From: Terry Reilly

Sent: Monday, July 09, 2018 8:06:07 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 07/09/18

- The forecast for the ridging during the balance of July has not changed that much from Friday’s forecast.

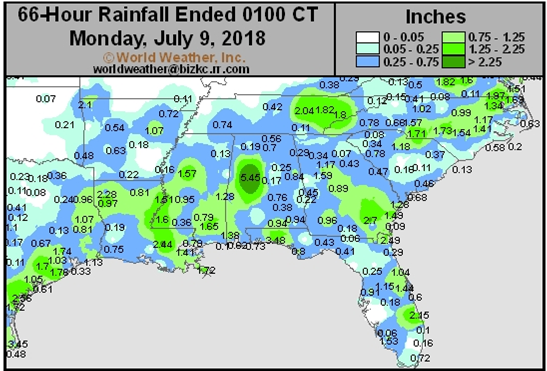

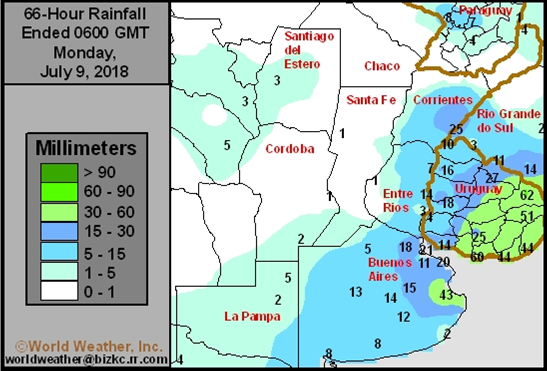

- Not much rain fell across the US Midwest since Friday. Eastern ND and upper MN saw rain. The Delta and SE was active.

- The US will see net drying through Thursday from central Plains to Michigan. Rain will fall from the eastern Dakotas to upper Michigan Wednesday into Thursday. IA may see some of this rain.

- US weather Friday will include rain in the northwestern half of the Corn Belt with 0.20 to 0.80 inch and local totals of 1.00 to 2.00 inches. Showers will also occur in the eastern Midwest, Delta, Tennessee River Basin, southeastern states and from southern California to the central and southern Rocky Mountains.

- US weather during the July 14-24 period will include a couple of waves of rain moving from northwest to southeast through the Midwest and northern and central Plains. These rains will become important as 0.20-0.75”, local 1-2”, will occur for each event.

- The Canadian Prairies will see rain early this week.

- Australia will see an increase in net drying.

Source: World Weather Inc. and FI

From World Weather Inc.

Upper air wind flow (high pressure ridge) forecast has not changed much since Friday

- High pressure ridge in western in western U.S. during the weekend will expand to the east early this week with most areas to be impacted by high pressure aloft from the Rocky Mountain region to the Atlantic Coast today and Monday

- 594 height line will encompass most areas from the Great Basin to the middle and southern Atlantic Coast

- Ridge axis will run from western Texas to eastern Montana and western North Dakota Tuesday and Wednesday

- 594 height line will encompass most areas from central and southern California and the Great Basin east to the western and central Midwest and all of the Delta and Tennessee River Basin

- Ridge flattens Thursday and Friday resulting in a high latitudinal zonal (west to east) flow pattern aloft

- This pattern prevails through weekend of July 14-15

- Ridge reforms over the Great Basin and Rocky Mountain region July 17-18 resulting in a west northwesterly flow pattern over the U.S. Midwest July 17-20

- West northwesterly flow promotes more normal temperatures in the Midwest and a better chance for rain

- Ridge will remain over the western United States through July 24 maintaining northwesterly flow pattern aloft in the Midwest

Source: World Weather Inc. and FI

Source: World Weather Inc. and FI

- Argentina on Independence Day holiday

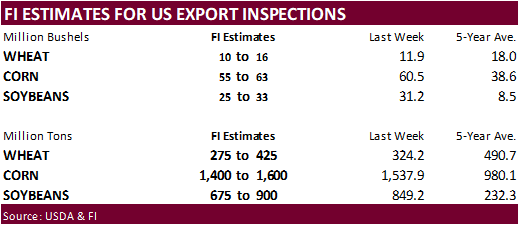

- USDA weekly corn, soybean, wheat export inspections, 11am

- CFTC commitments of traders weekly report for period ending July 3 on positions for various U.S. futures and options, 3:30pm (report delayed from Friday because of July 4 holiday)

- USDA weekly crop progress report, 4pm

- FAO Fisheries and Aquaculture report

- EU publishes grains and oilseeds trade data

- Ivory Coast weekly cocoa arrivals

TUESDAY, JULY 10:

- Cargo surveyors Intertek and AmSpec release their respective data on Malaysia’s July 1-10 palm oil exports, 11pm ET Monday (11am Kuala Lumpur Tuesday); SGS data during same period, 3am ET Tuesday (3pm local time Tuesday)

- Brazil’s crop agency Conab releases soy, corn output for July, 8am ET (9am Sao Paulo), along with 2017-18 grain and oilseed crop report

- Unica bi-weekly data on Brazil Center-South sugar production, 9am ET (10am Sao Paulo)

- Malaysian Palm Oil Board (MPOB) data on stockpiles, exports, production for June, 12:30am ET (12:30pm Kuala Lumpur)

- French Agriculture Ministry publishes crop areas, production forecasts

- FAO bi-annual food outlook report, which includes food import bill

- Global Ethanol Focus conference in Singapore, 1st day of 2

- EARNINGS: PepsiCo

WEDNESDAY, JULY 11:

- EIA U.S. weekly ethanol inventories, output, 10:30am

- USDA weekly crop net-export sales for corn, wheat, soy, cotton, 8:30am

- FranceAgriMer updates cereals balance sheets

- Global Ethanol Focus conference in Singapore, final day

THURSDAY, JULY 12:

- USDA weekly net-export sales for corn, wheat, soy, cotton, 8:30am

- U.S. National Weather Service’s Climate Prediction Center will release its latest forecast for El Nino, 9am

- USDA’s monthly World Agricultural Supply and Demand Estimates (WASDE) report for July, noon

- Brazil coffee exporters group Cecafe releases data on shipments in June and the prospect for exports in 2018-19 crop

- Strategie Grains publishes monthly EU grains report

- Port of Rouen data on French grain exports

- Buenos Aires Grain Exchange weekly crop report

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

- EARNINGS: Suedzucker

FRIDAY, JULY 13:

- China’s General Administration of Customs releases preliminary commodity trade data for June, including soy and palm oil, 10pm ET Thursday (10am Beijing Friday)

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders weekly report for period ending July 10 on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly updates on French crop conditions

Source: Bloomberg and FI

· Soybeans down 261 to 1,428 (CIRM Chicago)

· Rice down 23 to 343

· US stocks are higher, USD is lower, WTI crude higher, and gold higher, at the time this was written.

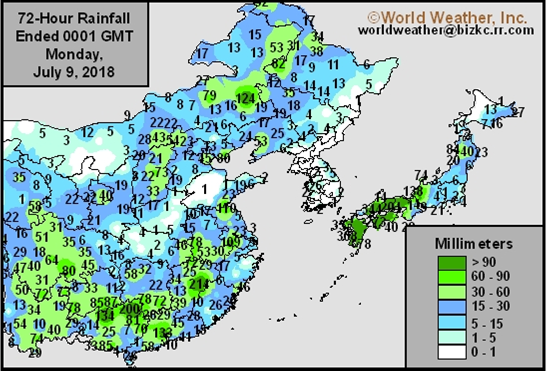

· Equity shares in China rebounded on Monday.

Corn.

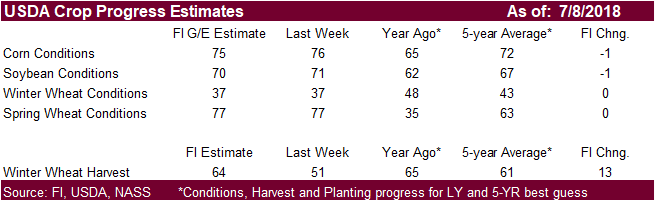

· We are looking for US corn crop conditions to decline slightly from the previous week.

- Baltic Dry Index was down 13 points to 1,609, or 0.8%.

- China will allow to import German poultry after banning it from bird flu.

· China sold about 50-51 million tons of corn this season. China will offer more corn on July 12 & 13.

Soybean complex.

· The US soybean complex is trading lower on Monday. The strong move on Friday and mostly unchanged US weather forecast prompted light liquidation. Over the short-term, we still see upside in this market on oversold conditions.

· China/US trade developments were slow over the weekend.

· The weather forecast for the US Midwest didn’t change much from Friday’s outlook.

· We are looking for US soybean crop conditions to decline slightly from the previous week.

· Offshore values are leading the CBOT products lower.

· China will reimburse the buyer the 25% tariff on soybean imports from the U.S. if the cargoes are for state reserves. (Bloomberg). There was one cargo that showed up after the 25 percent tariff kick in on Friday, but that cargo will be headed to state reserves.

· The CNGOIC reported China crushed 1.82 million tons of soybeans last week, down 90,000 tons from the previous week. Meal demand slowed.

· China September soybean futures decreased 11 yuan per ton or 0.3%, September meal was up 6 or 0.2%, China soybean oil up 12 (0.2%) and China September palm down 8 (0.2%).

· September China cash crush margins were last running at 63 cents, and compares to 56 cents last week and 84 a year ago.

· Rotterdam vegetable oils were mixed and SA soybean meal when delivered into Rotterdam were higher as of early morning CT time.

· MPOB is due out Tuesday.

· September Malaysian palm was 2 higher at MYR2268 and cash $2.50 lower at $585.00.

· Offshore values were leading soybean oil 21 points lower and meal $5.70/short ton lower.

· Under the 24-hour reporting system, US exporters sold 132,000 tons of soybeans to unknown during the 2018-19 marketing year.

· South Korea’s NOFI bought about 24,000 tons of rapeseed meal from India.

o 12,000 tons was purchased at $253.48 a ton c&f for arrival in South Korea around Nov. 10

o 12,000 tons was purchased at $254.98 a ton c&f for arrival in South Korea around Dec. 20

· China will offer 493,000 tons of soybean reserves on July 11 and July 18. China sold 660,524 tons of soybeans out of reserves so far, this season.

· China will offer 49,000 tons of soybean oil on July 11.

- China will offer 61,000 tons of rapeseed oil on July 17.

- Iran seeks 30,000 tons of sunflower oil on July 10.

- Iran seeks 30,000 tons of palm olein oils on July 10.

- Iran seeks 30,000 tons of soybean oil on August 1.

· US wheat futures are lower on lack of bullish news.

· We are looking for US crop conditions to remain unchanged from the previous week.

- December Paris wheat fell 0.50 euros to 188.75 euros ($221.28/ton) in early US trading hours.

- FCS tone EU soft wheat production survey: 135.3MMT (down 6.4MMT on last month)

- A recent Reuters poll pegged the EU soft wheat production at 136 million tons.

- Russian wheat exports totaled 40.4 million tons in 2017-18, up 50 percent from the previous year. Corn exports were 5.8 million tons, up 11 percent.

- Saudi Arabia plans to buy up to 700,000 tons of wheat per year from local producers.

Export Developments.

- Saudi Arabia bought 1.74 million tons of barley for Sep/Oct shipment at $226.47/ton. This was about 250k more than what they were seeking.

- Indonesia bought about 250,000 tons of Black Sea milling wheat (11.5%) in recent weeks at around $220 to $226 a ton c&f for shipment in July to early August.

· Jordan cancelled their import tender for 120,000 tons of wheat for Oct-Nov shipment.

· Jordan seeks 120,000 tons of barley on July 11 for Oct/Nov shipment.

- Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on July 11 for arrival by December 28.

- Results awaited: Syria seeks 200,000 tons of wheat on July 2 for Aug 1-Sep 30 shipment. Origins include Russian, Romania and/or Bulgaria.

Rice/Other

- China sold 62,804 tons of rice from state reserves at auction at an average price of 2607 yuan/per ton or $393.44/ton, 6.1 percent of what was offered.

- Iraq bought 200,000 tons of white sugar and 90,000 tons of vegetable oil.

- Results awaited: Iran seeks 50,000 tons of rice from Thailand on July 3.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.