From: Terry Reilly

Sent: Monday, October 08, 2018 8:21:44 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 10/08/18

PDF attached

Today is a US holiday so government reports are delayed until Tuesday.

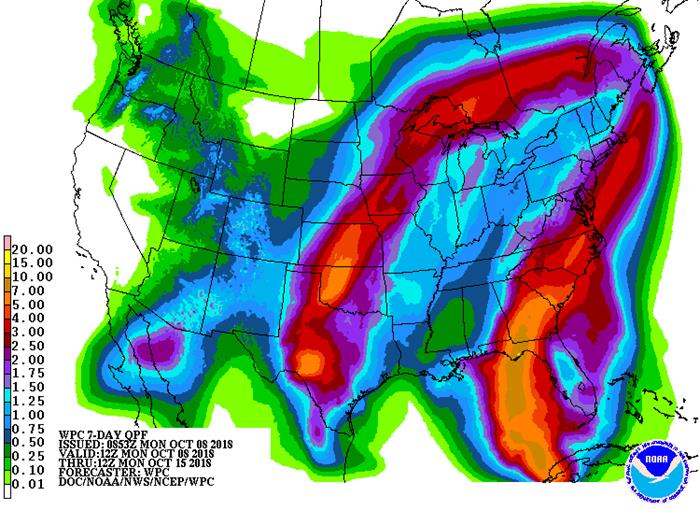

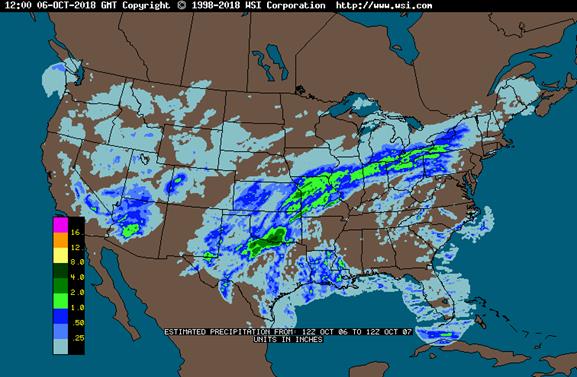

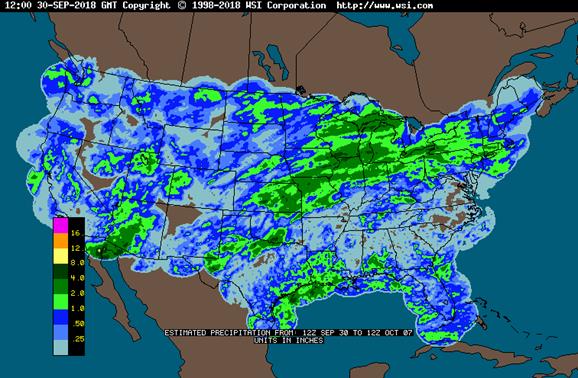

· Heavy rain fell over the weekend from West Texas through a part of Oklahoma and Kansas to southeastern Iowa southern Wisconsin, southern Michigan and northern Ohio.

· Tropical storm Michael and Hurricane Sergio will bring additional rain into the southwestern states and southeast this week. For the rest of the Midwest look for heavy rain to continue to fall bias WCB through Wednesday with 1-3”, locally 3-5”, similar to what we saw over the weekend.

· US weather next week will yield limited precipitation and cooler temperatures. Fieldwork progress will be most beneficial bias the ECB.

· The Canadian Prairies will see drier weather over the next week, but cool temperatures are expected to slow fieldwork progress. Alberta could see snow this week.

· Europe will remain in a drier bias but will not be completely dry.

· The Western CIS will see warm and dry conditions.

· Brazil weather over the next two weeks will include precipitation for most areas except for the northeast.

· Argentina will see a drier bias for the west-central and northeast.

· Argentina will see non-threatening frost/freezes Tuesday and Thursday.

- U.S. Columbus Day holiday; CBOT, ICE Futures U.S. remain open

- Japan on public holiday; Rubber futures trading on Tocom will be halted

- U.K. publishes first estimates for wheat and barley crops in 2018-19 season, 4:30am ET (9:30am London)

- EU weekly grain, oilseed import and export data, 10am ET (3pm London)

- Sugar Week in London, with various events and seminars throughout the week

- Ivory Coast weekly cocoa arrivals, and start date for main- crop harvest

- EARNINGS: Louis Dreyfus

TUESDAY, OCT. 9:

- Unica bi-weekly data on Brazil Center-South sugar output

- Marex Spectron Sugar Symposium in London, with speakers from Louis Dreyfus, Sopex, Freepoint Commodities

- France’s Agriculture Ministry updates its crop estimates

- The IMF presents its World Economic Outlook

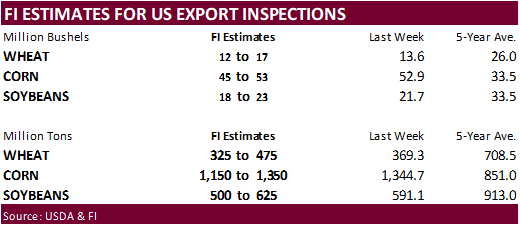

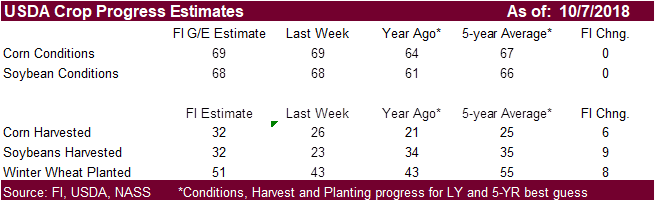

- USDA weekly corn, soybean, wheat export inspections, 11am; USDA weekly crop progress report, 4pm (Both delayed from Monday due to public holiday)

WEDNESDAY, OCT. 10:

- FranceAgriMer updates estimates for grain crops

- Malaysian Palm Oil Board (MPOB) releases stockpiles, exports and production data for September, 12:30am ET (12:30pm Kuala Lumpur)

- Malaysia Oct. 1-10 palm oil exports data from cargo surveyors AmSpec, Intertek, SGS

THURSDAY, 0CT. 11:

- EIA U.S. weekly ethanol inventories, output, 11am (Delayed from Wednesday due to public holiday)

- Strategie Grains monthly report

- Brazil’s crop agency Conab releases figures on corn, soybean production for October, 8am ET (9am Sao Paulo)

- USDA’s monthly World Agricultural Supply and Demand Estimates (WASDE) report for October, noon

- Port of Rouen data on French grain exports

- Buenos Aires Grain Exchange weekly crop report

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

- ADM Investor Services’ Sugar Treat seminar in London

- EARNINGS: Suedzucker

FRIDAY, OCT. 12:

- USDA weekly net-export sales for corn, wheat, soy, cotton, 8:30am (Delayed from Thursday due to holiday)

- China’s customs office releases September energy & commodities trade data (prelim), including soy, corn, palm, 11pm ET Thursday (11am Beijing Friday)

- FranceAgriMer weekly updates on French crop conditions

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

Source: Bloomberg and FI

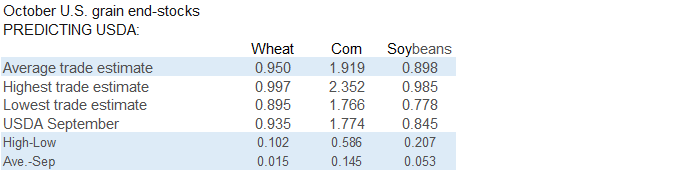

USDA October 11 report estimates – Bloomberg

U.S. Corn, Soy, Wheat Inventory Survey Before USDA WASDE Report in millions of bushels.

|———-Survey Results———–|USDA

2018-19 Crop: | Avg | Low | High | Sept.

================================================================

Corn | 1,913| 1,704| 2,352| 1,774

Soybeans | 905| 778| 985| 845

Wheat | 959| 895| 1,024| 935

Analyst |

Estimates: | Corn | Soybeans | Wheat

Futures Int’l | 2,028| 885| 942

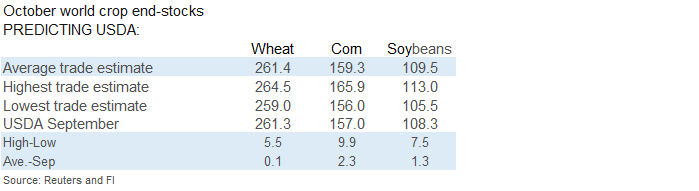

World Corn, Soybeans, Wheat Survey Before USDA WASDE Report in millions of metric tons.

|———-Survey Results———–|USDA

2018-19 Ending | | | |

Stocks: | Avg | Low | High | Sept.

Corn | 159.2| 155.9| 165.9| 157.0

Soybeans | 109.9| 105.5| 113.1| 108.3

Wheat | 261.2| 259.0| 263.7| 261.3

2017-18 Ending |

Stocks: |

Corn | 194.8| 192.0| 197.5| 194.2

Soybeans | 95.3| 94.4| 97.3| 94.7

Analyst | 2018-19|2017-18

Estimates: | Corn | Soybean | Wheat | Corn |Soybean

Futures Int’l | 162.5| 111.5| 262.0| 195.7| 95.9

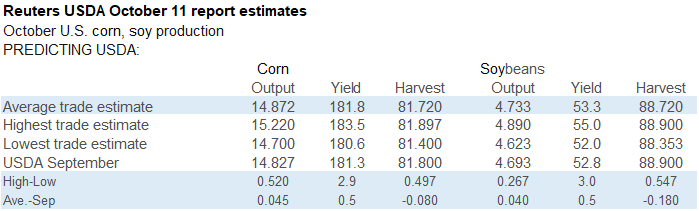

U.S. Corn, Soybean Production Survey Before USDA WASDE Report in millions of acres

|———-Survey Results———–|USDA

2018-19 Crop: | Avg | Low | High | Sept.

Corn Harvest | 81.8| 81.4| 85.0| 81.8

Corn Yield | 181.8| 180.6| 183.5| 181.3

Corn Production | 14,859| 14,700| 15,005| 14,827

Soybean Harvest | 88.7| 88.0| 88.9| 88.9

Soybean Yield | 53.3| 51.8| 55.0| 52.8

Soybean | | | |

Production | 4,722| 4,623| 4,800| 4,693

Analyst |————-Corn————-|Soybeans

Estimates: | Harvest | Yield | Production |Harvest |Yield | Production

Futures Int’l | 81.6| 183.5| 14,977| 88.6| 53.3| 4,724

Source: Bloomberg and FI

· Chicago wheat down 44 to 386. (down 22 in Mt. Vernon, IN and down 22 in Evansville, IN)

Deliveries

· SBM 41 – no apparent commercial stoppers, ADM Inv. customer stopped 41

· SBO 121 – no apparent commercial stoppers

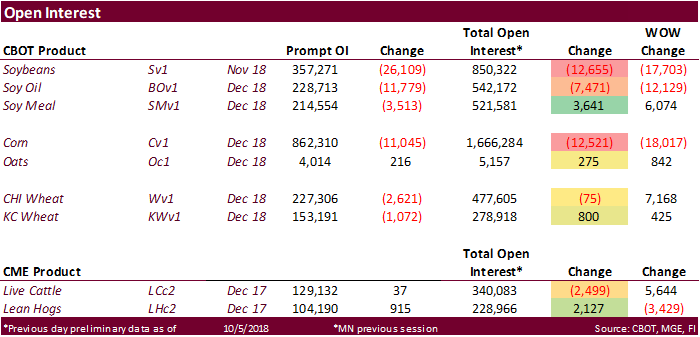

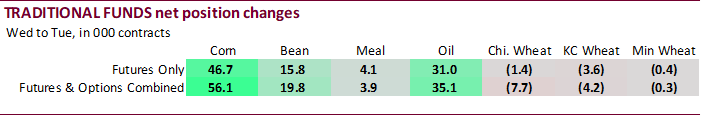

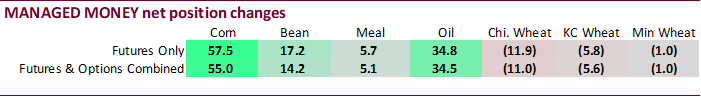

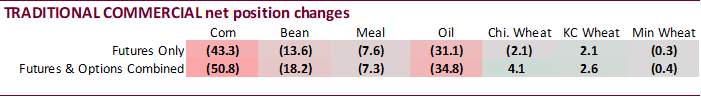

CFTC Commitment of Traders

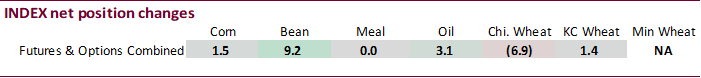

- Funds added 32,700 more than expected net long contracts in corn than trade expectations. Traditional funds bought 46,700 net futures only corn contracts for the week ending 10/2 and 56,100 net long futures and options corn contracts.

- Funds also bought more than expected soybean oil contracts than expected. Traditional funds were net buyers of 31,000 futures only contracts and 35,100 futures and options combined.

- We estimate the funds for corn as of 10/5/18 net long 64,200, net short 40,000 for soybeans, net long 36,100 for Chicago wheat, net long 69,100 for meal, and net short 14,200 for soybean oil.

· Brazil real was up 4%, US stocks are lower, USD higher, WTI crude sharply lower, and gold lower, at the time this was written. (8:00 am CT)

·

Corn.

- Corn is lower following wheat and soybeans. Today is a national holiday so government reports are pushed back a day.

- Day 2 of the Goldman Roll.

- Baltic Dry Index is down 6 points at 1,530 points.

- China reported another African Swine Fever outbreak in Liaoning. They banned Bulgarian pig imports.

- Nearly 20 percent of Argentina’s corn crop had been planted on record 5.8 million hectares. The BA Grains Exchange looks for a 43 million ton harvest.

- On October 11 USDA will updated their latest US crop supply survey and demand expectations. Using Bloomberg trade guesses, we were surprised to see such a wide range on US corn ending stocks for 2018-19 of 648 million bushels. The average trade guess is 1.913 billion bushels, up 139 million from September’s 1.774 billion bushels. US corn production averaged 14.859 billion, 32 million above last month with a 305-million-bushel range between the low/high estimates. Analysts look for the US corn harvested area to increase 34,000 acres from September.

· China may sell 8 million tons of corn this week.

· China sold about 85.5 million tons of corn out of reserves this season and some are predicting up to 100 million tons will be sold by the end of the marketing season.

Soybean complex.

· Soybeans are lower as weekend weather was about as expected.

· Brazil’s Sunday election narrowed the candidates to two leaders and will head to a second round of voting October 28 between right-wing Congressman Jair Bolsonaro and leftist rival Fernando Haddad. The Right-wing Brazilian presidential candidate promised to shrink the government, reduce payroll taxes and privatize many state companies.

· Soybean oil is lower on sharply lower crude oil. Soybean meal is off but don’t discount a two-sided trade.

· China’s soybean complex after a week-long holiday was up sharply on Monday. Soybean meal appreciated 2.7%, soybeans by 1.4% and soybean oil by 0.7%.

· China bought 8-10 Brazil soybean cargos last week, with about 4-5 old crop.

· Malaysia December palm oil was lower by 36MYR and leading SBO 25 points lower. Malaysian cash palm oil was down 5.00 at $555.00/ton.

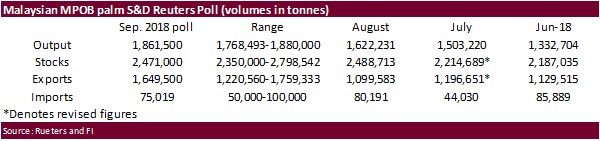

· MPOB will release September trade data on October 10. A Reuters survey on palm oil production calls for a 14.7 percent in September from August.

· Rotterdam oils were lower and SA soybean meal when imported into Rotterdam higher.

· Offshore values were suggesting a higher lead for US soybean meal by $0.10 and lower lead in SBO by 16 points.

· Last we heard ECB soybean oil was 125 over and WCB 25-50 (150-250 from others) over. Gulf 250 over. SA 100-165 over. Basically bids are all over the place.

· AgRural estimated Brazil planted 10 percent of their soybean crop, double than that of last year.

· Safras & Mercado reported new-crop brazil soybean sales as of October 1 at 27.3 percent, up from 14.1 percent at this time last year, and compares to an average 30.2 percent. Safras is using 121 million tons for 2019 production. Conab is due out soon with their estimate.

- The FSA seeks 17,200 tons of crude degummed soybean oil for Mozambique and Malawi for Nov. 11-29 delivery on October 10.

- China will offer 100,000 tons of soybeans out of reserves on October 10.

Wheat

· Wheat is lower (US markets) on lack of direction and upward revision to the Russia wheat production by IAKR from 69.3 million tons to 69.8 million tons.

· The US dollar is up 36.

- China set the 2017 wheat auction price floor at 2410 yuan per ton ($349.34/ton).

- IKAR reported Black Sea wheat 12.5 percent protein up $4/ton from the previous week to $228/ton. SovEcon reported $229/ton, up $3/ton.

- Russia will resume wheat/grain state reserve auctions in LH October.

- Egypt said they have enough reserves to last until February.

- China sold 3361 tons of 2013 wheat out of auction at 2172 yuan per ton ($313.85).

- Jordan seeks 100,000 tons of feed barley on October 9.

- Bangladesh seeks 50,000 tons of 12.5 percent wheat on October 9, optional origin.

- Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on October 10 for arrival by late February.

- Postponed: UAE seeks 60,000 tons of wheat for Oct/Nov shipment.

Rice/Other

- China failed to sell any rice out of auction.

· The Philippines seek 250,000 tons of rice on October 18 for arrival by late November.

· Mauritius seeks 9,000 tons of rice for delivery between Nov. 15, 2018, and March 31, 2019, set to close is Sept. 27.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.