From: Terry Reilly

Sent: Tuesday, August 07, 2018 8:21:44 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments

PDF attached

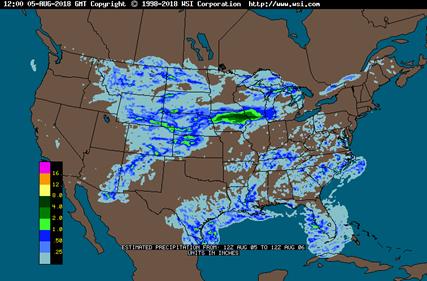

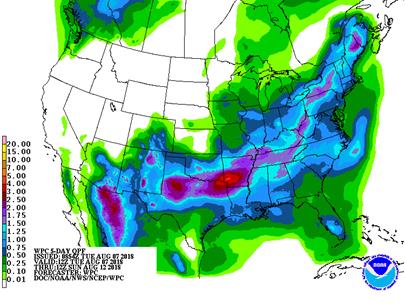

・ 6-10 day was wetter in the central and southwestern Midwest, and drier in the southern Delta. For 11-day, the precipitation outlook is drier in the Midwest and north central Plains.

・ Rain continued to fall across IA and surrounding areas through Tuesday. Other areas saw increasing crop stress.

・ Note critical rain will fall through Tuesday across southern IA before a week of dry weather sets in. Next critical rain even will be during the August 15-17 period.

AREAS OF GREATEST INTEREST

- Europe weather is expected to change during the middle and latter part of this week

- A succession of weather disturbances will begin impacting western and central Europe bringing cooler temperatures and periodic rainfall

- It will take several days for meaningful rain to reach all of the driest areas, but relief is expected and the pattern change will continue into next week

- Soil moisture improvements will come very slowly, but cooler temperatures will evolve more swiftly

- A succession of weather disturbances will begin impacting western and central Europe bringing cooler temperatures and periodic rainfall

- Drought continued in northwestern Europe where weekend rainfall was minimal and temperatures still well above average

- High temperatures in the middle and upper 90s Fahrenheit occurred in most of France and parts of Germany and 80s and lower 90s in England, Wales, Denmark and other southwestern Scandinavia areas

- Spain and Portugal reported highest temperatures of 100 to 108 except in southern Portugal where extremes reached 113

- The bottom line in Europe will be good for late season crops, but it has been dry and warm enough for a long enough period of time in the northwest that production cuts will not be fully reversible. Some late season crop improvement is possible, however

- Typhoon Shanshan may impact Honshu, Japan in the second half of this week, although confidence in the storm’s path is low

- Landfall is expected late Wednesday or Thursday near Tokyo and the storm may then move north northeast through the upper half of Honshu producing torrential rainfall and strong wind

- The storm threatens rice and citrus production areas, although most of the potential damage will be on central and eastern portions of Honshu

- Landfall is expected late Wednesday or Thursday near Tokyo and the storm may then move north northeast through the upper half of Honshu producing torrential rainfall and strong wind

- The bottom line for Australia is a more urgent need for rain this month in preparation for spring crop development in Queensland and northern New South Wales. Without improved rainfall the east-central crop areas will yield very poorly. Sufficient rain is expected in the west and south to combine with favorable soil moisture to ensure good late winter crop conditions.

- India monsoonal rainfall will continue limited in the west and south through the next ten days

- Rain is expected frequently from eastern Madhya Pradesh and Uttar Pradesh into Bangladesh, West Bengal, Odisha and the far Eastern States where multiple inches of rain are anticipated

- Rain will fall in Rajasthan, Gujarat and areas south into Tamil Nadu and Andhra Pradesh, but amounts will be below average with many areas failing to get enough rain to counter evaporation

- Temperatures will be seasonable

- Pakistan continues to suffer from excessive heat and dry weather

- Highest temperatures during the weekend were in the range of 100 to 111 degrees Fahrenheit similar to that reported last week

- Monsoonal rainfall has failed to reach southern Pakistan this year stressing some crops

- Water supply in northern parts of the nation was already below average this year and limited summer rainfall and persistent heat has not helped the situation

- Crop yields may be down, although irrigation has continued to be applied

- Southern Canada Prairies drought will not change this week; hot dry conditions are expected most of this week

- Very little rainfall is expected in the drought region until late in the coming weekend or early next week

- Hot weather is expected throughout the Canada Prairies this week with readings well above average until the weekend when rain and cooling evolve

- Extreme highs in the upper 80s and 90s Fahrenheit will be widespread and several extremes over 100 degrees are expected in the drought stricken areas in the south

- Thursday into Saturday will be hottest

- Extreme highs in the upper 80s and 90s Fahrenheit will be widespread and several extremes over 100 degrees are expected in the drought stricken areas in the south

- The bottom line for Canada’s Prairies remains one of concern over ongoing drought in the south and some central crop areas where production cuts are prevailing. Northern crop areas remain in mostly good shape, but a few areas will need later than usual frost and freezes to avoid crop damage because of wet weather at times this year.

- Russia’s Southern Region, middle and lower Volga River Valley and central and eastern Ukraine will experience net drying over the next ten days

- Temperatures will be warmer than usual, but not excessively hot

- Highs in the 80s and 90s Fahrenheit are most likely

- Net drying will raise crop moisture stress and return a more serious level of drought in southern portions of the described region

- Temperatures will be warmer than usual, but not excessively hot

- A boost in western Russia, Belarus, Baltic States and western Ukraine rainfall is expected next week, but this week is expected to be drier biased with a more erratic distribution of rain

- Seasonably warm temperatures are expected

- Interior southern Brazil and southern portions of Center South Brazil will receive additional rain through Friday

- Rain totals of 1.00 to 2.00 inches may impact far southern Minas Gerais and Rio de Janeiro, portions of Sao Paulo, Parana and southern Mato Grosso do Sul

- The greatest rain will occur tonight and Monday

- Showers rest of this week will be more random and light with Rio Grande do Sul, Santa Catarina and southern Parana wettest late this week

- Net drying is expected this weekend and next week

- Rain totals of 1.00 to 2.00 inches may impact far southern Minas Gerais and Rio de Janeiro, portions of Sao Paulo, Parana and southern Mato Grosso do Sul

Source: World Weather INC

SIGNIFICANT CORN AND SOYBEAN BELT PRECIPITATION EVENTS

WEST CORN BELT EAST CORN BELT

-Tue 50% cvg of up to 0.75” 90% cvg of 0.15-0.90”

and local amts over 2.0”; and local amts over 2.50”;

wettest south driest SE

Wed 40% cvg of up to 0.40”

and local amts to 0.65”

Wed-Fri 10-25% daily cvg of

up to 0.30” and locally

more each day;

wettest east

Thu-Aug 13 20-40% daily cvg of

up to 0.40” and locally

more each day

Sat-Aug 14 Up to 20% daily cvg of

up to 0.25” and locally

more each day; some

days may be dry

Aug 14-15 5-20% daily cvg of up

to 0.30” and locally

more each day

Aug 15-17 65% cvg of up to 0.60”

and local amts to 1.30”

Aug 16-18 75% cvg of up to 0.60”

and local amts to 1.30”

Aug 18 15% cvg of up to 0.20”

and locally more

Aug 19 15% cvg of up to 0.20”

and locally more

Aug 19-21 55% cvg of up to 0.50”

and locally more

Aug 20-21 65% cvg of up to 0.50”

and locally more

U.S. DELTA/SOUTHEAST SIGNIFICANT PRECIPITATION EVENTS

DELTA SOUTHEAST

-Tue 15-35% daily cvg of

up to 0.50” and locally

more each day

Tue-Wed 75% cvg of up to 0.75”

and local amts to 1.70”;

driest south

Wed-Fri 75% cvg of up to 0.75”

and local amts to 2.0”;

east Ga. and S.C. driest

Thu-Fri 75% cvg of up to 0.75”

and local amts to 2.0”;

wettest south

Sat-Aug 13 80% cvg of up to 0.75”

and local amts to 1.50”;

driest west

Sat-Sun 15-35% daily cvg of

up to 0.50” and locally

more each day

Aug 13-16 5-20% daily cvg of up

to 0.30” and locally

more each day

Aug 14-16 10-25% daily cvg of

up to 0.30” and locally

more each day

Aug 17-19 65% cvg of up to 0.60” 65% cvg of up to 0.75”

and locally more and locally more

Source: World Weather INC and FI

- New Zealand dairy auction on Global Dairy Trade online market starts ~7am ET (~noon London, ~11pm Wellington)

- China National Grain and Oils Information Center (CNGOIC) publishes forecast on country’s grains output

- EARNINGS: Dean Foods, Mosaic

WEDNESDAY, AUG. 8:

- China’s General Administration of Customs releases preliminary agricultural commodity trade data for July, 11pm ET Tuesday (11am Beijing Wednesday)

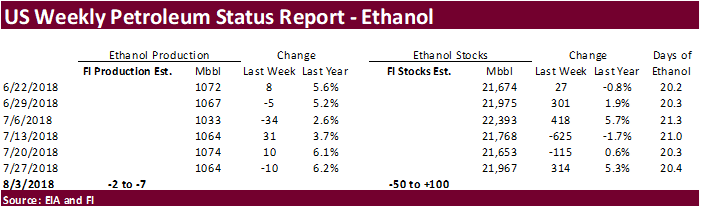

- EIA U.S. weekly ethanol inventories, output, 10:30am

- French Agriculture Ministry publishes crop areas, production forecasts

THURSDAY, AUG. 9:

- USDA weekly net-export sales for corn, wheat, soy, cotton, 8:30am

- Brazil’s crop agency Conab updates its forecast on 2017-18 grain and oilseed crop, 8am ET (9am Sao Paulo)

- Strategie Grains monthly report on European market outlook

- Port of Rouen data on French grain exports

- Buenos Aires Grain Exchange weekly crop report

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

- EARNINGS: BayWa

FRIDAY, AUG. 10:

- USDA’s monthly World Agricultural Supply and Demand Estimates (WASDE) report for August, noon

- China’s Ministry of Agriculture publishes China Agricultural Supply & Demand Estimates (CASDE) report

- Malaysian Palm Oil Board (MPOB) releases data on palm oil stockpiles, exports, production as of end-July, 12:30am ET (12:30pm Kuala Lumpur)

- Cargo surveyors Intertek, AmSpec release respective data on Malaysia’s Aug. 1-10 palm oil exports, 11pm ET Thursday (11am Kuala Lumpur Friday)

- SGS data during same period, 3am ET Friday (3pm Kuala Lumpur Friday)

- Unica’s bi- weekly Brazil Center-South sugar output, 9am ET

- FranceAgriMer weekly updates on French crop conditions

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- EARNINGS: BRF

Source: Bloomberg and FI

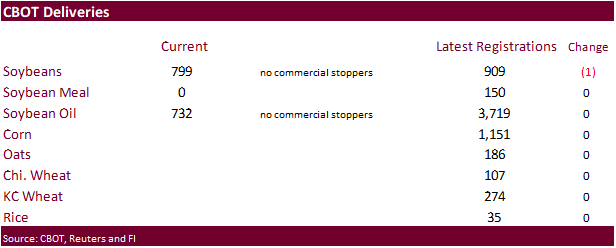

- Soybeans down 1 to 909

・ US stocks are higher, USD lower, WTI crude higher, and gold higher, at the time this was written.

Corn.

- Corn prices are mostly higher following wheat and soybeans. Crop estimates will likely shrink for the US if we see another couple week of declining crop conditions.

- USDA reported new-crop corn sold to unknown.

- Baltic Dry Index fell 2.3 percent to 1732 points.

- Producers are harvesting corn earlier than normal across northeast of France, eastern areas, in the far north and near the center of the country, according to Arvalis.

- We are hearing the corn crop in Ukraine may end up better than expected.

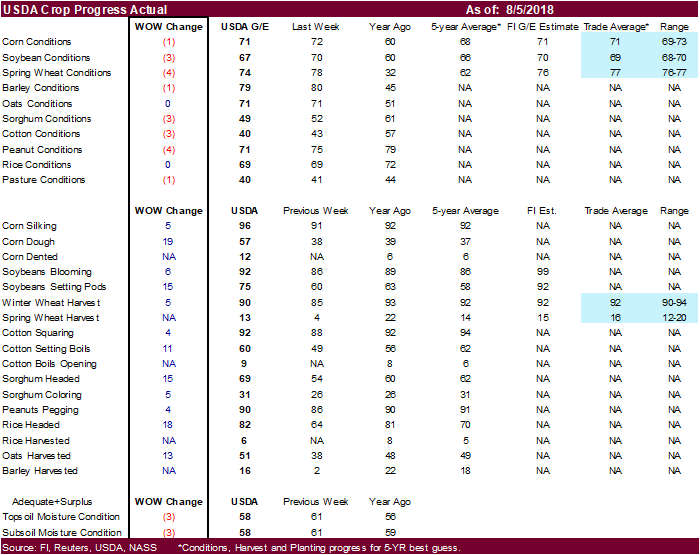

・ US crop conditions declined one in corn for the G/E categories from the previous week, in line with our estimate and a Reuters trade average. G/E conditions for PA fell 10, ND was down 5, SD down 5, Missouri off 7, and IA fell 3.

・ 96 percent of the corn crop is silking and 57 percent is dough.

- US oats crop conditions for the combined good/excellent categories were unchanged from the previous week at 71 percent. Last year oats conditions were only 51 percent and prices were around $2.64/bu.

・ USDA US corn export inspections as of August 02, 2018 were 1,287,772 tons, within a range of trade expectations, below 1,661,593 tons previous week and compares to 979,006 tons year ago. Major countries included Japan for 365,828 tons, Mexico for 276,186 tons, and Korea Rep for 208,071 tons.

・ A Bloomberg poll calls for U.S. corn ending stocks to come in at about 1.636 billion bushels versus USDA’s estimate of 1.552 billion in July, and the corn yield to be initially surveyed by NASS at 176.3 bu/ac versus their working estimate of 174.0 bu/ac. FI is looking for 178.0 and stocks to increase 199 million to 1.751 billion.

・ The Bloomberg poll shows a US corn production low/high of 14.210-14.740 billion, or 530 million bushel spread, with an average of 14.416 billion, 186 million above USDA. FI is using 14.543 billion, 127 million above the Bloomberg corn production average. If we are correct on our corn supply and ending stocks estimates for US corn, and are right on our soybean estimates, we look for soybean/corn spreading post USDA report on Friday.

・ EU has been buying a good amount of Black Sea corn.

・ Morocco opened its door to US poultry imports.

- USDA reported the following under the 24-hour reporting system:

–Optional origin sales of 179,000 metric tons of corn for delivery to unknown destinations during the 2018/2019 marketing year. An optional origin contract provides that the origin of the commodity may be the U.S. or one or more other exporting countries.

・ China sold about 59.4 million tons of corn out of reserves this season.

Soybean complex.

・ Soybeans are higher on a drop in US crop conditions and a weather forecast calling for dry weather during the last half of this week for the Midwest during the critical pod filling stage.

・ USDA reported new-crop soybeans sold to unknown destinations.

・ The CNGOIC lowered its outlook for 2018-19 China soybean imports to 94 million tons from 95 million, and sees 2017-18 imports at 95 million tons, also down 1MMT from previous. They see July-Sept. soybean arrivals at 26MMT and noted Chinese soybean crushers are intentionally delaying inbound shipments as supplies of the oilseed from state reserves are ample. China 2018-19 soybean meal consumption est. at 74.48MMT. (Bloomberg)

・ Malaysian Palm Oil Council estimates the 2018 palm oil price at 2,410 ringgit/ton, down 9 percent from their January forecast. Prices seen stabilizing in 2,179-2,611 ringgit range. (Bloomberg)

・ The Malaysian Palm Oil Board lowered its 2018 palm oil production to 19.9MMT, 2.9% lower than their January prediction. Production in 2H seen at 11MMT vs 11.2MMT in 2H 2017. Below normal rainfall was noted.

・ Offshore values were suggesting a higher lead for US soybean meal by $4.30 and higher lead for soybean oil by 47 points.

・ Malaysian palm was higher overnight by 29 ringgit and leading SBO 40 points higher.

・ Rotterdam meal was mixed and Rotterdam oils higher.

・ China’s soybean complex traded higher led by a 0.9% increase in soybean meal.

・ Traders look for Malaysian palm oil stocks to hit a 5-month high. We expect a gradual draw over the next several months.

・ Illinois: Soybean Consumption and Yield Potential https://farmdocdaily.illinois.edu/2018/08/soybean-consumption-yield-potential.html

・ USDA US soybean export inspections as of August 02, 2018 were 893,109 tons, above a range of trade expectations, above 768,769 tons previous week and compares to 686,770 tons year ago. Major countries included Vietnam for 74,414 tons, Spain for 65,001 tons, and China Main for 64,581 tons.

・ USDA’s August Crop Production and S&D’s are due out on Friday.

・ A Bloomberg poll calls for U.S. soybean ending stocks to come in at about 648 million bushels versus USDA’s estimate of 580 million in July, and the soybean yield to be initially surveyed by NASS at 49.8 bu/ac versus their working estimate of 48.5 bu/ac. FI is looking for 49.0 yield and US ending stocks to increase to 616 million bushels. If we are correct, soybeans could be friendly after the release of the report on Friday.

・ The Bloomberg poll shows a US soybean production low/high of 4.346-4.576 billion, or 230 million bushel spread, with an average of 4.425 billion, 115 million above USDA July. FI is using 4.353 billion, 72 million below the average trade guess.

・ Anec increased its outlook for 2018 Brazil soybean exports by 2MMT to 74MMT.

- USDA reported the following under the 24-hour reporting system:

–Export sales of 145,000 metric tons of soybeans for delivery to unknown destinations during the 2018/2019 marketing year.

- Egypt seeks 30k SBO and 10k Sunflower oil for LH September.

- Results awaited: South Korea seeks 12,000 tons of non-GMO soybeans in Aug 7 for Nov/Dec arrival.

- Results awaited: USDA seeks 2,160 tons of refined vegetable oil under the PL480 program on August 7 for shipment in September for Zimbabwe.

- The CCC seeks 9,000 tons of crude degummed soybean oil for Senegal and Guatemala, on August 8 for September shipment.

- Results awaited: Iran seeks 30,000 tons of soybean oil on August 1.

- Iran seeks 30,000 tons of sunflower oil on September 24.

・ China sold 1.054 million tons of soybeans out of reserves so far, this season.

・ US wheat futures are higher on ongoing world weather problems chipping away at global wheat production prospects.

・ The US wheat/corn ratio hit a three-year high and should continue to climb higher over the coming weeks.

・ US spring wheat ratings declined 4 points in the combined good/excellent categories, much larger than the 2 point drop we were looking for, and one point decrease estimated by the trade.

・ US winter wheat harvest progress increased 5 points to 90 percent. The trade was looking for a 7 point increase.

・ US spring wheat harvest progress increased 9 points to 13 percent. The trade was looking for a 12 points increase.

・ The French AgMin lowered its soft wheat estimate to 35.1 tons from 36.1MMT in July, and down 4% from 2017. Average yields are seen at 7.11 tons/ha versus 7.37 tons/ha in 2017. The durum crop is seen 13.4% lower from 2017 to 1.84MMT.

・ Ukraine may propose limiting milling wheat exports to 8 million tons, down from 10 million tons set in 2017-18.

・ The CNGOIC estimated China could import 4 million tons of wheat in 2018-19, up about 315,000 tons from the previous season. China’s wheat production seen at 122.5 million tons in 2018, down 7.27MMT from 2017.

・ USDA US all-wheat export inspections as of August 02, 2018 were 325,486 tons, within a range of trade expectations, below 379,149 tons previous week and compares to 636,942 tons year ago. Major countries included Philippines for 55,000 tons, Mexico for 44,676 tons, and China T for 37,149 tons.

・ Yesterday the European Union granted export licenses for 281,000 tons of soft wheat imports, bringing cumulative 2018-19 soft wheat export commitments to 1.175 million tons, well down from 1.872 million tons committed at this time last year.

・ USDA Attaché estimated Canada’s wheat crop at 32.15MMT from 29.984MMT last year.

Export Developments.

・ China sold 2983 tons of 2013 imported wheat at auction at an average price of 2370 yuan/ton ($347.01/ton), 0.2% of what was offered.

・ Thailand seeks 39,000 tons of feed wheat, optional origin, for September shipment.

・ Japan seeks 150,640 tons of milling wheat on August 9.

・ Jordan issued an import tender for 120,000 tons of feed barley on August 8.

・ Jordan issued an import tender for 120,000 tons of hard milling wheat on August 9.

- Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on August 8 for arrival by January 31.

Rice/Other

・ China sold 228,251 tons of rice out of auction at 2361 yuan per ton ($344.54/ton), 13 percent of what was offered.

・ Iraq seeks 30,000 tons of rice on August 12, open until Aug 16.

Terry Reilly

Senior Commodity Analyst C Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.