soybean meal values slipped $3-4/ton when imported into Rotterdam

- Rotterdam veg oil were near unchanged

- Paris wheat hit a three week high on July 4.

- Offshore values as of July 4 were leading soybean oil 15 higher and meal $0.50/short ton higher.

· China said they will not impose tariffs against the US until the US decides to pull the trigger.

- Baltic Dry Index was up 91 points on Wednesday to 1,567, or 6.2%, to a six month high.

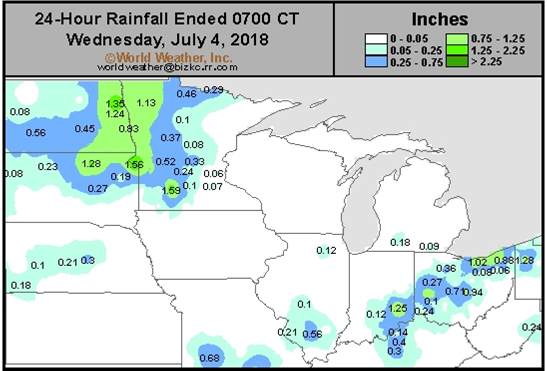

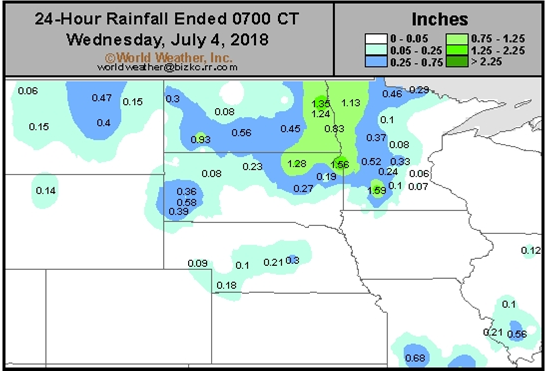

- Reuters noted “high water levels restricted navigation and limited barge tow sizes on the Mississippi River. High waters also prevented some elevators on northern stretches of the river from loading barges.”

· China sold 283,559 tons of 2013 soybeans out of reserves at an average price of 3028 yuan per ton ($457.08/ton), 56.7 percent of the 500,000 tons offered. China sold 660,524 tons of soybeans out of reserves so far, this season.

· China sold 29,817 tons of 2011 soybean oil out of reserves at an average price of 5002 yuan per ton ($753.68/ton), 50.9 percent of the 50,000 tons offered.

- The EU awarded 10,150 tons of wheat import quotas and 3,500 tons of barley import quotas.

- Russia’s AgMin increased their forecast for 2018-19 to 40-45 from previous 35-40 million tons. They left their crop estimate of 100 million tons unchanged.

- A Reuters poll calls for the Black Sea wheat exports to fall 11 percent to 58.8 million tons, and leave Russia as the world largest exporter at 35 million tons. Ukraine was polled at 16 million and Kazakhstan at 7.8 million tons. The combined crop of Russia, Ukraine and Kazakhstan is expected to decline by 12.6 percent to 110.8 million tons of wheat in 2018, the Reuters article added.

- The Czech grain harvest is seen at 6.3 million tons, down 8.2 percent from last season.

- Algeria bought about 600,000 optional origin milling wheat at $234-$237/ton for September shipment.

- Japan in a SBS import tender bought 27,210 tons of feed wheat and 38,180 tons of barley for arrival by December 28.

- Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on July 11 for arrival by December 28.

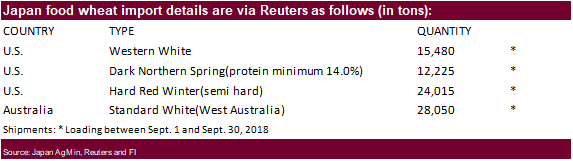

- Japan seeks 79,770 tons of food wheat on Thursday. Original details of the tender as follows:

· Jordan canceled their import tender for 120,000 tons of barley for Oct-Nov shipment.

- China sold 3,000 tons of 2013 imported wheat from state reserves at auction at an average price of 2370 yuan/per ton or $358.08/ton, 0.2 percent of what was offered.

· China plans to launch a GMO labeling investigation on cooking oils.

· Brazil producers are suing a large seed company over a patent’s validity to collect 800 million reais ($204 million) in royalties.

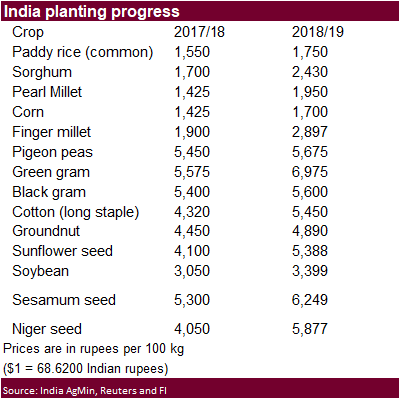

· India raised their government set purchase prices for several crops, by most since at least 2014. They are rising about 25 percent compares to previous increases of 3-4 percent in the last three years. Some warned this could hurt India’s economy.

July 3-4 China and other settlements after the maps (below)

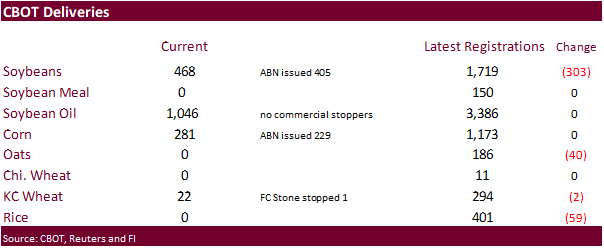

· Oats down 40 to 186 contracts

· Soybeans down 303 to 1,719 (303 taken out of Chicago-CIRM)

· Rice down 59 to 401

· KC wheat down 2 to 294

|

DJ Euronext Closing Wheat Futures – Jul 4 |

|

Source: Euronext

Paris-based milling wheat in Euros a metric tonne as quoted on the Euronext at the official close.

Contract Last Change High Low Settle Sep ’18 183.50 1.00 184.00 182.50 183.50 Dec ’18 186.50 1.00 187.00 185.50 186.50 Mar ’19 189.50 1.25 189.75 188.25 189.50 May ’19 191.00 1.00 191.00 190.25 191.00 Sep ’19 186.50 0.25 187.25 186.50 186.50 Dec ’19 189.00 0.00 190.00 187.00 189.00 Mar ’20 192.00 1.25 192.00 192.00 192.00 May ’20 191.50 -1.50 193.00 188.50 191.50 Sep ’20 187.75 -0.25 188.00 187.75 187.75 Dec ’20 190.00 0.00 190.00 190.00 190.00 Mar ’21 196.50 1.00 196.50 196.50 196.50 May ’21 196.50 1.00 196.50 196.50 196.50

NOTE: It is possible for a settlement price to fall outside the daily high and low due to an exchange’s specific rules on how a settlement price is determined. (END) Dow Jones Newswires |

|

DJ Rotterdam Soymeal Prices – Jul 04 |

|

HAMBURG (Dow Jones)–Lowest known offers in USD/t. At local time 11:30 GMT.

Argentine Soy Pellets 49 % Profat Rotterdam,USD/t,CIF Afl. unq Loco 409.00 unch Jul 18 405.00 unch Aug-Sep 18 407.00 unch Oct-Dec 18 419.00 unch Jan-Mar 19 414.00 unch Apr-Sep 19 395.00 unch

Brazilian Soy Pellets 48% Profat Rotterdam,USD/t,CIF Afl. 404.00 -3.00 Loco 408.00 -4.00 Jul 18 404.00 -3.00 Aug-Sep 18 404.00 -3.00 Oct-Dec 18 413.00 -4.00 Jan-Mar 19 400.00 -5.00 Apr-Sep 19 380.00 -3.00

Soy Pellets, 49% max 3,5% fibre, 13,5% moisture Rotterdam,USD/t,FOB Jul 18 408.00 -1.00 Aug 18 407.00 -1.00 Sep 18 407.00 -1.00 Oct 18 410.00 -1.00 Nov 18-Jan 19 416.00 -1.00 Nov 18-Apr 19 414.00 -1.00 May-Oct 19 397.00 unch |

|

DJ Rotterdam Soybean Prices – Jul 04 |

|

HAMBURG (Dow Jones)–Lowest known offers in USD/t At local time 11:30 GMT.

USA, U.S. Gulf Brazil, northern ports Rotterdam,USD/t,CIF Rotterdam,USD/t,CIF Jul 18 374.00 +1.00 Jul 18 402.00 -1.75 Aug 18 378.25 +1.50 Aug 18 unq Oct-Nov 18 374.75 +1.50 Apr 19 unq Dec 18 380.00 +1.25 May 19 unq Jun 19 unq |

|

DJ Algeria Buys 660,000 Tons of Wheat in Tender |

|

By David Hodari LONDON–Algeria’s state grain agency, the OAIC, purchased around 660,000 metric tons of milling wheat on Wednesday as part of a tender, according to traders. The agency doesn’t officially publish details of its tenders, but the price of the wheat cargoes ranged between $234 a ton and $237 a ton including shipping fees, traders said. Of the 660,000 tons Algeria reportedly bought, trading houses Bunge, Lecureur, Casillo, and Soufflet each provided 120,000 tons, the traders added. Trading houses Cargill, CAM, and Louis Dreyfus Company each provided 60,000 tons. The tender closed Tuesday. The grain is expected to be French and will likely be shipped during September, traders said. The price of wheat was last at $4.91 a bushel, with U.S. markets closed for the public holiday. Write to David Hodari at david.hodari@wsj.com (END) Dow Jones Newswires |

|

DJ China Dalian Grain Futures Closing Prices, Volume – Jul 04 |

|

Soybean No. 1

Turnover: 175,342 lots, or 6.44 billion yuan

Open High Low Close Prev. Settle Ch. Vol Open Settle Interest Jul-18 – – – 3,645 3,645 3,645 0 0 126 Sep-18 3,688 3,688 3,628 3,654 3,694 3,659 -35 151,628 181,156 Nov-18 3,727 3,727 3,727 3,727 3,792 3,727 -65 2 8 Jan-19 3,785 3,785 3,738 3,755 3,787 3,763 -24 22,958 80,296 Mar-19 3,713 3,763 3,713 3,763 3,823 3,729 -94 6 4 May-19 3,814 3,862 3,781 3,789 3,830 3,805 -25 740 5,196 Jul-19 – – – 3,883 3,908 3,883 -25 0 8 Sep-19 3,890 3,895 3,862 3,862 3,924 3,883 -41 8 206 Nov-19 – – – 3,846 3,886 3,846 -40 0 14

Corn

Turnover: 390,452 lots, or 7.09 billion yuan

Open High Low Close Prev. Settle Ch. Vol Open Settle Interest Jul-18 1,754 1,756 1,754 1,756 1,774 1,755 -19 1,924 16,794 Sep-18 1,787 1,790 1,782 1,785 1,784 1,785 1 110,928 550,422 Nov-18 1,816 1,822 1,816 1,819 1,816 1,818 2 203,476 33,350 Jan-19 1,848 1,854 1,843 1,848 1,845 1,847 2 61,238 525,748 Mar-19 1,880 1,884 1,877 1,879 1,878 1,879 1 330 3,628 May-19 1,923 1,927 1,915 1,918 1,916 1,919 3 12,556 106,988

Soymeal

Turnover: 2,929,440 lots, or 92.52 billion yuan

Open High Low Close Prev. Settle Ch. Vol Open Settle Interest Jul-18 2,980 2,980 2,980 2,980 3,002 2,980 -22 40 260 Aug-18 3,100 3,113 3,084 3,092 3,119 3,096 -23 60 624 Sep-18 3,141 3,164 3,105 3,116 3,148 3,134 -14 1,461,580 1,748,030 Nov-18 3,180 3,206 3,152 3,163 3,200 3,187 -13 395,518 130,176 Dec-18 – – – 3,185 3,185 3,185 0 0 362 Jan-19 3,220 3,241 3,183 3,193 3,217 3,212 -5 971,818 1,936,678 Mar-19 3,048 3,073 3,028 3,040 3,053 3,048 -5 1,786 5,570 May-19 2,867 2,877 2,841 2,848 2,872 2,857 -15 98,638 427,120

Palm Oil

Turnover: 335,514 lots, or 16.31 billion yuan

Open High Low Close Prev. Settle Ch. Vol Open Settle Interest Jul-18 – – – 5,106 5,106 5,106 0 0 0 Aug-18 – – – 4,978 4,978 4,978 0 0 20 Sep-18 4,860 4,864 4,810 4,812 4,864 4,838 -26 246,750 360,530 Oct-18 4,884 4,884 4,866 4,866 4,882 4,872 -10 6 8 Nov-18 4,954 4,962 4,870 4,884 4,900 4,930 30 16 10 Dec-18 – – – 4,972 4,942 4,972 30 0 6 Jan-19 4,932 4,940 4,892 4,892 4,934 4,910 -24 82,470 252,716 Feb-19 4,946 4,946 4,946 4,946 5,028 4,946 -82 4 2 Mar-19 – – – 4,980 4,980 4,980 0 0 0 Apr-19 – – – 5,074 5,074 5,074 0 0 18 May-19 5,048 5,048 5,010 5,020 5,044 5,026 -18 6,266 26,246 Jun-19 5,078 5,078 5,078 5,078 5,078 5,078 0 2 10

Soybean Oil

Turnover: 318,538 lots, or 17.99 billion yuan

Open High Low Close Prev. Settle Ch. Vol Open Settle Interest Jul-18 5,412 5,412 5,412 5,412 5,402 5,412 10 32 32 Aug-18 – – – 5,504 5,494 5,504 10 0 10 Sep-18 5,608 5,620 5,568 5,580 5,594 5,592 -2 215,432 648,922 Nov-18 – – – 5,610 5,610 5,610 0 0 52 Dec-18 – – – 5,744 5,744 5,744 0 0 16 Jan-19 5,788 5,796 5,748 5,758 5,774 5,768 -6 92,140 480,024 Mar-19 – – – 5,864 5,864 5,864 0 0 64 May-19 5,756 5,760 5,706 5,722 5,740 5,730 -10 10,934 59,934

Notes: 1) Unit is Chinese yuan a metric ton; 2) Ch. is day’s settlement minus previous settlement; 3) Volume and open interest are in lots; 4) One lot is equivalent to 10 metric tons. (END) Dow Jones Newswires |

Refined, bleached and deodorized palm oil, FOB, Malaysian ports

Offer Change Bid Change Traded

Jul 592.50 -05.00 Unquoted - -

Aug 595.00 -02.50 Unquoted - -

Sep 595.00 -02.50 Unquoted - -

Oct/Nov/Dec 597.50 -07.50 Unquoted - -

RBD palm olein, FOB, Malaysian ports

Offer Change Bid Change Traded

Jul 595.00 -05.00 Unquoted - -

Aug 597.50 -02.50 Unquoted - -

Sep 597.50 -02.50 Unquoted - -

Oct/Nov/Dec 600.00 -07.50 Unquoted - -

July 4 – The Bursa Malaysia benchmark palm oil contract ended down 12 ringgit a ton at 2,313 ringgit ($571)a ton.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.