From: Terry Reilly

Sent: Monday, October 01, 2018 8:35:49 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 10/01/18

· Some areas of the WCB saw flash flooding over the weekend. Risk was thought to be corn related more so than soybeans. 0.25 to 0.75 inch occurred in southeastern Wisconsin and central Lower Michigan with some locally heavy rain occurred in northern Missouri near the Iowa border.

· This week the Delta will be on the drier side. Showers will fall in the lower Midwest and Tennessee River Basin.

· Rain will fall from the southwestern desert areas through the northern Plains early to mid-week this week.

· The second week of the forecast calls for good rain across the WCB during the first half of the week.

· The Canada Prairies will be cold this week.

- China’s financial markets are closed through Oct. 7 for national holidays

- Futures trading including corn, wheat, sugar, palm oil, cotton will be halted in Shanghai, Dalian and Zhengzhou

- Australia on holiday

- AmSpec and SGS release their respective data on Malaysia’s palm oil exports for September

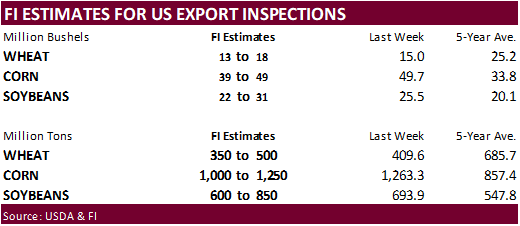

- USDA weekly corn, soybean, wheat export inspections, 11am

- USDA soybean crush for August, 3pm

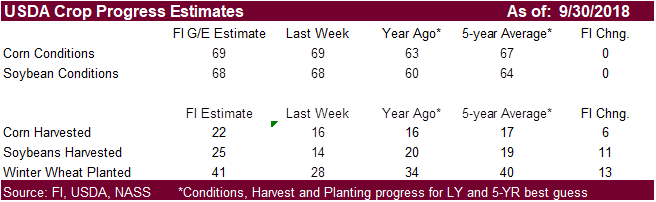

- USDA weekly crop progress report including corn, soybeans, 4pm

- Ivory Coast weekly cocoa arrivals, and start date for main-crop harvest

- EARNINGS: Cal-Maine Foods

TUESDAY, OCT. 2:

- New Zealand dairy auction on Global Dairy Trade online market starts ~7am ET (~noon London, ~11pm Wellington)

- EARNINGS: PepsiCo

WEDNESDAY, OCT. 3:

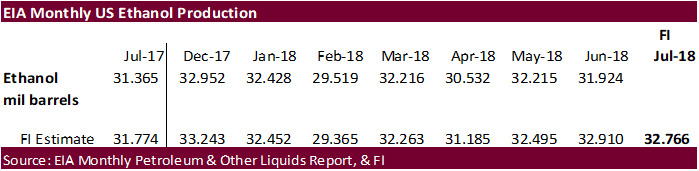

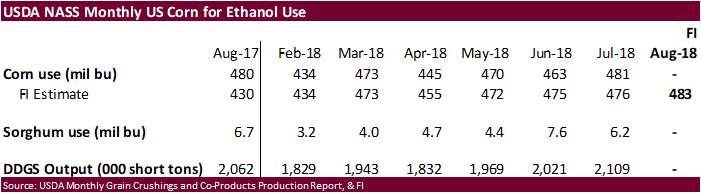

- EIA U.S. weekly ethanol inventories, output, 10:30am

THURSDAY, 0CT. 4:

- FAO food index for September, 4am ET (9am London)

- USDA weekly net-export sales for corn, wheat, soy, cotton, 8:30am

- Port of Rouen data on French grain exports

- Buenos Aires Grain Exchange weekly crop report

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

FRIDAY, OCT. 5:

- FranceAgriMer weekly updates on French crop conditions

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

Source: Bloomberg and FI

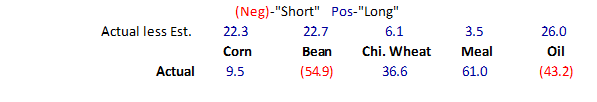

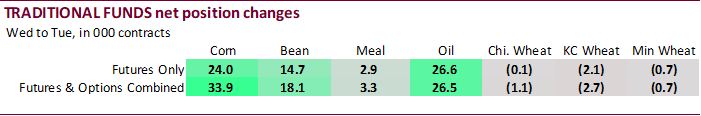

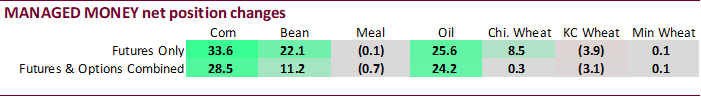

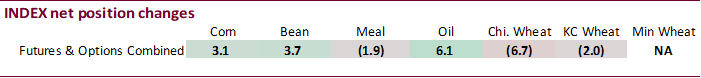

· There are no new record net short soybean oil positions for the week ending September 25.

· The traditional funds were more long than estimated for all the major agriculture commodities.

· Chicago wheat down 115 to 430.

· US stocks are higher, USD higher, WTI crude slightly higher, and gold lower, at the time this was written. (8:33 am CT)

Corn.

- Corn is higher on unfavorable US rains bias WCB over the weekend, new month/new money, and good demand.

- The US and Canada reached a trade deal. President Trump will announce a successor soon and Canada’s Prime Minister will hold a press conference at noon EST today.

- Indonesia sees their corn production at 30.05 million tons versus 28.92 MMT last year.

- China reported a H5N6 bird flu case in Guizhou province.

- China is relaxing on some hog transport restrictions in areas where African Swine fever cases dropped.

- Baltic Dry Index is up 15 points or 1 percent to 1555 points.

· CFTC Commitment of traders showed for the week ending September 25th, managed money funds added net 28,497 net longs in corn, with the position at net short 112,779 contracts. (F&O combined).

· Safras & Mercado 2018-19 corn production was altered to 94.2 million tons from 93.05 previously.

· The European Commission lowered its estimate for corn production to 61.9 million tons from 64.2 million previously and compares to 64.5MMT last year.

· China will sell 8 million tons of corn for the week ending October 5.

· China sold about 85.5 million tons of corn out of reserves this season and some are predicting up to 100 million tons will be sold by the end of the marketing season.

Soybean complex.

· CBOT soybeans traded two-sided before the day session on lack of directions and some follow through selling after USDA reported higher than expected September s1 stocks. Offshore and outside markets are supportive for soybean products, but soybean oil is finding pressure on meal/oil spreading. WTI crude is now lower. USD turned higher.

· China is on holiday all week.

· Malaysia December palm oil was down 17 and leading SBO 2 points lower. Malaysian cash palm oil was up 1.25 at $555.00/ton.

· Cargo surveyor SGS reported September Malaysian palm exports at 1,629,365 tons, 575,196 tons above the same period a month ago or up 55%, and 244,700 tons above the same period a year ago or up 18%.

· GAPKI reported August Indonesia palm exports at 2.99 million tons, up from 2.81MMT previous month and 2.98 million during August 2017.

· Rotterdam oils were unchanged to higher and SA soybean meal when imported into Rotterdam mixed.

· Offshore values were suggesting a higher lead for US soybean meal by $1.00 and higher lead in SBO by 22 points.

· CFTC Commitment of traders showed for the week ending September 25th, managed money funds added net 11,199 net longs in soybeans, with the position at net short 58,614 contracts. (F&O combined).

· Money managers last week reversed their record net short position by adding net 24,168 longs (F&O combined).

· The European Commission increased its estimate for the rapeseed crop to 19.7MMT t from 19.2 last month, below 21.95 in 2017-18.

· Strategie Grains estimated EU rapeseed production for 2018-19 at 19.9 million tons, up from 19.62MMT previously and compares to their forecast of 22.17 million tons in 2017-18.

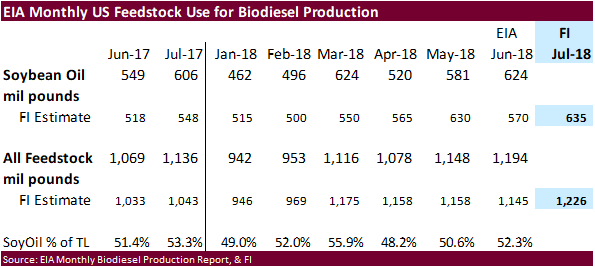

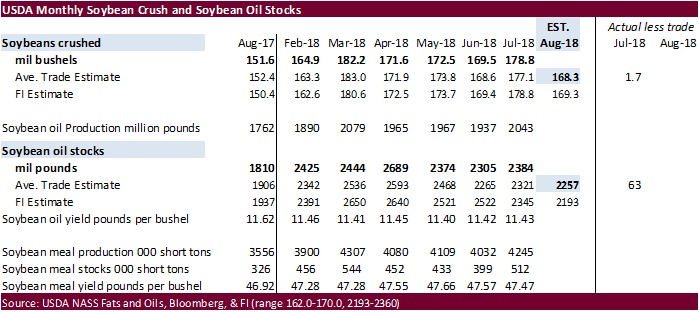

· The USDA NASS crush report will be out later today. Reuters is using a 169.3 bu/ac crush and Bloomberg 168.3.

Wheat

· Chicago wheat is near unchanged to higher on lack of direction.

· News is light.

· Paris wheat is lower. USD is slightly higher.

· IKAR reported 12.5% Russian wheat export prices up $4/ton to $224/ton from the previous week. SovEcon reported prices up $4/ton to $226/ton.

· Russia collected 98.4 million tons of grains so far this season, down from 124.3 million tons last year.

· CFTC Commitment of traders showed, from the previous week, managed money funds added a small amount of net longs in SRW wheat, sold net 3,054 KC longs, and added only 53 longs in MN. (F&O combined).

- Libya seeks 1 million tons of Russian wheat.

- There are no offers in Morocco’s import tender for 336,364 tons of US durum wheat for arrival by December 31.

- Bahrain seeks 25,000 tons of wheat on October 2 for Nov shipment.

- Taiwan seeks 110,000 tons of US wheat on October 2 for Nov-Dec shipment.

- Jordan retendered for another 100,000 tons of feed barley on October 3.

- Bangladesh seeks 50,000 tons of 12.5 percent wheat on October 9, optional origin.

- Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on October 10 for arrival by late February.

- Postponed: UAE seeks 60,000 tons of wheat for Oct/Nov shipment.

Rice/Other

· Thailand seeks to sell 120,000 tons of sugar on October 3.

· The Philippines seek 250,000 tons of rice on October 18 for arrival by late November.

· Mauritius seeks 9,000 tons of rice for delivery between Nov. 15, 2018, and March 31, 2019, set to close is Sept. 27.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.