From: Terry Reilly

Sent: Friday, August 03, 2018 8:04:09 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 08/03/18

Please note I will be out of the office Friday.

PDF attached

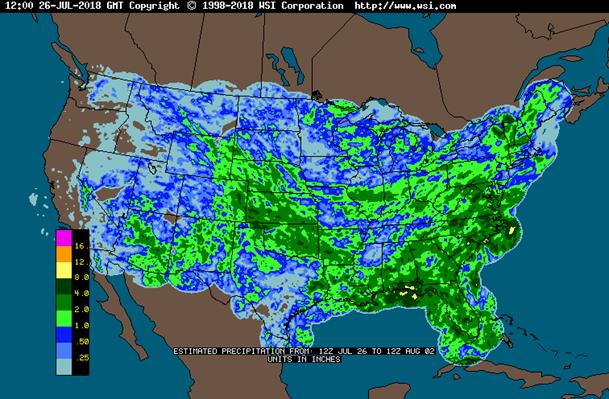

US crop conditions are expected to decline one in corn, soybeans unchanged, and spring wheat down 1-2 what updated on Monday. Spring wheat harvest progress may have advanced 11 points to 15 percent complete. Winter wheat could end up 7 points to 92 percent complete.

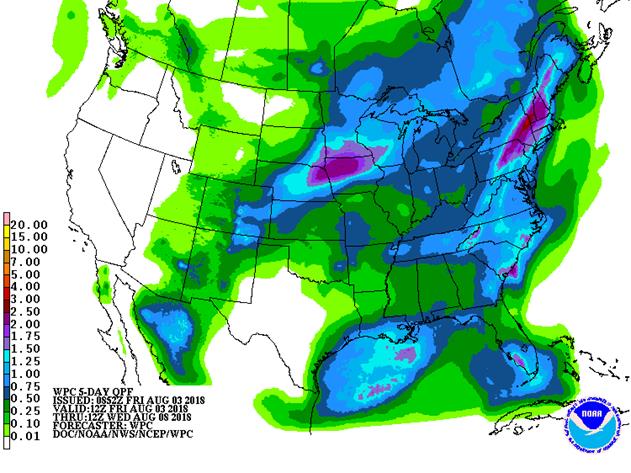

· The near-term weather model appears to be drier for the central WCB through early next week.

· 6-10 day is drier for the central and eastern Midwest and temperatures are coolers for the southeastern Plains and Delta. 11-15 day is wetter in the Midwest and eastern Great Plains, and temperatures are slightly warmer in the Midwest and eastern Plains.

· The ridge of high pressure building up over the Great Plains and a part of western Corn Belt during the coming weekend and next week is still slated to happen, accelerating net drying and limiting rainfall across the Plains, Midwest and Delta from August 5th through August 14.

· Temperatures across the northern Midwest will be warm to hot through early next week.

· Rainfall between now and August 5 for the Midwest will be very important.

· Some of the Midwest northern growing areas will pick up on rain. The northwestern growing areas will see rain this weekend. The Delta will see rain in the southeastern areas on Saturday. All other areas of the Delta will see net drying through the weekend.

· Canada’s southern Prairies will still see stress this week for the summer crops. Southeastern Canada is in good shape.

SIGNIFICANT CORN AND SOYBEAN BELT PRECIPITATION EVENTS

WEST CORN BELT EAST CORN BELT

up to 0.35” and locally

more each day

Fri-Sat 45% cvg of up to 0.75”

and local amts over 2.0”;

S.D. to Mn. wettest;

driest south

Sun-Mon 65% cvg of up to 0.75”

and local amts over 2.0”;

Ia. wettest; far south and

far NW driest

Mon-Tue 80% cvg of up to 0.75”

and local amts to 2.0”;

west-central and SW

Illinois driest

Tue-Wed 60% cvg of up to 0.50”

and local amts to 1.10”;

driest south

Wed-Aug 10 70% cvg of up to 0.55”

and local amts to 1.15”;

wettest south

Aug 9-11 Up to 20% daily cvg of

up to 0.25” and locally

more each day; some

days may be dry

Aug 11-12 5-20% daily cvg of up

to 0.30” and locally

more each day

Aug 12-13 40% cvg of up to 0.50”

and locally more;

wettest north

Aug 13-14 45% cvg of up to 0.40”

and locally more;

north and east wettest

Aug 14-16 5-20% daily cvg of up

to 0.30” and locally

more each day

Aug 15-16 5-20% daily cvg of up

to 0.30” and locally

more each day

U.S. DELTA/SOUTHEAST SIGNIFICANT PRECIPITATION EVENTS

DELTA SOUTHEAST

Tdy-Fri Up to 10% daily cvg of 85% cvg of 0.40-1.50”

up to 0.20” and locally and local amts to 2.50”

more each day; some in most areas from Fl.

days may be dry to Va. and a few bands

of 2.50-3.75” with up

to 0.40” and locally

more elsewhere;

east Ms. driest

Sat-Mon 10-25% daily cvg of

up to 0.30” and locally

more each day

Sat-Tue 15-35% daily cvg of

up to 0.50” and locally

more each day

Tue-Wed 65% cvg of up to 0.75”

and local amts to 1.50”;

driest south

Wed-Aug 10 80% cvg of up to 0.75”

and local amts to 2.0”;

driest NE

Aug 9-10 75% cvg of up to 0.75”

and local amts to 1.50”

Aug 11-16 10-25% daily cvg of 10-25% daily cvg of

up to 0.30” and locally up to 0.30” and locally

more each day more each day

Source: World Weather Inc. and FI

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly updates on French crop conditions

- EARNINGS: Kraft Heinz Co.

MONDAY, AUG. 6:

- Canada on holiday

- Malaysian Palm Oil Council POINTERS webinar

- Malaysian Palm Oil Board, Malaysian Palm Oil Council, Indonesian Palm Oil Association give their latest market outlook

- EU weekly grain, oilseed import and export data, 10am (3pm London)

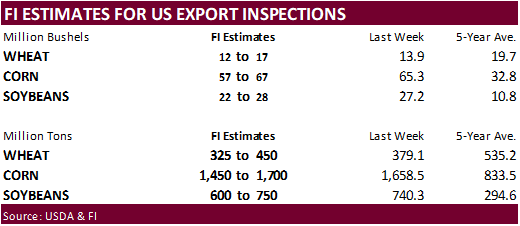

- USDA weekly corn, soybean, wheat export inspections, 11am

- USDA weekly crop progress report, 4pm

- Ivory Coast weekly cocoa arrivals

- EARNINGS: Tyson Foods

TUESDAY, AUG. 7:

- New Zealand dairy auction on Global Dairy Trade online market starts ~7am ET (~noon London, ~11pm Wellington)

- China National Grain and Oils Information Center (CNGOIC) publishes forecast on country’s grains output

- EARNINGS: Dean Foods, Mosaic

WEDNESDAY, AUG. 8:

- China’s General Administration of Customs releases preliminary agricultural commodity trade data for July, 11pm ET Tuesday (11am Beijing Wednesday)

- EIA U.S. weekly ethanol inventories, output, 10:30am

- French Agriculture Ministry publishes crop areas, production forecasts

THURSDAY, AUG. 9:

- USDA weekly net-export sales for corn, wheat, soy, cotton, 8:30am

- Brazil’s crop agency Conab updates its forecast on 2017-18 grain and oilseed crop, 8am ET (9am Sao Paulo)

- Strategie Grains monthly report on European market outlook

- Port of Rouen data on French grain exports

- Buenos Aires Grain Exchange weekly crop report

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

- EARNINGS: BayWa

FRIDAY, AUG. 10:

- USDA’s monthly World Agricultural Supply and Demand Estimates (WASDE) report for August, noon

- China’s Ministry of Agriculture publishes China Agricultural Supply & Demand Estimates (CASDE) report

- Malaysian Palm Oil Board (MPOB) releases data on palm oil stockpiles, exports, production as of end-July, 12:30am ET (12:30pm Kuala Lumpur)

- Cargo surveyors Intertek, AmSpec release respective data on Malaysia’s Aug. 1-10 palm oil exports, 11pm ET Thursday (11am Kuala Lumpur Friday)

- SGS data during same period, 3am ET Friday (3pm Kuala Lumpur Friday)

- Unica’s bi- weekly Brazil Center-South sugar output, 9am ET

- FranceAgriMer weekly updates on French crop conditions

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- EARNINGS: BRF

Source: Bloomberg and FI

- None Reported

Weekly Bloomberg Bull/Bear Survey

· Wheat survey results: Bullish: 9 Bearish: 2 Neutral: 3

· Corn: Bullish: 8 Bearish: 2 Neutral: 5

· Soybeans: Bullish: 6 Bearish: 5 Neutral: 4

· Raw sugar: Bullish: 5 Bearish: 3 Neutral: 1

· White sugar: Bullish: 5 Bearish: 1 Neutral: 3 White-sugar

· Change In Nonfarm Payrolls (Jul): 157K (est 193K, prevR 248k)

– Unemployment Rate (Jul): (est 3.9%, prev 4.0%)

– Average Hourly Earnings (M/M) (Jul): 0.3% ( est 0.3%, prevR 0.1%)

– Average Hourly Earnings (Y/Y) (Jul): 2.7% (est 2.7%, prev 2.7%)

– Change In Private Payrolls (Jul): 170K (est 190K, prev 234K)

– Change In Manufacturing Payrolls (Jul): 37K (est 25K, prevR 33K)

– Average Weekly Hours All Employees (Jul): 34.5(est 34.5, prevR 34.6)

– Labor Force Participation Rate (Jul): 62.9% (prev 62.9%)

· US Trade Balance (Jun): $-46.3 (est -$46.5Bln, prevR -$43.2Bln)

· China To Levy Differentiated Tariffs On About $60Bln US Goods

· China Govt Says It Will Immediately Impose The Import Tax Measures If The U.S. Starts To Slap Tax On China Imports (livesquak)

· China Central Bank Says Raising Reserve Requirements For Forex Settlements In Order To Fend Off Financial Risks, Promote Stable Operations Of Financial Institutions

Corn.

- Corn prices were nearly unchanged on lack of direction with soybeans lower and wheat mixed.

- Baltic Dry Index increased 17 points to 1,773 or 1%.

· Farm Futures sees the 2018 US corn yield at 175.4 bushels per acre and production at 14.360 billion.

· Informa may release US crop supply later. In July we understand Informa used a 176.0 yield and 14.392 billion bushel crop. USDA is at 14.230 billion bushels and 174.0/bu for the yield.

· FI is using 178.0 with 14.543 billion.

· French corn conditions for the week ending July 29 fell by 5 points from the previous week to 66 percent, below 79 percent at this time last year.

· Argentina’s corn harvest is running at 84% complete, compared to 79.1% last week and 68.7% last year. Wheat plantings were 97.3$ complete.

· China sold 856,885 tons of corn out of reserves at an average price of 1416 yuan per ton ($206.16/ton), 22 percent of total offered. Yesterday they sold 1.1 million tons.

· China sold about 59.4 million tons of corn out of reserves this season.

Soybean complex.

· Soybeans on Friday saw a choppy trade after China said they plan to levy additional tariffs on about $60 billion US products if the US adds more tariffs, so it’s subject to US actions they said.

· Soybeans are down for the third day of risk off from the ongoing China/US trade concerns. Products are mixed with meal down and soybean oil struggling to stay near unchanged.

· China Gvt’s New Proposed Tariffs On U.S. Goods Include Soybean Oil, Peanut Oil, Corn Oil, Olive Oil, Mutton, Dried, Smoked And Salted Beef, Coffee, Wheat Flour, Spirits (ICE)

· Farm Futures sees the 2018 US soybean yield at 49.8 bushels per acre and production at 4.420 billion.

· Informa might release crop supply later. In July we understand Informa used a 49.1 yield and 4.425 billion bushel crop. USDA is at 4.310 billion bushels and 48.5/bu for the yield.

· FI is using 49.0 with 4.353 billion.

· China approved the imports of sunflower seeds from Bulgaria.

· China September soybean futures -16 yuan per ton or 0.5%

· China September meal -1 or 0.1%

· China September soybean oil -20 or 0.4%

· China September palm -28 or 0.6%

· September China cash crush margins were last running at 42 cents/bu, compared to 43 previous session, 48 last week and 66 cents a year ago.

· Rotterdam vegetable oils were mostly unchanged, and SA soybean meal were lower, as of early morning CT time.

· October Malaysian palm was up 5 to MYR2196, and cash unchanged at $568.75/ton.

· Offshore values were leading soybean oil 26 points higher (23 higher for the week to date) and meal $0.20/short ton lower ($4.70 lower for the week to date).

- No fresh export developments for Friday.

- South Korea seeks 12,000 tons of non-GMO soybeans in Aug 7 for Nov/Dec arrival.

- USDA seeks 2,160 tons of refined vegetable oil under the PL480 program on August 7 for shipment in September for Zimbabwe.

- Results awaited: Iran seeks 30,000 tons of soybean oil on August 1.

- Iran seeks 30,000 tons of sunflower oil on September 24.

· China sold 1.054 million tons of soybeans out of reserves so far, this season.

· US wheat futures are mixed. Chicago is down on profit taking, KC mixed on higher Paris wheat and lower Chicago along with light selling, and MN higher on US spring wheat crop concerns.

· We look for a 1-2 point drop in the US spring wheat rating on Monday.

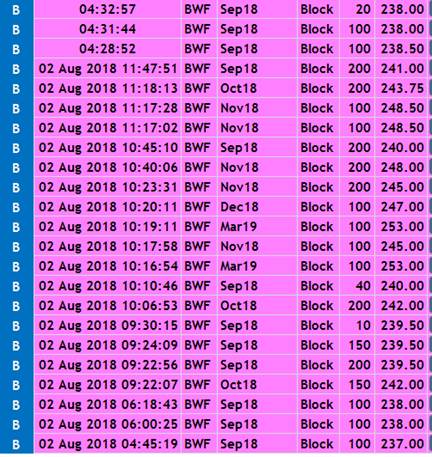

· 1300 Black Sea wheat basis SEP already traded this morning. 238-239.75. All lower than yesterday. Last trade 238. (JD)

· December Paris wheat futures was last 0.75 euros higher at 214.00 euros. Yesterday the contract made another high during the session and on a rolling basis Paris wheat hit over a 4-year high. (April 2014)

· For the August Crop Production report, we are using 47.5 and 613 million bushels for spring wheat, 41.7 and 77 million for durum, and 47.6 bu/ac and 1.884 billion for the all-wheat crop.

· India’s weather office noted there is a 47 percent chance of India recording below average rainfall during the second half of the monsoon season which stretches between June to September. The first two months of the season were below normal.

· Egypt said they have enough strategic wheat reserves for 4 months.

· Yesterday the EU awarded 72,048 tons of wheat imports under quotas. No barley was granted.

Black Sea – THURSDAY/FRIDAY MORNING BLOCKS

Export Developments.

· Yesterday Egypt bought 240,000 tons of Russian and Roman wheat for September 11-20 shipment. Lowest paid was $251.96/ton c&f.

· Yesterday Algeria bought at least 360,000 tons of milling wheat at around $263/ton c&f & $272/ton c&f, for October shipment.

· Jordan issued an import tender for 120,000 tons of feed barley on August 8.

- Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on August 8 for arrival by January 31.

Rice/Other

· Iraq seeks 30,000 tons of rice on August 12, open until Aug 16.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.