From: Terry Reilly

Sent: Monday, September 10, 2018 7:46:00 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 09/10/18

PDF attached

- A cold snap across northeastern China over the weekend ended the growing season for many crops, including corn. The cold weather came about 10-15 earlier than normal. Lows were in the 30’s and lower 40’s in Heilongjiang.

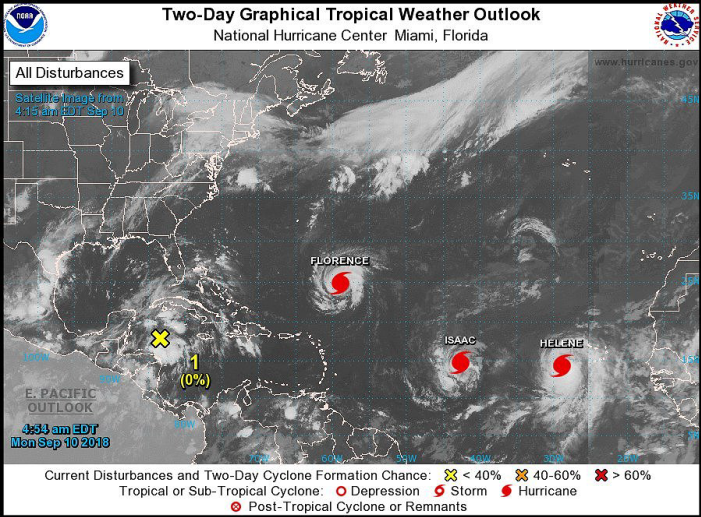

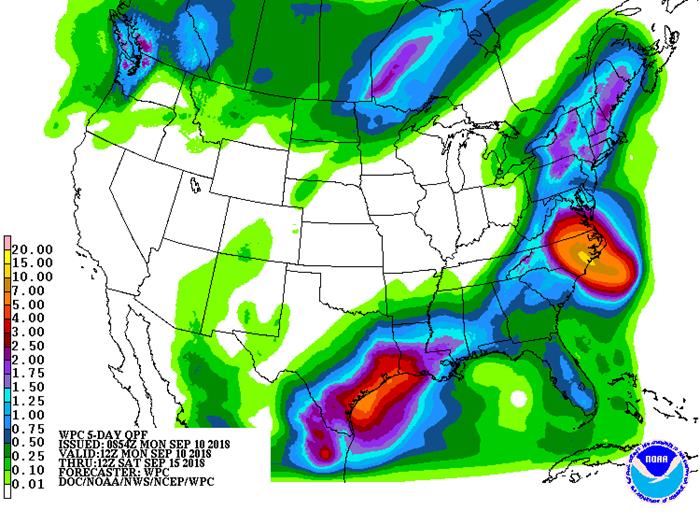

- Traders should monitor Hurricane Florence that will impact the Carolina’s, affecting several unharvested summer crops including cotton. Landfall may occur near Jacksonville, N.C.

- Tropical Storm Isaac will move across the Windward Islands late this week and enter the Caribbean Sea.

- Alberta, Canada will experience a couple of cold air shots from mid- to late-week this week resulting in snow and freezing temperatures.

- Australia will see limited rainfall with exception of the coastal areas this week.

- Rain this week will be limited from France to Poland. France, Italy, southern Germany, Australia and Czech Republic all have an opportunity for rain next week.

- The lower Volga River Basin needs additional rain.

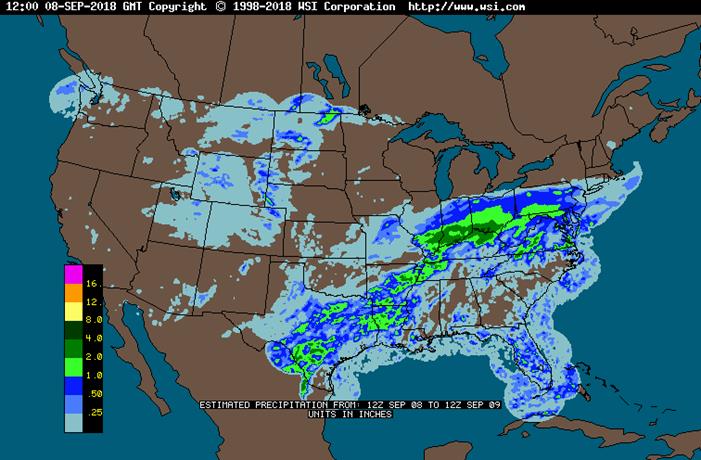

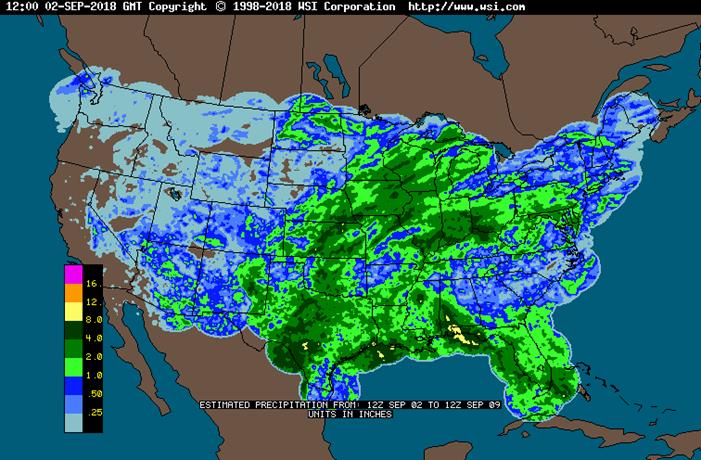

- This week a large portion of the Midwest will dry down. It will remain wet across the northern spring wheat states into the upper WBC. HRW wheat states will see very little rain.

- Argentina will be wet this week while southern Brazil turns wet mid-week into next week.

MONDAY, SEPT. 10:

- Malaysia on public holidays through Sept. 11; Palm oil futures trading closed in Kuala Lumpur during holidays

- Intertek and AmSpec release their respective data on Malaysia’s Sept. 1-10 palm oil exports, 11pm ET Sunday (11am Kuala Lumpur Monday)

- EU weekly grain, oilseed import and export data, 10am ET (3pm London)

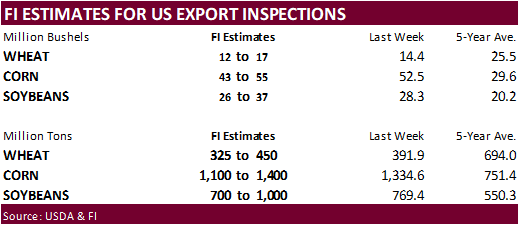

- USDA weekly corn, soybean, wheat export inspections, 11am

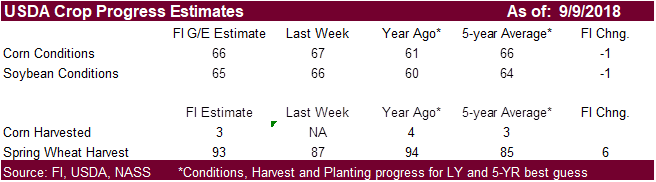

- USDA weekly crop progress report, 4pm

- AB Foods trading update

- Ivory Coast weekly cocoa arrivals

TUESDAY, SEPT. 11:

- Indonesia, Malaysia on public holidays

- Brazil’s crop agency Conab releases latest figures on 2017-18 corn, soybean production, 8am ET (9am Sao Paulo)

- Unica’s bi-weekly report on Brazil Center-South sugar output, 9am ET (10am Sao Paulo)

- Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) releases crop outlook report

- French Agriculture Ministry publishes crop forecasts

- UN releases The State of Food Security and Nutrition in the World report

WEDNESDAY, SEPT. 12:

- Malaysian Palm Oil Board (MPOB) data on stockpiles, exports, production for August, 12:30am ET (12:30pm Kuala Lumpur)

- Cargo surveyor SGS data on Malaysia’s Sept. 1-10 palm oil exports, 3am ET (3pm Kuala Lumpur)

- EIA U.S. weekly ethanol inventories, output, 10:30am

- USDA releases monthly World Agricultural Supply and Demand Estimates (WASDE) report, noon

- FranceAgriMer updates estimates for grain crops

THURSDAY, SEPT. 13:

- USDA weekly net-export sales for corn, wheat, soy, cotton, 8:30am

- U.S. National Weather Service’s Climate Prediction Center updates its monthly forecast for El Nino, 9am

- Strategie Grains monthly report on European market outlook

- Port of Rouen data on French grain exports

- Buenos Aires Grain Exchange weekly crop report

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

- EARNINGS: Fonterra Co-operative Group

FRIDAY, SEPT. 14:

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly updates on French crop conditions

- Malaysia to announce crude palm oil export tax for October

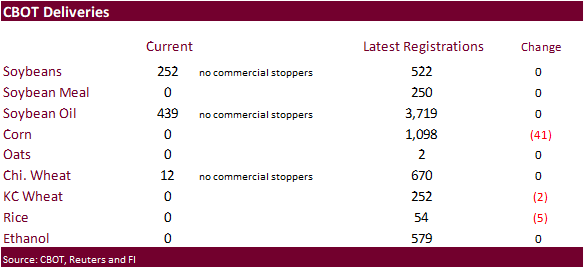

· KC Wheat down 2 to 252 (Wichita, KS)

· Rice down 5 to 54 (Otwell, AR)

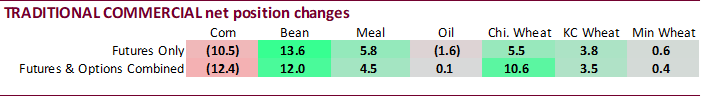

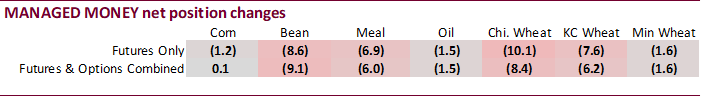

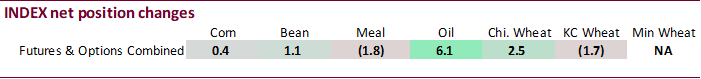

Commitment of Traders

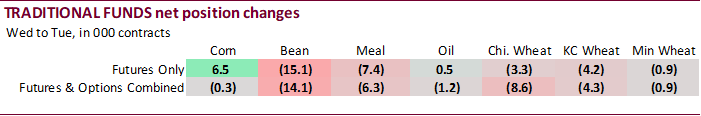

Funds over the shortened week due to holiday sold more contracts in all the major agriculture commodities. Traditional funds were 18,500 contracts less long than expected in corn, 24,100 contract more in soybeans, 8,300 less long in Chicago wheat, 8,500 less long in soybean meal and 4,500 contracts less long in soybean oil.

· US stocks are higher, USD lower, WTI crude higher, and gold lower, at the time this was written.

Corn.

- Corn prices are lower on lack of bullish news. Traders will be monitoring Hurricane Florence that will impact the Carolina’s, affecting several unharvested summer crops including cotton.

- Oats are higher.

- The trade will be watching if the US decides to add several million dollars of additional tariffs against China.

- China corn ended 9 yuan higher.

- Japan over the weekend reported an outbreak of swine fever-not African swine fever. This is their first outbreak of swine fever in 26 years. African swine fever virus is unrelated to the classical swine fever virus. African swine fever has a more complex genetic structure.

- Last week FAO warned African swine fever will spread in Asia.

· Baltic Dry Index is last 1,482, down 9 points or 0.5% from last session.

· South Korea’s NOFI passed on 138,000 tons of corn but bought 10,000 tons of barley at $276.87/ton for February arrival.

· Last week a total of 138,000 tons of corn was bought by two South Korean firms last week.

o MFG bought 69,000 tons of corn at $206.88 a ton c&f plus a $1.25 a ton surcharge for additional port unloading for arrival in South Korea around Jan. 30, 2019.

o NOFI bought 69,000 tons of corn at $206.48 a ton c&f plus a $1.25 a ton surcharge for additional port unloading arrival in South Korea around Jan. 20, 2019.

· Recall we reported on Friday SK’s KOCOPIA bought 60,000 tons of US corn.

· China will sell another 8 million tons of corn September 13 and 14. China sold about 75.3 million tons of corn out of reserves this season.

Soybean complex.

- Soybeans are higher on weather threats in the US and China. China saw a cold snap over the weekend across Heilongjiang and Inner Mongolia, and futures prices shot up overnight. Jilin was unaffected. Meanwhile traders will be monitoring Hurricane Florence that will impact the Carolina’s, affecting several unharvested summer crops including cotton.

- The trade will be also watching if the US decides to add several million dollars of additional tariffs against China.

- Brazil is looking into launching their own futures contract to help conduct business with the major imports such as China due to the wide Brazil/US price discrepancy.

- A US soybean cargo arrived at the China port of Qingdao.

· Alberta, Canada will see harvest delays this week.

· Last we heard IL soybean oil was option, East 50 over, West 14 over, and Gulf 250 over. Brazil and Argentina 150 over.

· ITS reported Malaysian palm oil exports during the first 10 days of the month at 489,492 tons, up 63 percent from the August 1-10 period. AmSpec is 69.5% higher at 506,212 tons.

· Rotterdam oils were higher and SA soybean meal when imported into Rotterdam $1.00-$5.00/ton higher.

· China soybean futures volume was 530,000 contracts against a previous open interest of only 309,000.

· Offshore values were suggesting a higher lead for US soybean meal by $0.80 and higher lead for soybean oil by 28 points.

· The CCC bought 5,000 tons of refined veg oil for in mostly 4-liter cans and priced in a range of $1,117.42 to $1,265.77 per ton.

· Delayed: 15,610 tons of bulk crude degummed soybean oil for Pakistan.

· The CCC seeks 1540 tons of fully refined vegetable oil on September 18 for carious countries for Oct/Nov delivery.

- Iran seeks 30,000 tons of sunflower oil on September 24.

· China will sell 100,000 tons of soybeans September 12.

- China sold about 1.69 MMT of soybeans out of reserves this season.

Wheat

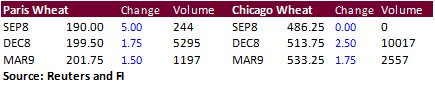

· US wheat is mixed with Chicago and KC higher, and MN mostly lower on lack of direction. Chicago and KC prices are thought to be temporally oversold after futures declined last week.

· Russia harvest to date 84 million tons of grains (Sep 7), down from 103.5MMT a year ago. The average yield is 2.80 t/h versus 3.25 year ago.

· Up to 25,000 tons of Turkish flour exports were held up at the border destined to go to Iraq. Last week Ankara restricted four exports. Iraq depends heavily on Turkish four imports.

· The Czech Republic’s AgMin grain production was seen at 6.62 million tons in August, down from 6.86 million tones.

- Saudi Arabia bought 1.5MMT million tons of barley for November/December delivery. Average price was $260.79/ton c&f.

- Jordan seeks 120,000 tons of wheat and 120,000 tons of barley on September 13 and September 12, respectively.

- Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on September 12 for arrival by late February.

- Syria’s General Establishment for Cereal Processing and Trade (Hoboob) seeks 200,000 tons of soft bread wheat from Russia, Romania or Bulgaria, with shipment sought between Oct. 15 and Dec. 15. The deadline is Sept. 17 and requires payment in Syrian pounds.

- Ethiopia seeks 200,000 tons of milling wheat on September 18 for shipment two months after contract signing.

- Morocco seeks 336,364 tons of US durum wheat on September 28 for arrival by December 31.

Rice/Other

· China sold 23,832 tons of rice at auction at an average price of 2669 yuan per ton ($389.10/ton), 3.35 percent of what was offered.

· The Philippines seeks an extra 250k tons of rice for Q4 and Q1 2019 shipment.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.