From: Terry Reilly

Sent: Tuesday, August 14, 2018 8:24:58 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 08/14/18

PDF attached

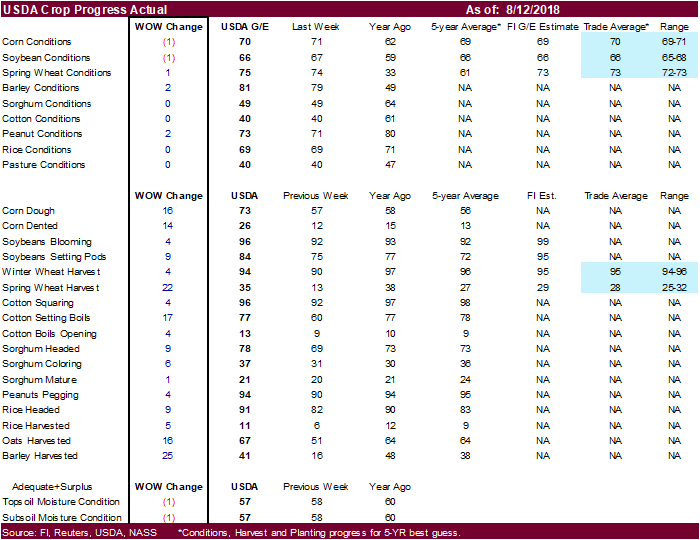

· USDA US crop conditions declined one point in the combined good and excellent categories for corn and soybeans.

· US barley conditions were up 2 in the G/E categories. Sorghum was unchanged. Oats were not reported.

· US spring wheat conditions improved one point (+2 good and -1 excellent)

· US rice conditions were down one point in the excellent and up one point in the good.

· US cotton conditions were unchanged.

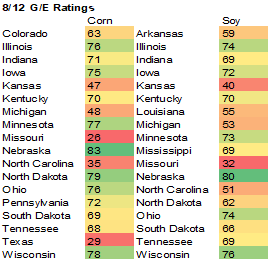

· US weather will turn favorable this week with less threatening temperatures and forecasts for rain in some dry areas.

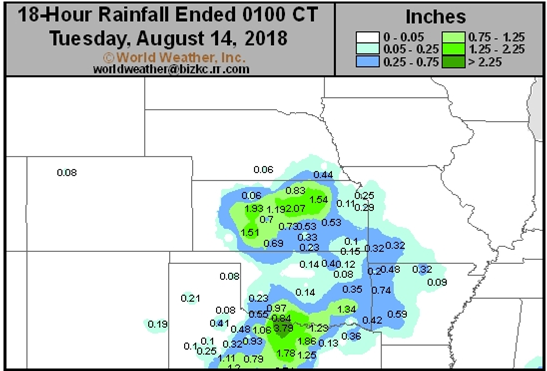

· Rainfall in the heart of the Midwest will vary from 0.50 to 1.50 inches by Sunday.

· Northern Plains rainfall will vary from 0.10 to 0.60 inch and local totals to 0.75 inch, but most of the region will experience net drying until next weekend when greater rain falls in the east.

· The Delta will see daily rounds of showers and thunderstorms through the next 7 days.

· Upcoming Thomson Reuters crop tours: August 6-8: U.S. corn & soybeans

· Two waves of rain will move through northwestern portions of the CIS during the coming week. Most of the precipitation will occur from western Ukraine, Belarus and Baltic States across northwestern Russia to the Volga-Vyatsk.

· India’s monsoon is not likely to resume normally in the west or far south for another 5 days and that will continue of some concern.

· Canada’s Prairies continues to suffer from drought. Some rain may develop this weekend.

· Western Australia, South Australia and Victoria may see rain this week, but New South Wales and Queensland remain dry.

Source: World Weather and FI

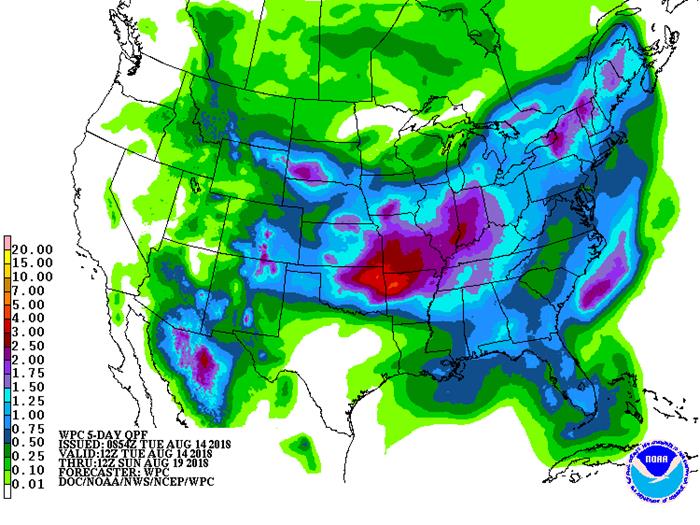

SIGNIFICANT CORN AND SOYBEAN BELT PRECIPITATION EVENTS

WEST CORN BELT EAST CORN BELT

Tdy-Wed 75% cvg of 0.50-2.0”

and local amts over 3.50”

in most areas from east-

central and SE Neb. and

east Ks. to east-central

and NE Mo. with up to

0.50” and locally more

elsewhere; far NW

driest

Tue-Thu 90% cvg of 0.15-1.0”

and local amts over 2.0”;

south Il. to central In.

wettest

Thu-Fri 10-25% daily cvg of

up to 0.50” and locally

more each day; central

and south wettest

Fri-Sat 10-25% daily cvg of

up to 0.50” and locally

more each day

Sat-Aug 20 75% cvg of up to 0.75”

and local amts over 1.75”

Sun-Aug 20 70% cvg of up to 0.75”

and local amts over 1.75”;

wettest west

Aug 21 60% cvg of up to 0.60” 50% cvg of up to 0.50”

and locally more; and locally more;

driest NW wettest south

Aug 22-23 Up to 20% daily cvg of Up to 20% daily cvg of

up to 0.20” and locally up to 0.20” and locally

more each day more each day

Aug 24-27 10-25% daily cvg of 10-25% daily cvg of

up to 0.35” and locally up to 0.35” and locally

more each day more each day

U.S. DELTA/SOUTHEAST SIGNIFICANT PRECIPITATION EVENTS

DELTA SOUTHEAST

-Tue 15-25% daily cvg of

up to 0.50” and locally

more each day;

wettest north

Tdy-Wed 10-25% daily cvg of

up to 0.40” and locally

more each day

Wed-Fri 60% cvg of 0.35-1.50”

and local amts to 3.0”

north with up to 0.35”

and locally more in

central and southern

areas

Thu-Sat 65% cvg of up to 0.75”

and local amts to 1.75”;

driest SE

Sat-Aug 20 65% cvg of up to 0.75”

and local amts to 1.75”;

driest south

Sun-Aug 20 60% cvg of up to 0.50”

and local amts to 1.10”

Aug 21-22 40% cvg of up to 0.50”

and locally more;

wettest north

Aug 21-23 60% cvg of up to 0.65”

and locally more

Aug 23-27 10-25% daily cvg of

up to 0.35” and locally

more each day

Aug 24-27 15-35% daily cvg of

up to 0.50” and locally

more each day

Source: World Weather and FI

Source: World Weather and FI

- Olam International media briefing on earnings, 10:30am Singapore Aug. 14 (10:30pm ET Aug. 13)

- EARNINGS: JBS, Golden Agri- Resources, Olam International, WH Group, Marfrig

WEDNESDAY, AUG. 15:

- India on holiday

- Cargo surveyors Intertek, AmSpec release respective data on Malaysia’s Aug. 1-15 palm oil exports, 11pm ET Tuesday (11am Kuala Lumpur Wednesday)

- SGS data for same period, 3am ET Wednesday (3pm Kuala Lumpur Wednesday)

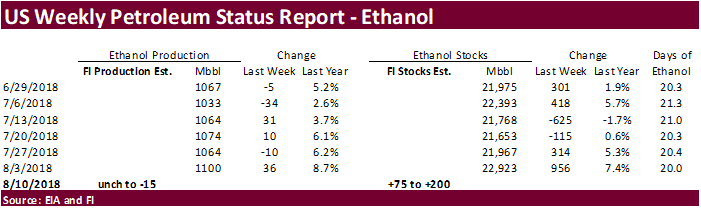

- EIA U.S. weekly ethanol inventories, output, 10:30am

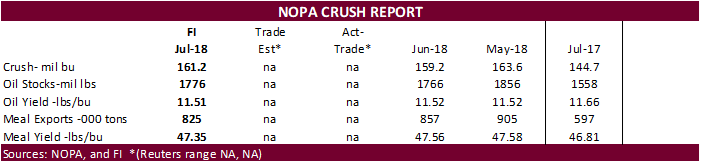

- National Oilseed Processors Association report on U.S. soybean processing data, noon

- The Salvadoran coffee council releases monthly El Salvador export data

THURSDAY, AUG. 16:

- USDA weekly net-export sales for corn, wheat, soy, cotton, 8:30am

- Port of Rouen data on French grain exports

- Buenos Aires Grain Exchange weekly crop report

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

FRIDAY, AUG. 17:

- FranceAgriMer weekly updates on French crop conditions

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- EARNINGS: Deere & Co.

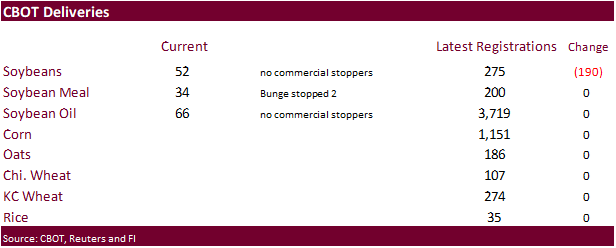

- Soybeans down 190 to 275, Cofco Chicago

· US stocks are higher, USD slightly lower, WTI crude higher, and gold higher, at the time this was written.

- Turkey’s currency hit another all-time low.

- US Import Price Index (M/M) (Jul): 0.0% (est 0.0%, prevR -0.1%)

– US Import Price Index Ex Petroleum (M/M) (Jul): -0.1% (est 0.1%, PrevR-0.4%

– US Import Price Index (Y/Y) (Jul): 4.8% (est 4.5%, prevR 4.7%)

– US Export Price Index (M/M): -0.5% (est 0.2%, prevR 0.2%)

– US Export Price Index (Y/Y):4.3% (prev 5.3%)

Corn.

- Corn is higher from higher soybeans and technical buying.

- Baltic Dry Index increased 0.9 percent to 1725 points.

· USDA US crop conditions declined one point in the combined good and excellent categories for corn.

· US barley conditions were up 2 in the G/E categories. Sorghum was unchanged. Oats were not reported.

· USDA US corn export inspections as of August 09, 2018 were 1,261,900 tons, within a range of trade expectations, below 1,287,772 tons previous week and compares to 761,317 tons year ago. Major countries included Mexico for 423,445 tons, Japan for 277,421 tons, and Colombia for 147,215 tons.

- Argentina is still struggling with low river levels (lowest in decade) and it continues to disrupt shipping. Grain ships in the Rosario metro area will continue to load beneath capacity -Rosario Exchange.

· UkrAgroConsult raised its forecast for Ukraine’s 2018 grain harvest to 62.6 million tons from previous 61.4MMT. they increased the corn output to record 28.5 million tons from 27.3 million tons previously. Grain exports were projected at 42.5 million tons from 41.0 million tons a month ago.

- China’s AgMin confirmed an outbreak of foot and mouth disease in its central province of Henan. They culled 173 pigs at a processing plant. That is the seventh case of the O-type strain of the disease found in livestock this year.

- African swine fever was discovered in Ghana.

· China sold about 61.4 million tons of corn out of reserves this season. Another 8 million tons will be offered this week.

Soybean complex.

· Soybeans and meal are higher on Argentina export tax news and technical buying. Soybean oil is under pressure from meal/oil spreading.

· Argentina suspended their export tax program on soybean meal and soybean oil for six months. Each month they gradually lowered export taxes by a half percent. Exports of both products are currently taxed at 23 percent, having been gradually lowered from 32 percent in 2015.

· Argentina’s economy has been struggling recently with the central bank raising its key interest rate by 5 percentage points to 45 percent until at least October.

· Reuters noted that by the end of 2019 soymeal and soybean oil export taxes should have been at 18 percent compared with the 15 percent planned before the suspension.

· US temperatures this week are nonthreatening.

· China’s provinces in the northeast, such as Jilin and Liaoning, continue to see heavy rain/

· China cash margins were last 84 cents/bu on our analysis, compared to 76 previous session, 87 cents late last week, and compares to 94 cents last week.

· China’s soybean complex traded higher. Soybeans were up 0.1%, soybean meal up 0.5%, soybean oil up 0.2% and palm down 0.1%.

· Offshore values were suggesting a lower lead for US soybean meal by $5.50 and lower lead for soybean oil by 20 points.

· India’s July palm oil imports fell 33 percent in July from a year earlier to 550,180 tons. 352,325 tons of soybean oil was also imported, down about 25 percent from last year. All vegetable oil imports were 1.12 million tons, off 27 percent from last year.

· October Malaysian palm was higher overnight by 9 ringgits and leading SBO 19 points lower. Cash was $2.50/ton higher.

· Rotterdam meal was mixed and vegetable oils also mixed.

· The volatility has prompted the CME to raise soybean futures margins by 14.6 percent to $2,350 per contract from $2,050 for August and September 2018 futures, effective August 14. Other margin changes by month were changed as well. https://www.cmegroup.com/notices/clearing/2018/08/Chadv18-321.html#pageNumber=1

· USDA US soybean export inspections as of August 09, 2018 were 580,824 tons, below a range of trade expectations, below 893,158 tons previous week and compares to 590,887 tons year ago. Major countries included Mexico for 109,219 tons, China Main for 62,999 tons, and Indonesia for 24,875 tons.

· USDA US crop conditions declined one point in the combined good and excellent categories for soybeans.

· NOPA is due out on Wednesday with the July crush. Look for a record for the month, but down slightly on a daily adjusted basis from June due to downtime.

· Yesterday the Argentine peso weakened to a new low. The central bank raised its main interest rate to 45 percent and will leave it at that level until October.

- Iran seeks 30,000 tons of sunflower oil on September 24.

- China sold 1.091 million tons of soybeans out of reserves so far, this season.

· US wheat prices are mostly higher. Global trade developments increased this week and traders are keeping an eye on the export prices in Egypt’s import tender this morning. Look for a two-sided trade in US wheat, with a possible higher close.

· Manitoba’s crop report showed crop conditions in that Canadian province fell last week because of drought.

· Argentina’s weather is not completely ideal for early wheat establishment, but the country should still realize a large crop based on area expansion.

· On Monday US wheat inspections were second highest season to date.

· USDA US all-wheat export inspections as of August 09, 2018 were 462,854 tons, above a range of trade expectations, above 326,584 tons previous week and compares to 511,624 tons year ago. Major countries included Mexico for 89,254 tons, Japan for 84,088 tons, and Philippines for 65,875 tons.

· US spring wheat conditions improved one point (+2 good and -1 excellent)

· US spring wheat harvest progress was reported up 22 points to 35 percent, 7 points above a Reuters trade guess and compares to 27 percent for the 5-year average.

· US winter wheat harvest progress was reported up 4 points to 94 percent, one point above a Reuters trade guess and compares to 96 percent for the 5-year average.

· Egypt is in for wheat for September 21-30 and October 1-10 shipment. Lowest offer is $230.99/ton for Romanian wheat.

· Jordan passed on 120,000 tons of feed barley.

· Iraq seeks 50,000 tons of milling wheat on 8/15.

· Jordan issued an import tender for 120,000 tons of hard milling wheat on August 15.

- Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on August 22 for arrival by January 31.

Rice/Other

· US rice conditions were down one point in the excellent and up one point in the good.

· US cotton conditions were unchanged.

· Egypt’s ESIIC seeks 150,000 tons of raw sugar on Aug 18 for shipment within the first half of September and two 50,000 ton shipments from September 15-Oct 15.

· China sold 216,443 tons of rice at auction at an average price of 2407 yuan/ton ($349.76/ton), 7% of what was offered.

· Results awaited: Iraq seeks 30,000 tons of rice on August 12, open until Aug 16. Lowest offer was $449.50/ton c&f from Thailand.

· Thailand to sell 120k tons of raw sugar on Aug. 22.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.