From: Terry Reilly

Sent: Tuesday, August 28, 2018 8:20:55 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 08/28/18

PDF attached

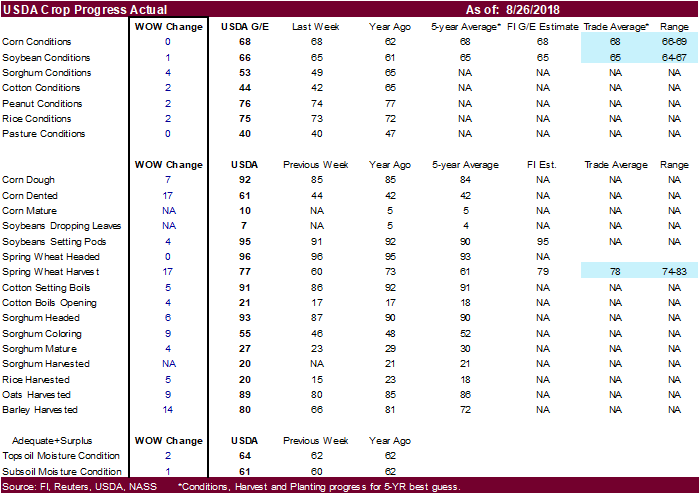

· US crop conditions were unchanged in the combined good/excellent categories for corn (down one good and up one in excellent). The trade was looking for unchanged. For soybeans G/E conditions increased one point (up one in excellent). The trade was looking for unchanged. Spring wheat harvesting progress increased 17 points to 77 percent, one point below a Reuters estimate, and 16 points above a 5-year average.

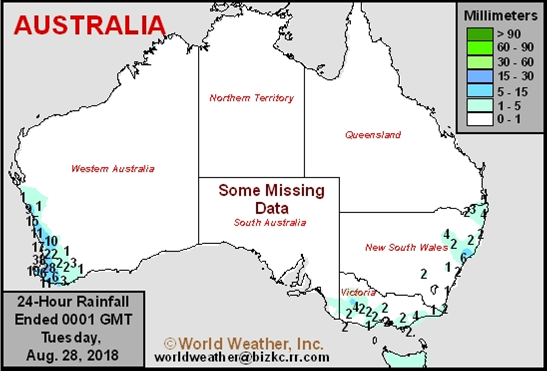

· Western Australia could see rain Tuesday and Wednesday.

· Argentina will receive rain Wednesday into Friday of this week.

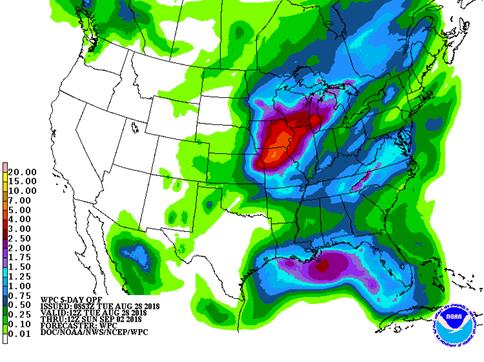

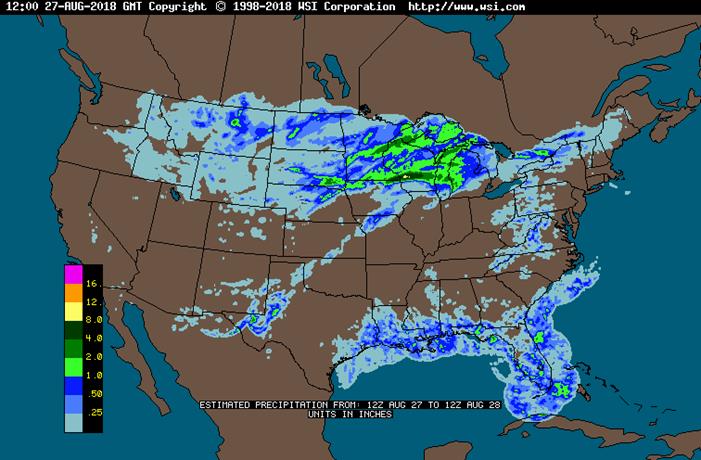

· Central Missouri, parts of TN, northern MI and northern Minnesota are still in need of rain.

· The Delta will see rain this week.

· The two-week outlook calls for favorable weather across the US.

· West Texas will experience net drying over the coming week.

· Eastern China will see net drying through at least August 29.

· Canada’s Prairies will see badly needed rain today.

· Indonesia and Malaysia rainfall are slowing and some attribute the below normal rainfall to El Nino.

Source: World Weather and FI

SIGNIFICANT CORN AND SOYBEAN BELT PRECIPITATION EVENTS

WEST CORN BELT EAST CORN BELT

-Tue 70% cvg of 0.35-1.40”

and local amts to 2.50”

from Ks. to Wi. with up

to 0.65” and locally

more elsewhere

Tue-Wed 85% cvg of up to 0.75”

and local amts to 1.50”;

wettest NW

Wed 15% cvg of up to 0.40”

and locally more;

far south wettest

Thu 20% cvg of up to 0.40”

and local amts to 0.85”;

wettest south

Thu-Fri 75% cvg of up to 0.75”

and local amts to 1.50”

with some 1.50-3.50”

amts in the south; far

NW driest

Fri-Sun 85% cvg of up to 0.75”

and local amts to 1.50”

with some 1.50-3.0”

amts in the west

Sat-Sun 35% cvg of up to 0.75”

and local amts to 2.0”;

wettest south

Sep 3-5 10-25% daily cvg of

up to 0.75” and locally

more each day;

wettest north

Sep 3-6 5-20% daily cvg of up

to 0.30” and locally

more each day

Sep 6-8 65% cvg of up to 0.70”

and locally more

Sep 7-9 60% cvg of up to 0.50”

and locally more

Sep 9-10 10-25% daily cvg of

up to 0.35” and locally

more each day

U.S. DELTA/SOUTHEAST SIGNIFICANT PRECIPITATION EVENTS

DELTA SOUTHEAST

-Tue 10-25% daily cvg of

up to 0.35” and locally

more each day;

wettest south

Tue 25% cvg of up to 0.40”

and locally more;

wettest south

Wed-Thu 85% cvg of up to 0.75”

and local amts to 1.50”

Wed-Fri 80% cvg of up to 0.75”

and local amts to 1.50”

Fri-Sep 3 5-20% daily cvg of up

to 0.30” and locally

more each day

Sat-Sep 3 15-35% daily cvg of

up to 0.40” and locally

more each day

Sep 4-7 5-20% daily cvg of up 5-20% daily cvg of up

to 0.30” and locally to 0.35” and locally

more each day more each day

Sep 8-10 10-25% daily cvg of 10-25% daily cvg of

up to 0.35” and locally up to 0.35” and locally

more each day more each day

Source: World Weather and FI

Source: World Weather Inc.

TUESDAY, AUG. 28:

- Palm Oil Trade Fair & Seminar in Kuala Lumpur, Aug. 28-29. Speakers include Oil World Executive Director Thomas Mielke, LMC Intl Chairman James Fry and Godrej Director Dorab Mistry

WEDNESDAY, AUG. 29:

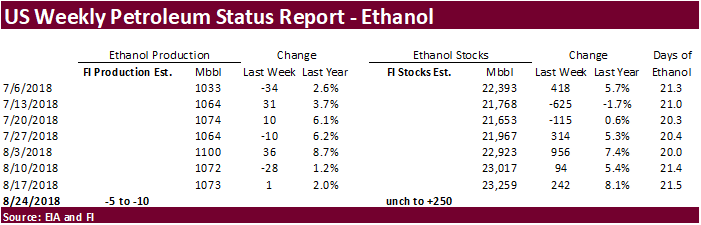

- EIA U.S. weekly ethanol inventories, output, 10:30am

THURSDAY, AUG. 30:

- USDA weekly net-export sales for corn, wheat, soy, cotton, 8:30am

- Port of Rouen data on French grain exports

- Buenos Aires Grain Exchange weekly crop report

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

FRIDAY, AUG. 31:

- Malaysia on holiday; No palm oil futures trading on Bursa Malaysia Derivatives

- Statistics Canada’s domestic crop production report for July, 8:30am ET

- FranceAgriMer weekly updates on French crop conditions

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

CME plans to increase storage fees for corn and soybeans.

- No changes

· US stocks are higher, USD lower, WTI crude higher, and gold mostly higher, at the time this was written.

· US Advance Goods Trade Balance (USD) Jul: -72.2B (est -69.0B; prev -67.9B)

· US Wholesale Inventories (M/M) Jul P: 0.7% (est 0.2%; prev 0.1%)

– Retail Inventories (M/M) Jul: 0.4% (prev 0.1%)

Corn.

- Easing trade concerns are supporting US corn futures.

- Canada and the US plan to meet as early as today.

- Baltic Dry Index fell 0.8 percent to 1,684 points.

· US crop conditions were unchanged in the combined good/excellent categories for corn (down one good and up one in excellent). The trade was looking for unchanged.

· Our weighted rating was unchanged from the previous week at 82.2, a tenth below a 5-year average.

· Our September corn yield estimate is 175.5 bushels per acre.

· Our US corn production is 14.355 billion bushels, 231 million below last year.

· FC Stone is due out with US production estimates on August 30.

· ProFarmer is at 14.501 billion bushels with a yield of 177.3.

· Another 4 million tons of China corn reserves will be offered on Thursday and Friday. China sold about 65.4 million tons of corn out of reserves this season.

Soybean complex.

· Soybean prices traded in a narrow two-sided range this morning on easing trade concerns now that a deal with Mexico was completed on Monday. USDA also unveiled their trade damage payment plan for producers, and soybean and pork farmers appear will benefit most from the program. We are hearing US producers don’t have to sell their crop to collect a check under the aid program, just complete harvest.

· USDA reported soybean meal was sold to Mexico.

· It was quiet on the cash side for the US on Monday.

· Some producers in the Delta are harvesting soybeans in the Delta. No word on yield yet.

· US weather forecast remains favorable for the most part.

· Note First Notice Deliveries are on Friday. There are only 12 soybean registrations, zero meal and 3,719 soybean oil. Look for no meal, no soybeans, and 1500-2000 soybean oil.

· Oil World lowered the Malaysian palm oil production estimate for 2018 to 19.8 million tons. This compares to 19.92 million past year. He put 2019 at 20.4 million tons. Futures price target was set at 2500MRY.

· Rotterdam oils were mixed and SA soybean meal when imported into Rotterdam mostly lower.

· China cash margins were last 71 cents/bu on our analysis, down 2 cents from previous session, down 84 cents late last week, and 96 cents last year.

· Offshore values were suggesting a higher lead for US soybean meal by $3.70 and lower lead for soybean oil by 4 points.

· US soybean crop conditions in the combined G/E categories increased one point (up one in excellent). The trade was looking for unchanged.

· Our weighted rating increased 0.3% to 81.8, matching a 5-year average. This is the first increase for our weighted index since July 22.

· We increased our US soybean yield by a 0.5 bu/ac to 50.5 bushels. USDA is at 51.6 bushels.

· Our US soybean production estimate is 4.481 billion bushels, 44 million above the previous week, and 89 million above last year.

· FC Stone is due out with US production estimates on August 30.

· ProFarmer is at 53.0 bushels per acre and 4.683-billion-bushels.

· Under the 24-hour reporting system, private exporters sold 198,862 tons of soybean meal for delivery to Mexico. Of the total 146,781 tons is for delivery during the 2018-19 marketing year and 52,081 tons is for delivery during the 2019-20 marketing year.

· Egypt’s GASC seeks at least 30,000 tons of soyoil and 10,000 tons of sunflower oil on Wednesday for arrival Oct 1-15.

· South Korea seeks 15,000 tons of non-GMO soybeans on September 4 for Nov/Dec arrival.

· The CCC seeks 15,610 tons of crude degummed soybean oil on August 29 for export to Pakistan. Shipment was for Sep 27 to Oct 7.

- USDA seeks 5,000 tons of refined oil for the export program on September 5 for October shipment.

- During the week ending August 31, China plans to sell 301,200 tons of 2013 soybeans, 60,100 tons of 2011-2013 rapeseed oil, and 53,800 tons of imported 2011 soybean oil.

- China sold nearly 1.3MMT of soybeans out of reserves this season.

- Iran seeks 30,000 tons of sunflower oil on September 24.

Wheat

- Higher trade in Paris wheat futures and technical buying are lifting US wheat higher.

- December Paris wheat is up 0.50 euro at 199.50 euros.

- IKAR lower its Russia wheat production forecast to 69.6MMT from 70.8 million tons. Grain exports were lowered to 39.8 from 41MMT, and grain production lowered to 110.0MMT from 112.8MMT.

- US spring wheat harvest progress increased 17 points to 77 percent, near expectations.

Export Developments.

· Egypt’s GASC seeks optional origin wheat for October 11-20 shipment.

· China sold 3,500 tons of 2013 imported wheat at 2,393 yuan per ton ($348.12/ton), 0.22 percent of what was offered.

· Jordan seeks 120,000 tons of feed barley on August 28.

· Jordan seeks 120,000 tons of hard milling wheat on Aug 29 for Nov/Dec shipment.

- Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on August 29 for arrival by January 31.

· Taiwan seeks 110,500 tons of US milling wheat from the US on August 31 fir October/November shipment.

Rice/Other

· China sold 141,670 tons of rice from reserves at 2,442 yuan per ton ($355.25/ton), 8 percent of what was offered.

· The Philippines will imports 132,000 tons of rice soon.

· South Korea seeks 92,783 tons of rice on Aug. 31 for Nov/Dec arrival.

TONNES(M/T) GRAIN TYPE ARRIVAL/PORT

10,000 Brown medium Nov 30/Gwangyang

10,000 Brown medium Dec 31/Busan

20,000 Brown medium Dec 31/Gunsan

20,000 Brown medium Dec 31/Mokpo

20,000 Brown medium Dec 31/Donghae

12,783 Brown long Nov 30/Masan

· Results awaited: Egypt’s ESIIC seeks 100,000 tons (150k previously) of raw sugar for shipment within the first half of September and two 50,000-ton shipments from September 15-Oct 15.

· Results awaited: Thailand plans to sell 120k tons of raw sugar on Aug. 22.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.